简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】The Interplay of Policy, Economy, and Geopolitics - Triggering Multidimensional Challenges in the Global Oil Market!

Zusammenfassung:In the coming months, OPEC+'s decisions, U.S. political dynamics, Iraq's energy policy adjustments, and China's economic policy changes will have a profound impact on the global oil market. Investors and analysts need to closely monitor these dynamics to better understand and predict market trends.

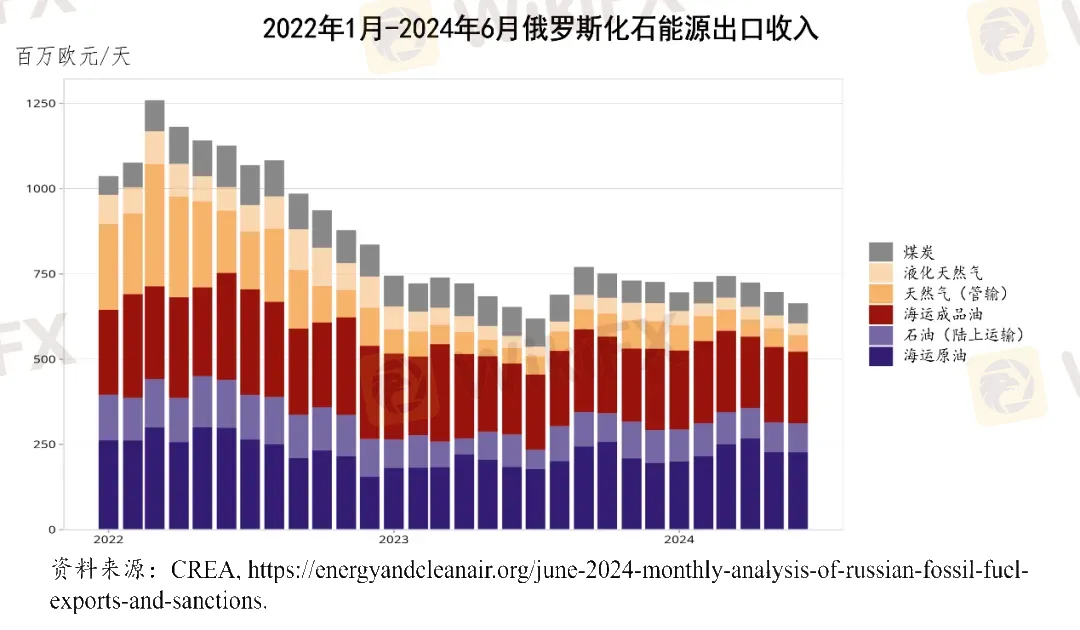

Since the outbreak of the Russia-Ukraine conflict in 2014, we have entered the 30th month. The sanctions imposed on Russia by the United States, the European Union, and the G7 have been in place for 20 months. Although the sanctions initially impacted Russia's energy exports, the Russian energy industry has shown adaptability and resilience, and its energy exports and production have basically returned to normal. According to official data from industry institutions and the Russian Ministry of Energy, Russia's energy exports and production have stabilized.

Data from June 2024 shows that despite a 5% month-on-month decrease in fossil fuel export revenue, crude oil production still exceeds the OPEC+ production target by about 100,000 barrels per day. Although crude oil exports have fallen to a seven-month low, the value of seaborne oil exports remains at a relatively high level. Sanctions have idled more than 50 Russian tankers, reducing transportation costs and mitigating the impact of Western sanctions on Russian oil sales and revenue. The United States, the European Union, and the G7 have intensified sanctions, but Russia has successfully circumvented some of the sanctions by using shadow fleets and covert cargo transfers.

Ukrainian President Zelensky is actively lobbying the United Kingdom and other Western countries to further tighten sanctions on Russia and discuss strategies to further disrupt Russian oil sales. Despite questions about the effectiveness of the sanctions, Ukraine's actions show its determination to weaken Russia's economic foundation. In response to the sanctions, Russia has adjusted its crude oil export policy, prioritizing the needs of the domestic refining industry while seeking new markets and transportation methods to bypass the sanctions. This strategy has helped stabilize domestic fuel prices and ensure the supply of civilian and military fuel.

The global energy market has felt the impact of changes in Russian oil exports, including increased oil price volatility and shifts in the direction of oil flows. Although sanctions and price cap mechanisms have not completely deprived Russia of its oil export revenue, Russia has successfully maintained the stability of its energy industry by adjusting its export strategy and finding new buyers.

Despite the impact of Western sanctions on Russia's energy exports, Russia has successfully maintained the stability of its energy industry through flexible responses and market adjustments. Ukraine and Western countries are looking for new sanctions to further limit Russia's oil revenue. However, the interconnectedness of the global energy market and Russia's adaptability have made the sanctions less effective than expected.

