简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S&P 500 Drops Reversal Warning, Equities Brace. Yen to Extend Rise

Lời nói đầu:The S&P 500 left behind a reversal warning amidst rising EU-US trade war concerns and the IMF downgrading the 2019 outlook. Equities are bracing in Asia as the Yen may extend gains.

The anti-risk Japanese Yen was the best-performing major on Tuesday, rising alongside a downturn in market sentiment as anticipated. This was triggered by a trio of concerning developments. First, the United States escalated trade tensions with the European Union, threatening to impose $11b in tariffs on their imports because of EU subsidies for Airbus, a major commercial aircraft maker.

Then later in the day, Italy trimmed 2019 GDP estimates to 0.1% from 1.0% as it raised this years budget deficit forecast to 2.5%. The latter has been a sticking issue between the country and with Brussels, increasing concerns about a Eurozone debt crisis. Lastly, the IMF cut the 2019 global outlook to its weakest since the 2008 financial crisis.

After the German DAX 30 tumbled by the most in over two weeks (as expected), the S&P 500 followed suit as it ended its longest winning streak (8 days) since early October. US front-end government bond prices rallied, signaling risk aversion that engulfed the markets. The haven-linked US Dollar was little changed though, mainly due to losses during the first half of the trading session.

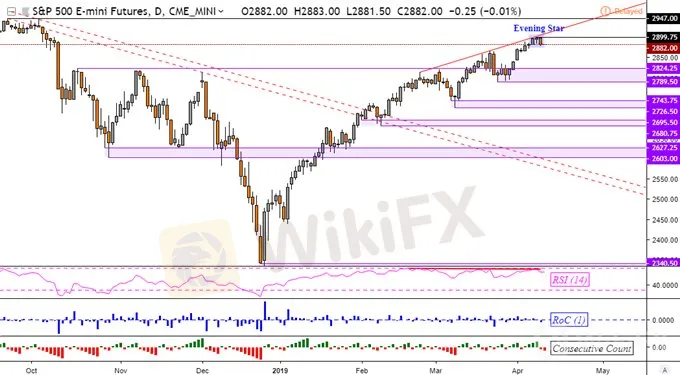

S&P 500 Technical Analysis

Taking a look at the more liquid futures, the S&P 500 left behind a bearish reversal warning at its latest peak just under 2900. That would be an Evening Star that is coupled with negative RSI divergence, signaling fading upside momentum. This may precede a turn lower towards a range of support between 2789 and 2824 on the daily chart below.

S&P 500 Daily Chart

Chart Created in TradingView

Wednesdays Asia Pacific Trading Session

The downturn on Wall Street poses as a risk for Asia Pacific equities, particularly with rising concerns about another trade war front and slowing global growth. It wouldnt be too surprising to see the Japanese Yen extend its advance while the pro-risk Australian Dollar takes a hit. The latter will also be looking to local consumer confidence which may surprise higher, extending AUD/NZDs bullish reversal.

US Trading Session Economic Events

Asia Pacific Trading Session Economic Events

Miễn trừ trách nhiệm:

Các ý kiến trong bài viết này chỉ thể hiện quan điểm cá nhân của tác giả và không phải lời khuyên đầu tư. Thông tin trong bài viết mang tính tham khảo và không đảm bảo tính chính xác tuyệt đối. Nền tảng không chịu trách nhiệm cho bất kỳ quyết định đầu tư nào được đưa ra dựa trên nội dung này.

Sàn môi giới

IB

TMGM

FXCM

GO MARKETS

STARTRADER

Neex

IB

TMGM

FXCM

GO MARKETS

STARTRADER

Neex

Sàn môi giới

IB

TMGM

FXCM

GO MARKETS

STARTRADER

Neex

IB

TMGM

FXCM

GO MARKETS

STARTRADER

Neex

Tin HOT

Tin tức Forex 17/03: Sàn XM tung cơ chế mới hỗ trợ đối tác

Thấy gì từ sự kiện Pi Network thu hồi hàng loạt đồng Pi khiến cộng đồng tẩy chay?

WikiFX Review sàn Forex Vantage 2025: Hành trình chinh phục trader Việt?

Pi Network và tin đồn cơ chế neo giá: Những điều bạn cần biết

Làm sao để tránh bẫy sàn lừa đảo khi đầu tư Forex? Đây là Tips từ WikiFX

Pi Network hôm nay: Ai cứu 'Pi thủ' đây?

Bí quyết giao dịch Forex giúp bạn thắng lớn mà không cần margin cao

Cơn sốt đầu tư Pi Network: Bao nhiêu người Việt Nam đang tham gia?

Pi Network hôm nay: Giá Pi sắp phục hồi vì một tín hiệu tích cực mới?

Pi Network hôm nay: Chuyên gia dự báo giá Pi sắp tới sẽ đạt con số kỷ lục!

Tính tỷ giá hối đoái