简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

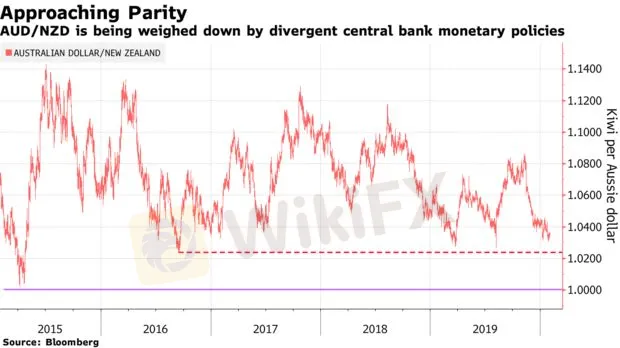

AUD/NZD Shows a Tendency to Approach 1.01

Ikhtisar:The exchange rate of AUD against NZD fell 5% after reaching the highest point in last November. And whether the tendency this week is strengthened or not, which draws close attentions from investors.

The exchange rate of AUD against NZD fell 5% after reaching the highest point in last November. And whether the tendency this week is strengthened or not, which draws close attentions from investors.

Although the inflation and unemployment rate is well improved, it is estimated that the Reserve Bank of Australia will at least cut interest rates once, and even twice according to the prediction from some banks. By comparison, it is surprising that the Reserve Bank of New Zealand has kept interest rate on hold since last November, which weakens the prediction that RBNZ will ease monetary policy further. The latest market expectation suggests that there is a possibility of 62% that RBZN may cut interest rate this year.

Per price trend, monetary policy has a significant impact on AUD/NZD. The possibility of RBNZ‘s further interest rates cut in February is reduced expectedly. If New Zealand Treasury worries about the novel coronavirus’ pressure on the economy in New Zealand, the possibility of rate cut will be increased. And the views can be proved by some new trends this week. RBAs Chairman Philip Lowe gave a speech at Sydney on Wednesday, and will make the half-year statement to Congress on Friday.

AUD/NZD recently hovers above the support level of 1.0238, the lowest point since September 14, 2016. And any breakthrough in this level will help increase the tendency above.

We expect the RBA will reduce the cash rate to 0.5% in April, while RBNZ will stabilize the rate at 1.0% in the first half of 2020, and AUD/NZD is expected to be close to 1.01 by June.

AUD/NZD Daily Pivot Point: 1.0355

S1: 1.0340 R1: 1.0370

S2: 1.0325 R2: 1.0385

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

Baca lebih banyak

Join and GET 2100 WikiBit for free on Christmas Day!

Countdown 24 hours!

Data Ekonomi Menjadi Aneh? Bagian II

Masalah serupa berlaku untuk "survei pendirian," yang B.L.S. gunakan untuk mentabulasi angka pertumbuhan pekerjaan. Agensi mensurvei sekitar 145.000 bisnis dan agensi pemerintah tentang berapa banyak karyawan yang mereka miliki dalam daftar gaji.

Data Ekonomi Menjadi Aneh? Bagian I

Amerika Serikat mengalami keruntuhan yang tak terduga dalam aktivitas ekonominya. Itu yang kita tahu. Tetapi lebih dari itu bahkan dalam resesi normal, alat-alat yang harus kita pahami apa yang terjadi pada perekonomian menjadi terdistorsi atau lebih sulit untuk ditafsirkan, karena berbagai alasan.

Corona Menyentuh Ekspor, Perdagangan Jepang Turun 99% Pada Maret

Surplus perdagangan Jepang turun 99 persen di bulan Maret dari tahun sebelumnya karena masalah virus corona memukul ekspor ke mitra dagang utamanya, data resmi menunjukkan Senin.

WikiFX Broker

Berita Terhangat

Penipuan Karyawan PEMAKAMAN Modus Investasi Forex Kerugian US$ 250,000

Kembalinya MetaTrader 5 Ke Perusahaan Prop Broker Funding Pips

Trio Broker Penipu 2025 Dengan Alamat, Penghargaan & Kerangka Situs Web Yang Sama

Menangkan Hingga $200 dalam Acara Eksklusif WikiFX untuk Indonesia !

Platform Futu Catat Rekor ! Volume Perdagangan Melonjak 86,8%, Laba Bersih US$240,7 juta

Panduan WikiFX: Cara Menghindari Risiko dari Broker Ilegal dalam Investasi Forex

Nilai Tukar