简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Economic Outlook of the Eurozone in 2020 Is Expected to Be Steady

الملخص:In 2020, economic growth of the Eurozone and the world in general will also depend on how global trade talks turn out, particularly whether negotiations between various global players, including Britain and the European Union, can eliminate uncertainties in international trade.

European Central Bank(ECB) Executive Board member Isabel Schnabel said the Eurozone‘s inflation is estimated to be slowly inching towards the central bank’s target range. Monetary policy and increasing loans may prop up prices in the medium term, and Eurozones economy, supported by easing monetary measures, is estimated to see a 1.1% growth this year.

Germany‘s economy resumed marginal growth after declining for 3 months, while Spain and France both experienced considerable expansion. New jobs have been growing for the first time in 4 months, while business confidence also improved. Britain also had some good news, as the service sector’s index last December has been revised upwards, while new orders have seen the largest increase in 5 months. Inflation is expected reach 1.6% in 2022 as economic expansion accelerates.

In 2020, economic growth of the Eurozone and the world in general will also depend on how global trade talks turn out, particularly whether negotiations between various global players, including Britain and the European Union, can eliminate uncertainties in international trade.

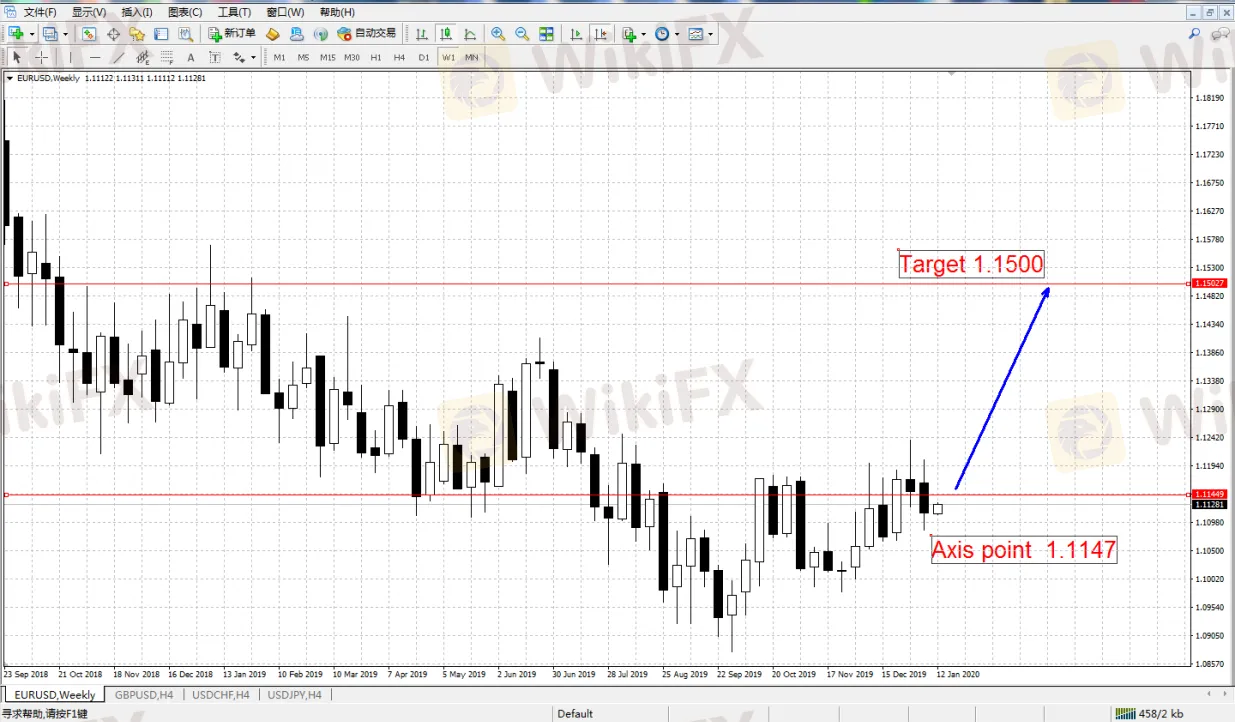

Technically, 1.1147 will be the axis point for EUR/USD in the first half of the year. Based on stabilized Eurozone economic data, weakened US dollar and reduced systematical risks, it‘s likely that the euro will slightly rise to above 1.15. On the other hand, US President Donald Trump’s policies have boosted USD above fair level for at least the past 2 years, but as the influence of these policies eventually declines, USD is also expected to return to a fair level. After the initial impacts of fiscal stimulus eventually faded, US economy growth may not reach its full potential.

عدم اعطاء رأي:

الآراء الواردة في هذه المقالة تمثل فقط الآراء الشخصية للمؤلف ولا تشكل نصيحة استثمارية لهذه المنصة. لا تضمن هذه المنصة دقة معلومات المقالة واكتمالها وتوقيتها ، كما أنها ليست مسؤولة عن أي خسارة ناتجة عن استخدام معلومات المقالة أو الاعتماد عليها.

وسيط WikiFX

أحدث الأخبار

احتيال VenturaZone | كيف سُرقت أموال المتداولين؟

شركة Forexdana المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

أفضل أوقات تداول الفوركس لتحقيق أقصى ربحية | دليل WikiFX

كيف يخدعون | منصات التداول الوهمية التي تختفي بعد الإيداع

ما هو التداول عالي التردد (HFT) في الفوركس | تغيير جذري أم رهان محفوف بالمخاطر؟

شركة DMA Capitals المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

GlobTFX تجمد حسابات عملائها | وعود بالتعويض تنتهي بسرقة جديدة

شركة MEXEM المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

تحذير إحتيال: بالتنويم المغناطيسي "الخير كابيتال" ستخفي أموالك

حساب النسبة