简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

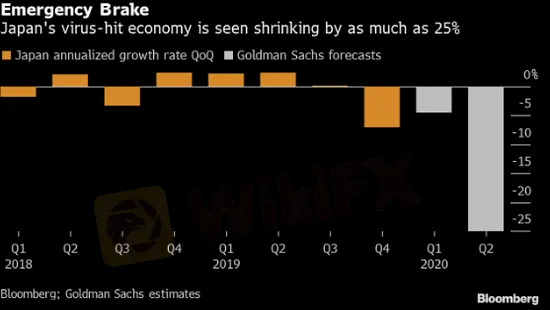

Japan’s Economy May See a Record 25% Shrinkage

Lời nói đầu:JCER Senior Researcher Jun Saito recently commented that the global epidemic may be the final blow on Japan’s sluggish economy, while Goldman Sachs estimated Japan’s economy may see a record 25% shrinkage this quarter.

JCER Senior Researcher Jun Saito recently commented that the global epidemic may be the final blow on Japan’s sluggish economy, while Goldman Sachs estimated Japan’s economy may see a record 25% shrinkage this quarter.

Jun Saito repeated the point that Japan is heading towards a severe recession, attributing it to the shocks on demand and supply. In addition, the delaying of Olympics and Paralympics will “put more downward pressure” on Japan’s economy.

According to the estimation of Goldman Sachs, Japan’s economy will shrink an unprecedented 25% this quarter despite a stimulus scheme never seen in history. While coronavirus outbreak in the US and some European economies is easing, this may not be a very good news for the safe-haven yen, which has benefited from the continuous global economic slump in March. Now that the market expects a peak of global coronavirus cases, risk aversion sentiment is eventually thinning, which will definitely weigh on the yen.

Miễn trừ trách nhiệm:

Các ý kiến trong bài viết này chỉ thể hiện quan điểm cá nhân của tác giả và không phải lời khuyên đầu tư. Thông tin trong bài viết mang tính tham khảo và không đảm bảo tính chính xác tuyệt đối. Nền tảng không chịu trách nhiệm cho bất kỳ quyết định đầu tư nào được đưa ra dựa trên nội dung này.

Sàn môi giới

XM

FOREX.com

IB

Neex

FXCM

AvaTrade

XM

FOREX.com

IB

Neex

FXCM

AvaTrade

Sàn môi giới

XM

FOREX.com

IB

Neex

FXCM

AvaTrade

XM

FOREX.com

IB

Neex

FXCM

AvaTrade

Tin HOT

Tin tức Forex 17/03: Sàn XM tung cơ chế mới hỗ trợ đối tác

Thấy gì từ sự kiện Pi Network thu hồi hàng loạt đồng Pi khiến cộng đồng tẩy chay?

WikiFX Review sàn Forex Vantage 2025: Hành trình chinh phục trader Việt?

Pi Network và tin đồn cơ chế neo giá: Những điều bạn cần biết

Làm sao để tránh bẫy sàn lừa đảo khi đầu tư Forex? Đây là Tips từ WikiFX

Pi Network hôm nay: Ai cứu 'Pi thủ' đây?

Bí quyết giao dịch Forex giúp bạn thắng lớn mà không cần margin cao

Pi Network hôm nay: Giá Pi sắp phục hồi vì một tín hiệu tích cực mới?

Pi Network hôm nay: Chuyên gia dự báo giá Pi sắp tới sẽ đạt con số kỷ lục!

Tính tỷ giá hối đoái