منتجات

Moreاختيار وسيط

قم بتصفية وتقديم تقييم شامل للعديد من الوسطاء. يمكنك عرض المعلومات التنظيمية وخدمات الشركة والإيداعات والسحوبات والفروقات والأخبار ومراجعات المستخدمين والشكاوى والمزيد. تساعدك مرشحات البحث لدينا على معرفة المزيد عن الوسطاء ومعلوماتهم، مما يساعدك في اختيار وسطاء عالي الجودة لفتح حساب أو التحقق من المعلومات.

وسيط للمقارنة

اختر صفحات معلومات شاملة لاثنين أو أكثر من الوسطاء لمقارنة أنظمتهم وعمليات الإيداع والسحب والفروقات والمراجعات والشكاوى وغيرها من التفاصيل. من خلال إجراء تقييم شامل للوسطاء، يمكنك تحليل نقاط القوة والضعف لديهم، مما يساعدك في اختيار وسيط عالي الجودة يلبي متطلباتك الحالية.

هيئة مشهورة

The Sum Of All Fears

The Sum Of All Fears

PIMCO raises $5.5 billion for private credit funds - Business Insider

The California-based manager wasn't immune to structured credit's disastrous March, but has been able to raise money to take advantage of the dislocation.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

Warren Buffett, Berkshire Hathaway sold its airline stocks in April - Business Insider

The famed investor said he was "wrong" to invest in American, Delta, United, and Southwest.

Deutsche Bank Q1 earnings: German lender posts 67% fall in profits - Business Insider

Deutsche Bank has had a challenging few years months including a restructuring and big losses. DB said it would be cutting 18,000 jobs last year.

Barclays Q1 earnings beat forecasts as markets income surges 77% - Business Insider

The British banking giant took a $2.6 billion impairment charge to reflect the impact of the coronavirus pandemic.

ECB President Lagarde warned of a 15% contraction to the eurozone - Business Insider

Eurozone leaders have already announced a stimulus package of more than 500 billion euros to protect the bloc from the economic fallout of COVID-19.

Star fund manager closes short Treasurys bet after losing billions in assets - Business Insider

Fund manager Michael Hasenstab of Templeton Global finally ended his three-year bet that Treasury yields would rise after seeing billions in outflows.

Gold price to hit record $3,000 on central bank stimulus, BofA says - Business Insider

Monetary authorities are spending trillions of dollars to keep economies stable, creating a perfect situation for gold to rally, the analysts said.

Howard Marks warned stock rally is 'inappropriately positive' - Business Insider

"Is it really appropriate that, given all the bad news in the world today, we should get back to the highs in only three months?"

Japan to give all citizens free money for coronavirus economic fallout - Business Insider

Japan's Prime Minister Abe Shinzo intends to hand out about $1,000 in coronavirus aid relief for each citizen.

Wealthy art owners are raising cash from their collections amid the looming recession - Business Insider

Art isn't necessarily impacted by the risks commonly associated with the financial market, which makes it a lower call risk as an investment.

'I still think cash is trash': Ray Dalio dismissed dollars on Reddit - Business Insider

"I believe that cash, which is non-interest-bearing money, will not be the safest asset to hold."

Stocks, oil, bitcoin surge after Fed boosts coronavirus stimulus - Business Insider

"The Fed is now providing backstops for pretty much everything."

US unemployment could surge to 30% in Q2, GDP plunges 50%, Fed boss warns - Business Insider

"It is a huge shock and we are trying to cope with it and keep it under control," St. Louis Fed chief James Bullard told Bloomberg.

What brands does LVMH own? A look at 17 of the most iconic LVMH brands - Business Insider

LVMH, which struck a deal to buy Tiffany & Co. for $16.2 billion last year, is the world's largest luxury goods seller— and they just keep on growing.

Warren Buffett: 'most gruesome mistake' was Dexter Shoe, $9 billion error - Business Insider

"As a financial disaster, this one deserves a spot in the Guinness Book of World Records," the Berkshire Hathaway boss and famed investor said.

Oil price, gold spikes fizzle after Iran attack as escalation fears wane - Business Insider

Gold punched above $1,600 for the first time since 2013, and oil spiked. But the gains fizzled. "They've barely scratched the US," says an analyst.

The SEC is investigating whether BMW manipulated sales figures - Business Insider

'We can confirm that we have been contacted by the SEC and will cooperate fully with their investigation,' a BMW spokesperson told Business Insider.

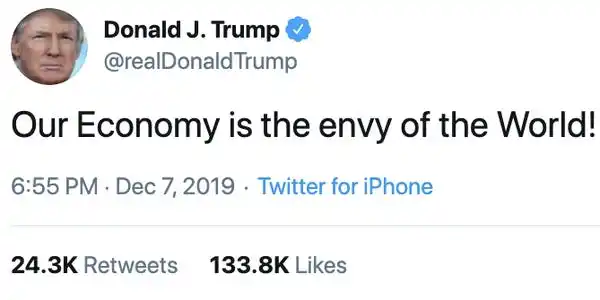

Bad news for Trump — 60% of Americans say the surging stock market doesn't affect them - Business Insider

Only 40% of respondents in the Financial Times poll said that the stock market had gone up this year. The S&P 500 has soared about 26% in 2019.