简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/NOK Traders Watching Norway Industrial Production Data

Ikhtisar:USD/NOK traders will be eyeing the release of Norways industrial production data. Will the recent slump in economic performance prompt the central bank to postpone

USD/NOK TALKING POINTS – NORWEGIAN KRONE, INDUSTRIAL PRODUCTIO

Norwegian Krone watching industrial production data

Will the Norges Bank raise rates at next policy meeting?

Looking ahead, Krone will be eyeing GDP, CPI report

See our free guide to learn how to use economic news in your trading strategy!

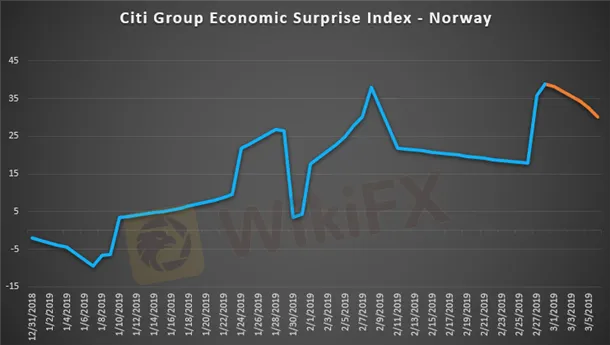

USD/NOK will be on its toes leading up to the release of Norways highly anticipated month-on-month industrial production data. The last report showed a 1.0 percent decline with economic performance out of Norway recently slumping as global growth slows down. The OECD recently cut its 2019 world growth outlook to 3.3 percent from 3.5.

As an-export driven economy with a heavy reliance on the petroleum sector, the Norwegian Krone is sensitive to changes in global demand and shifts in crude oil prices. Norway is also a major exporter of natural gas to the EU and is therefore also sensitive to economic changes in the Continent whether it be from reduced demand or political upheaval.

USD/NOK recently extended past the 8.5356-8.6323 resistance range but retreated shortly after the pair exhausted its sugar rush and came down after negative RSI divergence revealed slowing upside momentum. The next possible barrier rests at 8.6910 where the pair pivoted following the sharp incline. The fundamental outlook suggests USD/NOK still has significant room to climb.

USD/NOK – Daily Chart

Looking ahead, the upcoming rate decision and commentary by the ECB may move the Nordic currency due to the EU‘s unique relationship with Scandinavian economies. In Norway, CPI data is scheduled to be released next week which may influence the Norges Bank’s upcoming policy meeting on March 21. Their intention is to raise rates once this year, but gloomy presentiments may cause them to pivot and delay the hike.

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

WikiFX Broker

WikiFX Broker

Berita Terhangat

Penipuan Karyawan PEMAKAMAN Modus Investasi Forex Kerugian US$ 250,000

Kembalinya MetaTrader 5 Ke Perusahaan Prop Broker Funding Pips

Menangkan Hingga $200 dalam Acara Eksklusif WikiFX untuk Indonesia !

Platform Futu Catat Rekor ! Volume Perdagangan Melonjak 86,8%, Laba Bersih US$240,7 juta

Nilai Tukar