简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dollar Dip on Dovish Fed’s Beige Book

Zusammenfassung:The dollar continues to tumble, trading at its lowest level since April, below the $104 mark. The U.S. Beige Book suggests economic growth has moderated and inflation shows signs of easing, strengthening the likelihood of a September rate cut. Improved risk appetite in the market propelled the Dow Jones up nearly 300 points in the last session, breaking its all-time high.

The dollar tumbling on the Dovish Feds Beige book suggests the inflation is heading to 2%.

The Japanese yen gained significantly yesterday due to potential Japanese official market intervention.

Eye on todays ECB interest rate, which is expected to hold the interest rate unchanged.

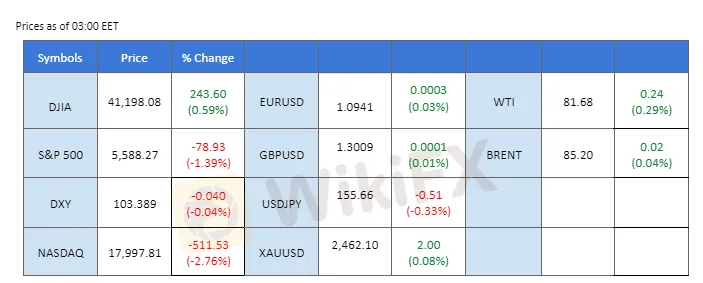

Market Summary

The dollar continues to tumble, trading at its lowest level since April, below the $104 mark. The U.S. Beige Book suggests economic growth has moderated and inflation shows signs of easing, strengthening the likelihood of a September rate cut. Improved risk appetite in the market propelled the Dow Jones up nearly 300 points in the last session, breaking its all-time high. However, the tech-heavy Nasdaq dipped nearly 3% as semiconductor mega-cap stocks plummeted in reaction to potential new chip restrictions from the Biden administration.

In Japan, the Japanese Yen experienced significant price movement, sparking speculation of another intervention by Japanese officials. The Yen rose against the lacklustre dollar, trading below the 156.00 mark, a level not seen in a month. Meanwhile, Australian job data released early on suggests the labour market in the country is easing, hindering the Aussie dollars strength. On the other hand, the European Central Bank's interest rate decision is due later today, with expectations for the ECB to hold rates unchanged, providing buoyancy for the euro.

In the commodity market, gold remains above the $2,450 level, although improved risk appetite in the market has hindered its safe-haven appeal. Meanwhile, oil prices experienced a technical rebound, catalysed by upbeat U.S. weekly crude inventories data that came in significantly lower than market expectations.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.3%) VS -25 bps (6.7%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the US dollar against a basket of six major currencies, extended its losses as more Federal Reserve members expressed dovish views on the US economic outlook. Federal Reserve Governor Christopher Waller mentioned that the timing of rate cuts is drawing closer, following recent data showing moderate economic growth and declining inflation pressures. Richmond Fed President Tom Barkin also noted that he sees a broader slowdown in inflation.

The dollar index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 26, suggesting the index might enter oversold territory.

Resistance level: 104.05, 104.45

Support level: 103.65, 103.25

XAU/USD, H1

Gold prices initially retraced sharply due to profit-taking and technical corrections after breaking above a record high. However, the commodity managed to hold its ground after hitting the support level of $2,450. With rising market volatility and risk-off sentiment, the appeal of gold remains strong. The upcoming US Presidential elections, a downbeat US economic outlook, and dovish statements from the Federal Reserve continue to support gold prices.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 50, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 2460.00, 2475.00

Support level: 2445.00, 2425.00

GBP/USD,H4

The GBP/USD pair broke above its crucial psychological resistance level at 1.3000 in the last session, propelled by upbeat UK economic indicators. The UK CPI reading, released last night, came in at 2%, surpassing market expectations and potentially leading the BoE to put any rate cut decisions on hold. Meanwhile, the dovish narrative from the Fed's Beige Book, unveiled yesterday, has also weakened the dollar's strength, providing additional support for the pair.

The GBP/USD broke above its psychological resistance level and remained above such a level, suggesting a bullish bias for the pair. The RSI remains in the upper region while the MACD eases slightly, suggesting that the bullish momentum is easing.

