简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold this Week: Bullish!

Lời nói đầu:Gold prices consolidates after hitting a record high ($2,075) in August, but the macroeconomic environment may keep gold afloat.

WikiFX News (24 Aug)- Gold prices consolidates after hitting a record high ($2,075) in August, but the macroeconomic environment may keep gold afloat.

The rebound in gold prices from the monthly low ($1,863) struggles to retain the momentum as the Federal Open Market Committee (FOMC) in its meeting minutes revealed a looming change in the monetary policy outlook: the FOMC has voted unanimously to push back “the expiration of the temporary U.S. Dollar liquidity swap lines through March 31, 2021” after extending its lending programs till the end of the year.

In addition, the Feds chairman Jerome Powell is expected to reveal something new at the Jackson Hole Economic Symposium scheduled for August 27-28, with the information further supporting gold prices.

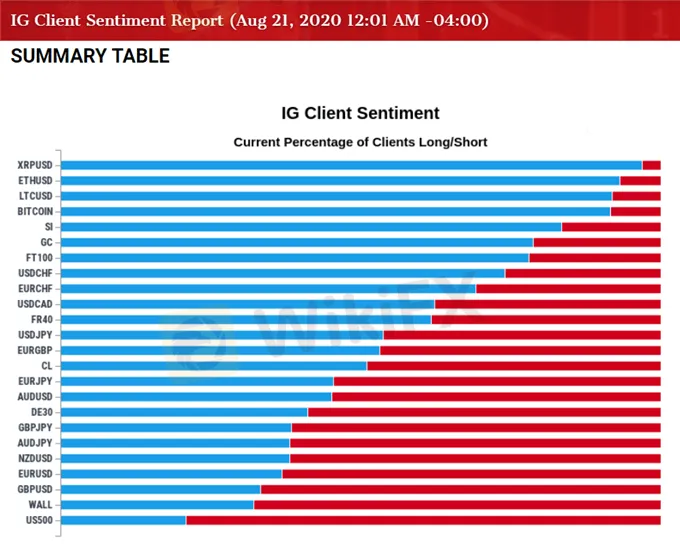

The IG Client Sentiment report implies that the continuous crowding behavior may raise gold prices, heightening the appeal of gold as an alternative to fiat currencies. Technically speaking, it is expected to see bullish gold enduring as it has been trading to fresh yearly highs for every single month so far in 2020.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

Chart: IG Client Sentiment

Miễn trừ trách nhiệm:

Các ý kiến trong bài viết này chỉ thể hiện quan điểm cá nhân của tác giả và không phải lời khuyên đầu tư. Thông tin trong bài viết mang tính tham khảo và không đảm bảo tính chính xác tuyệt đối. Nền tảng không chịu trách nhiệm cho bất kỳ quyết định đầu tư nào được đưa ra dựa trên nội dung này.

Sàn môi giới

HFM

FXTM

EC Markets

IC Markets Global

ATFX

FBS

HFM

FXTM

EC Markets

IC Markets Global

ATFX

FBS

Sàn môi giới

HFM

FXTM

EC Markets

IC Markets Global

ATFX

FBS

HFM

FXTM

EC Markets

IC Markets Global

ATFX

FBS

Tin HOT

Tin tức Forex 17/03: Sàn XM tung cơ chế mới hỗ trợ đối tác

Thấy gì từ sự kiện Pi Network thu hồi hàng loạt đồng Pi khiến cộng đồng tẩy chay?

Pi Network hôm nay: Giá Pi sắp phục hồi vì một tín hiệu tích cực mới?

Tính tỷ giá hối đoái