简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

Zusammenfassung:The ECB's consumer expectations survey shows mixed economic signals with slight improvements in unemployment expectations but unchanged growth forecasts. The euro faces pressure from a strong USD, while the GBP shows resilience, contributing to the strength of GBP/USD and the decline of EUR/GBP.

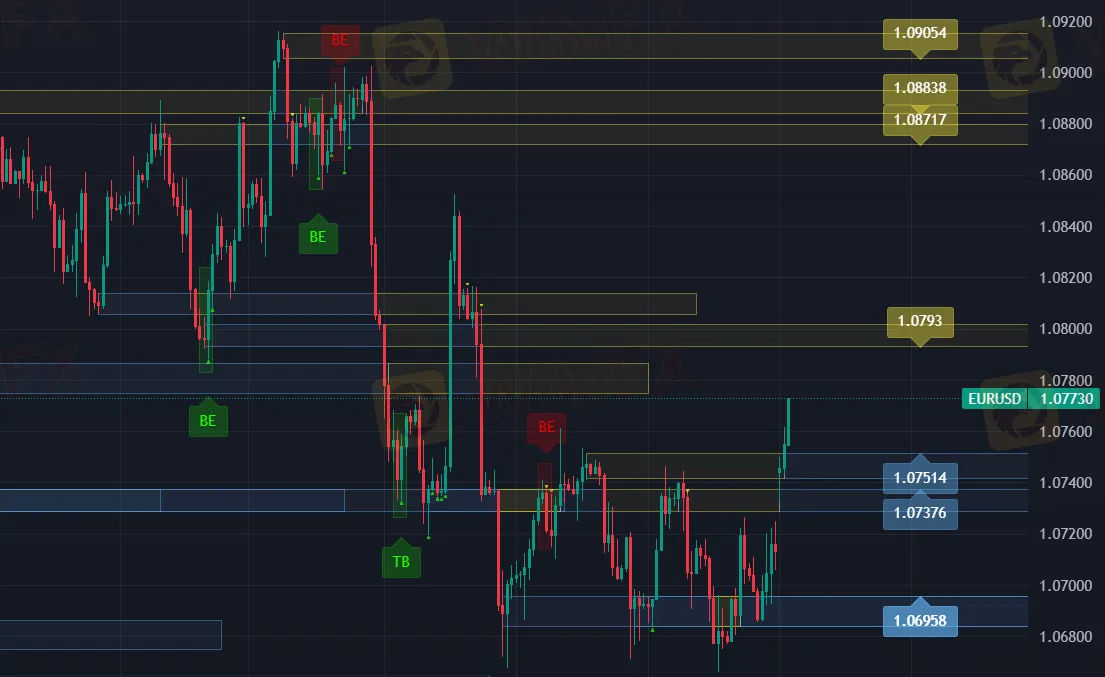

EUR/USD 4H Chart

GBP/USD 4H Chart

EUR/GBP 4H Chart

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

Key Support Levels:

EUR/USD:1.06842

GBP/USD:1.26029

EUR/GBP:0.84158

Key Resistance Levels:

EUR/USD:1.07515

GBP/USD:1.27033

EUR/GBP:0.8500

Recent data from the European Central Bank's (ECB) consumer expectations survey presents a mixed picture for the Eurozone economy. The 12-month ahead unemployment expectation has slightly improved, while the growth expectation remains unchanged at a modest 0.8%. Additionally, the 3-year ahead inflation expectation has slightly decreased, with uncertainty over inflation expectations falling to its lowest level since February 2022. Despite these mixed signals, the euro is facing significant pressure, on track for its largest monthly decline since January, due to the strength of the US dollar.

In contrast, the British pound is showing resilience, heading for its first weekly gain in a month. This gain is supported by improving economic data and market sentiment, contributing to the strength of the GBP against both the USD and the EUR.

Consolidated Impact on EUR/USD, GBP/USD, and EUR/GBP

Overall Sentiment:

EUR/USD:Bearish, driven by mixed economic data from the Eurozone and strong USD performance.

GBP/USD:Neutral to bullish, supported by improving UK economic data.

EUR/GBP:Bearish for EUR, supported by stronger GBP performance.

Key Influences:

EUR/USD:

Improved Eurozone labor market expectations provide limited support.

Unchanged growth expectations and slightly lower long-term inflation expectations.

Significant monthly decline for the euro due to robust USD strength and mixed economic signals.

GBP/USD:

Sterling gains supported by improving UK economic data and market sentiment.

Potential for further GBP strength if UK economic data continues to improve.

EUR/GBP:

Euro weakness against GBP due to mixed Eurozone economic data.

Stronger GBP performance driving EUR/GBP lower.

Potential Movement:

EUR/USD:Likely to remain under pressure with potential downside movement, contingent on further economic data and USD strength.

GBP/USD:Potential upside movement if UK economic data continues to improve.

EUR/GBP:Likely to trend lower with stronger GBP performance against a weaker EUR.

Important Economic Calendar Events for the Eurozone

Eurozone CPI (YoY) (June)– June 30, 2024: A key measure of inflation.

Eurozone Unemployment Rate (May)– June 30, 2024: Indicator of labor market health.

Germany Manufacturing PMI (June)– July 1, 2024: Reflects manufacturing sector activity.

Eurozone Services PMI (June)– July 3, 2024: Indicates health of the services sector.

Germany Industrial Production (MoM) (May)– July 5, 2024: Measures industrial output.

Eurozone Retail Sales (MoM) (May)– July 5, 2024: Indicator of consumer spending trends.

Eurozone Sentix Investor Confidence (July)– July 8, 2024: Measures investor confidence and economic outlook.

UK GDP (MoM) (May)– July 10, 2024: Measure of monthly economic growth.

UK Manufacturing Production (MoM) (May)– July 10, 2024: Reflects manufacturing output.

UK CPI (YoY) (June)– July 17, 2024: A key measure of inflation.

UK Unemployment Rate (May)– July 18, 2024: Indicator of labor market health.

UK Retail Sales (MoM) (June)– July 20, 2024: Measures consumer spending trends.

Important Economic Calendar Events for the UK

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Solaris: Weiteres Millionen-Funding noch dieses Jahr – auch Verkauf steht im Raum

Volocopter: Laut Bericht steht das Flugtaxi-Startup kurz vor einer Übernahme aus China

KI-Blase, Milliarden-schwere US-Konkurrenz – warum DeepLs Jarek Kutylowski trotzdem keine Angst hat

Ich war auf der billigsten und der teuersten Kreuzfahrt derselben Reederei – das waren die größten Unterschiede

Ethereum: Deflationstrend und ETF-Euphorie könnten Rallye entfachen

Nur 100 Euro im Monat: So habe ich 4000 Euro Gewinn in 5 Jahren mit einem ETF-Depot für meine Kinder gemacht

85 Prozent Plus in einer Woche: Die 5 größten Altcoin-Gewinner im Bitcoin-Boom

Ripple XRP: Die Rally nimmt Fahrt auf – warum der Kurs jetzt explodiert

Ethereum: Rekordzuflüsse bei ETFs und Risiken durch unstaked ETH – Wohin geht der Kurs?

Statt in den Ruhestand zu gehen, kauften meine Frau und ich eine Pension: Es half uns, einen neuen Lebenssinn zu finden

Wechselkursberechnung