Resistance level: 1.3065, 1.3140

Support level: 1.2940, 1.2850

EUR/USD,H4

The EUR/USD pair broke out from its price consolidation range and remains at its highest level since March, indicating a bullish bias for the pair. This movement was catalyzed by the Eurozone CPI reading, which aligned with market expectations at 2.5%, suggesting that the ECBs interest rate decision due later today will likely hold unchanged. Meanwhile, the dollar continues to trade in a downtrend trajectory as the Fed releases dovish statements ahead of its own interest rate decision.

EUR/USD is poised at its 4-month high level after breaking above its price consolidation range, suggesting a bullish signal for the pair. The RSI remains closely toward the overbought zone while the MACD remains flowing in the upper region, suggesting that the bullish momentum remains strong.

Resistance level: 1.0985, 1.1040

Support level: 1.0895, 1.0853

Nasdaq (US100), H4

The Nasdaq plummeted by more than 500 points in the last session as tech mega caps faced strong headwinds.

Nasdaq has dropped below the Fibonacci level of 61.8% suggesting the bullish trajectory structure has broken. The RSI has dipped into the oversold zone while the MACD has crossed below the zero line, suggesting the bearish momentum is gaining.

Resistance level: 20000.00, 20130.00

Support level: 19720.00, 19460.00

USD/JPY, H4

The Japanese yen rose sharply, sparking speculation about further interventions from Japanese officials to support the yen from multi-decade lows. The yen, recently rebounding from a 38-year low, saw significant volatility. Bank of Japan data indicated that Japanese authorities spent 2.14 trillion yen intervening last week. Combined with the estimated amount spent on Thursday, Japan is suspected to have bought nearly 6 trillion yen via intervention. This potential intervention, coupled with the recent downward trend of the dollar, has weighed heavily on the USD/JPY pair.

USD/JPY is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 25, suggesting the pair might enter oversold territory.

Resistance level: 157.65, 159.25

Support level: 155.30, 153.60

ETH/USD, H4

Ethereum (ETH) is currently poised at its key liquidity zone near the $3,400 level, awaiting the positive news of the ETH ETF launch. ETF issuers have begun filing their final S-1 registration statements, suggesting that the launch date is imminent. The Ethereum price is expected to surge to it's all-time high above $5,000 following the ETF launch.

ETH prices are poised at their recent high level, waiting for a catalyst to trade higher. The RSI has dropped out from the overbought zone, while the MACD has crossed, which suggests that the bullish momentum is easing.

Resistance level: 3670.00, 3940.00

Support level: 3250.00, 3030.00

CL OIL, H4

Crude oil prices rebounded sharply, buoyed by a bullish inventory report. According to the Energy Information Administration (EIA), US crude oil inventories declined sharply by 4.870 million barrels, far exceeding the market expectations of a 900,000-barrel drop. This significant decline in inventories suggests strengthening demand and a lower supply outlook, supporting oil prices.

Oil prices are trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 49, suggesting the commodity might experience technical correction since the RSI stays below the midline.

Resistance level: 82.90, 84.10

Support level: 81.35, 79.70

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Solaris: Weiteres Millionen-Funding noch dieses Jahr – auch Verkauf steht im Raum

Volocopter: Laut Bericht steht das Flugtaxi-Startup kurz vor einer Übernahme aus China

KI-Blase, Milliarden-schwere US-Konkurrenz – warum DeepLs Jarek Kutylowski trotzdem keine Angst hat

Ich war auf der billigsten und der teuersten Kreuzfahrt derselben Reederei – das waren die größten Unterschiede

Ethereum: Deflationstrend und ETF-Euphorie könnten Rallye entfachen

Nur 100 Euro im Monat: So habe ich 4000 Euro Gewinn in 5 Jahren mit einem ETF-Depot für meine Kinder gemacht

85 Prozent Plus in einer Woche: Die 5 größten Altcoin-Gewinner im Bitcoin-Boom

Ripple XRP: Die Rally nimmt Fahrt auf – warum der Kurs jetzt explodiert

Ethereum: Rekordzuflüsse bei ETFs und Risiken durch unstaked ETH – Wohin geht der Kurs?

Luxusmarken in der Krise: Burberry meldet enormen Umsatzeinbruch und verkündet eine neue Strategie

Wechselkursberechnung