简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Job Growth Reduced Chances of the Fed’s Rate Cut

Ikhtisar:Statistics from the US Department of Labour show that US Nonfarm Payroll increased by 225,000 in January, 2020, exceeding the market’s estimation of 165,000 and December’s 147,000 after revision while being significantly higher than the 175,000 of the same period last year.

Statistics from the US Department of Labour show that US Nonfarm Payroll increased by 225,000 in January, 2020, exceeding the market’s estimation of 165,000 and December’s 147,000 after revision while being significantly higher than the 175,000 of the same period last year.

Among these, private sector saw an increase of 206,000 jobs, higher than market estimation of 150,000 and the 139,000 of previous month after revision. Labour force participation rate also rose from 63.2% in December, 2019 to 63.4% in January, 2020.

The better-than-expected employment data suggests the US job market remains robust. Government’s survey on businesses shows building and construction job growth in January has been the highest in a year, while recruitment in transportation and logistics also boost strong growth.

We conclude that a steady situation employment supports the opinions of the Fed’s policymakers that the job market is strong, and the employment figures backed the decision of Federal Reserve Board to hold interest rate at current level. The Fed’s Chairman Jerome Powell also noted that the current monetary policy is on the right track, while the optimistic data also offers positive support to US dollar’s exchange rate.

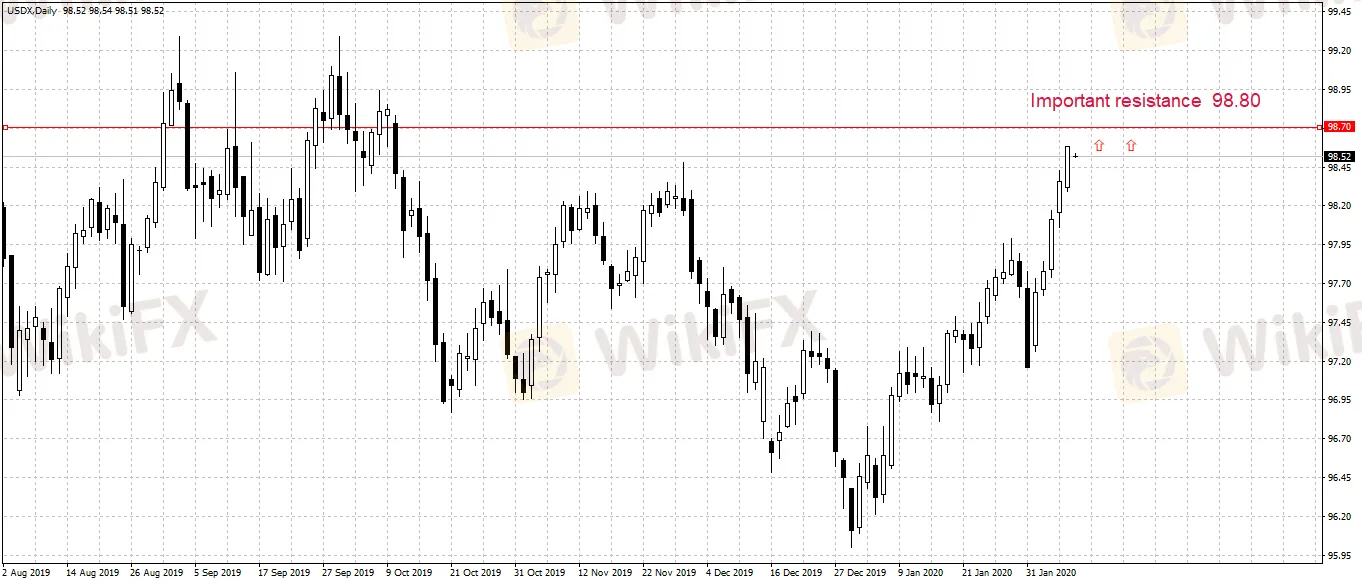

USDX daily pivot points 98.44-98.52

S1: 98.38 R1: 98.67

S2: 98.18 R2: 98.78

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

Baca lebih banyak

EUR/USD Meluncur ke Area 1,1575, Terendah Baru Harian Jelang Lagarde/Powell

Pasangan EUR/USD beringsut lebih rendah menuju sesi Amerika Utara dan turun ke terendah baru harian, di sekitar wilayah 1,1575 dalam satu jam terakhir

GBP/USD Naik ke Puncak Tiga Hari, Terlihat akan Membangun Momentum di Atas 1,3600

Pasangan GBP/USD melesat ke puncak tiga hari selama pertengahan sesi Eropa, dengan para pembeli sekarang berusaha untuk membangun momentum di atas 1,3

EUR/USD Pertahankan Kenaikan Moderat di Sekitar 1,1600, Kurang Tindak Lanjut

Pasangan EUR/USD mempertahankan kenaikan intraday moderatnya sepanjang paruh pertama sesi Eropa, meskipun tampaknya kesulitan untuk memanfaatkan perge

Pembeli EUR/USD Menyentuh 1,1600, Menunggu Lagarde dari ECB dan Powell dari Fed

EUR/USD mengambil tawaran beli di dekat 1,1600 untuk menggambarkan kenaikan tiga hari dari terendah tahun ini menjelang sesi Eropa hari ini.Pasangan

WikiFX Broker

Berita Terhangat

KEKAISARAN Penipuan Trading & Investasi Online Terpusat Di Israel & Georgia

FINRA Memerintahkan Robinhood Financial Membayar Restitusi $3,75 Juta kepada Pelanggan

Nilai Tukar