简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Pound Eyes Parliament-Led Brexit Efforts, Yen May Resume Rise

Ikhtisar:British Pound volatility is likely as the UK Parliament tries to wrest away control of Brexit from the government. The Yen may rise amid renewed global slowdown fears.

TALKING POINTS – BRITISH POUND, BREXIT, YEN, SENTIMENT

British Pound volatility likely as Parliament takes charge of Brexit

Yen may rise as French, US data stokes global slowdown concerns

Tone of global economic news flow sets the stage for risk aversion

Political drama in Westminster may take canter stage in European trading hours after the UK House of Commons appeared to have wrestled control of the Brexit process from the government of Prime Minister Theresa May. A series of “indicative votes” meant to gauge MPs appetite for a variety of EU withdrawal configurations and perhaps even a second referendum are due Wednesday.

In the meantime, traders will no doubt monitor the flurry of lead-in activity with great interest. Gauging which options might have the most broad-based support as well as the likelihood that Ms May will respect the pollings outcome – either by implementing it or stepping aside – may drive seesaw British Pound volatility. Lasting directional follow-through seems unlikely for now however.

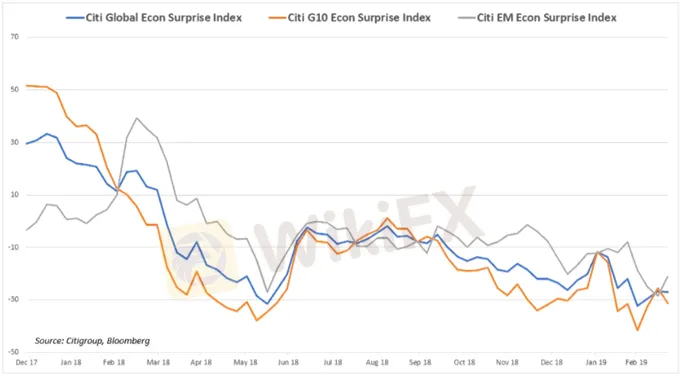

On the data front, a revised set of fourth-quarter French GDP figures as well as US housing and consumer confidence statistics. Disappointing outcomes echoing the recent trend toward underperformance relative to forecasts (see chart below) may feed global growth concerns and sour sentiment, boosting the anti-risk Japanese Yen while hurting the likes of the cycle-sensitive Australian Dollar.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

CHART OF THE DAY – GLOBAL ECONOMIC DATA FLOW WARNS OF WEAKNESS

Citigroup helpfully tracks the tendency of economic data outcomes across a variety of countries and groupings to deviate from baseline forecasts, either in the positive or negative direction. A macro view sizing up the overall global index as well as independent measures for the G10 and emerging market (EM) economies reveals that data flow as steadily deteriorated since mid-2018.

Broadly speaking, this suggests that realized economic outcomes have tended to be worse than analysts models anticipated for the better part of nine months. Against this backdrop, it seems hardly surprising that investors have turned skittish. If the downward revision of projections continues to lag the pace of deterioration in economic conditions, risk aversion is likely to remain the path of least resistance.

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

WikiFX Broker

WikiFX Broker

Berita Terhangat

WikiFX Mengucapkan Selamat Hari Raya Idul Fitri 1446 H, Mohon Maaf Lahir dan Batin

Broker StoneX Meningkatkan Investasi Perbankan dan Perdagangan Dengan Akuisisi Benchmark

Nilai Tukar