Against the backdrop of the global economy gradually recovering from the COVID-19 pandemic, the oil market is going through a critical adjustment period. The OPEC+ organization, led by Saudi Arabia and Russia, is expected to maintain its routine stance at the next month's meeting and not adjust the production increase plan that started in the fourth quarter. This decision reflects the market's concern about falling oil prices and a cautious attitude towards the production increase plan. Since the announcement of the production reduction plan last year, Brent crude oil futures prices have rebounded from the low to around $85 per barrel.

This price stability has eased the urgency of OPEC+'s production increase. Market analysts and OPEC+ representatives generally believe that the organization will observe the demand growth situation this summer before deciding whether to adjust its production policy. Jorge Leon, Senior Vice President of Rystad Energy AS, pointed out that if the demand growth in the second half of the year meets expectations, OPEC+ will have room to gradually lift production cuts starting in October. However, the International Energy Agency (IEA) warns that despite the stable decline in global inventory this quarter, the slowdown in demand growth in Asia may lead to a significant slowdown in the market in the fourth quarter. The IEA's analysis shows that even if OPEC+ postpones the production increase, global oil inventory may still remain stable in the fourth quarter, and supply may be in surplus next year.

This forecast has increased market uncertainty, and investors and analysts are closely monitoring more data and reports to be released soon.As of today, the September contract price of Brent crude oil futures is $82.44 per barrel, up 4 cents from the July 22 settlement price, while the contract closed down 23 cents on July 22. The September contract price of WTI crude oil futures is $78.40 per barrel, the same as the settlement price on July 22, when the contract closed down 24 cents.

In the political field, members of the US Democratic Party are uniting to support Vice President Harris as the party's presidential candidate. This means that Harris's stance on climate change and energy policy may have a profound impact on the oil market. She has actively promoted the development of clean energy and taken more aggressive legal enforcement measures against fossil fuel companies. In other words, if Harris is elected, it may have an impact on oil demand and supply. It will enhance the market's expectations of the United States in terms of climate change and energy policy, especially in terms of demand and supply.

In terms of geopolitics, Iraq's energy policy adjustment is also worth noting. Iraqi Prime Minister Mohammed Shia al-Sudani launched a power transmission line connecting the northern region of the country with Turkey. This energy policy adjustment aims to reduce dependence on crude oil and also helps to comply with the OPEC+ crude oil production commitment. However, as the second-largest producer in OPEC, the adjustment of its energy policy not only affects the domestic economy but may also have an impact on the global oil market. Despite Iraq's huge oil reserves, it still heavily relies on imports of electricity and natural gas from neighboring countries. Iraq burned an average of 120,000 barrels of crude oil in its power plants every day in the first half of the year. Data from the Joint Organizations Data Initiative (JODI) shows that Iraq's average direct burning of crude oil in 2023 was 185,000 barrels per day.

In terms of economic policy, the People's Bank of China has recently lowered the main short-term and long-term interest rates, with the one-year and five-year loan market quoted rates (LPR) each reduced by 10 basis points. This policy adjustment may stimulate economic growth and thus affect global oil demand. As one of the world's largest oil consumers, changes in China's economic policy have an important impact on the global oil market. In addition, this policy adjustment by the People's Bank of China may have a multifaceted impact on the global oil market. First, lowering interest rates may stimulate domestic investment and consumption, increasing demand for oil.

Secondly, China's economic growth may drive the global economic recovery, further increasing demand for oil. However, this impact may be affected by other factors, such as global economic uncertainty and geopolitical risks. Overall, the future development of the global oil market will be affected by various factors, including OPEC+'s production policy, international political dynamics, the advancement of climate change policies, and economic policy adjustments of major global economies. These factors interact with each other, shaping the supply and demand balance and price trends of the oil market. Market participants need to closely monitor these dynamics to make wise investment and business decisions.

In the coming months, OPEC+'s decisions, U.S. political dynamics, Iraq's energy policy adjustments, and China's economic policy changes will have a profound impact on the global oil market. Investors and analysts need to closely monitor these dynamics to better understand and predict market trends.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Solaris: Weiteres Millionen-Funding noch dieses Jahr – auch Verkauf steht im Raum

Volocopter: Laut Bericht steht das Flugtaxi-Startup kurz vor einer Übernahme aus China

KI-Blase, Milliarden-schwere US-Konkurrenz – warum DeepLs Jarek Kutylowski trotzdem keine Angst hat

Ich war auf der billigsten und der teuersten Kreuzfahrt derselben Reederei – das waren die größten Unterschiede

Ethereum: Deflationstrend und ETF-Euphorie könnten Rallye entfachen

Nur 100 Euro im Monat: So habe ich 4000 Euro Gewinn in 5 Jahren mit einem ETF-Depot für meine Kinder gemacht

85 Prozent Plus in einer Woche: Die 5 größten Altcoin-Gewinner im Bitcoin-Boom

Ripple XRP: Die Rally nimmt Fahrt auf – warum der Kurs jetzt explodiert

Ethereum: Rekordzuflüsse bei ETFs und Risiken durch unstaked ETH – Wohin geht der Kurs?

Statt in den Ruhestand zu gehen, kauften meine Frau und ich eine Pension: Es half uns, einen neuen Lebenssinn zu finden

Wechselkursberechnung