简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】The Fed's Rate Cut Expectations and AI Stock Fatigue Pose a Double-Edged Sword for Investors!

Zusammenfassung:It can be seen that the current financial market is full of uncertainty. On the one hand, investors are highly concerned about the Federal Reserve's interest rate cut expectations and policy changes, and on the other hand, concerns about the prospects of artificial intelligence technology and investment returns are also affecting the performance of the stock market. These factors work together to form a complex and changeable market environment, and investors need to make decisions more cautious

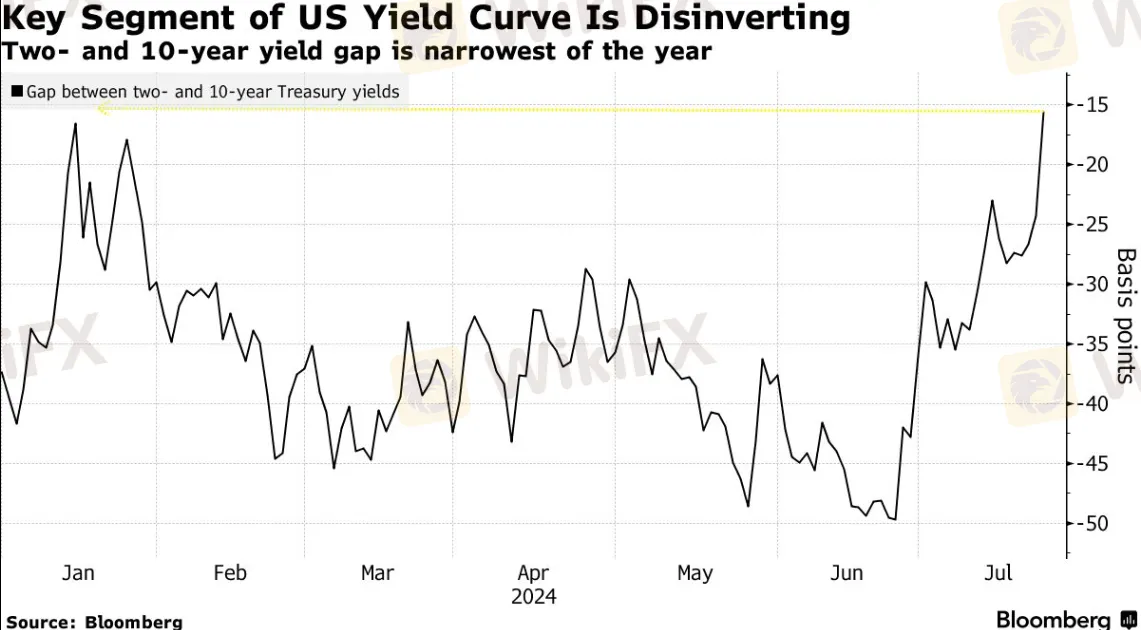

Amidst the growing calls for the Federal Reserve to start cutting interest rates as early as next week, the U.S. Treasury yield curve has steepened dramatically. On Wednesday, the two-year U.S. Treasury yield, sensitive to policy, fell by three basis points, while the 10-year Treasury yield rose by about the same magnitude. This brought the gap between these yields to approximately 14 basis points, the narrowest spread since October 2023. This shift indicates that investors believe the Federal Reserve may cut rates faster and more significantly than previously anticipated. Swaps traders still believe that the rate cut this year will exceed two 25 basis point reductions, with the first cut possibly coming in September.

However, as the Federal Reserve is about to announce its latest interest rate decision next week, the pressure for a rate cut is mounting. Former New York Fed Chairman Dudley stated in an opinion column that policymakers should cut rates at the July meeting. CreditSights Senior Fixed Income Strategist Zachary Griffiths noted, “The front-end market has been rebounding on the expectation that the Fed will cut rates earlier and more than the market had previously priced in.” This trend suggests that the steepening of the yield curve is resuming, a bet favored by investors anticipating Trump's victory in the November presidential election.

Economic data on Wednesday showed that the U.S. manufacturing industry has once again fallen into contraction, and there was an unexpected decline in new U.S. home sales. A few hours later, $70 billion in five-year U.S. Treasury bonds were auctioned off at a yield of 4.121%, higher than the 4.110% trading level of the securities at the end of the bidding. Compared to Tuesday's record demand for $69 billion in two-year U.S. Treasury bonds, this result was seen as average. The movement in long-term yields led the U.S. Treasury to not accept any dealer bids in Wednesday's debt repurchase operations.

Meanwhile, investors' disappointment with the prospects of artificial intelligence has led to a $1 trillion wipeout of the NASDAQ 100 index. Questions have arisen about how long the substantial investments in artificial intelligence technology will take to yield returns. The NASDAQ index fell by more than 3.6%, marking its worst performance since October 2022. On the list of laggards were the darlings of artificial intelligence technology, including semiconductor companies such as NVIDIA, Broadcom (BRCM), and Arm Holdings Plc. (ARM). Alphabet Inc. released a lukewarm earnings report later on Tuesday, which included inflated capital expenditures, sparking a drop in stock prices. The company's stock fell by more than 5%, marking its worst performance since January. Tesla's stock plummeted by more than 12% after CEO Musk provided few details about his company's self-driving car plans.

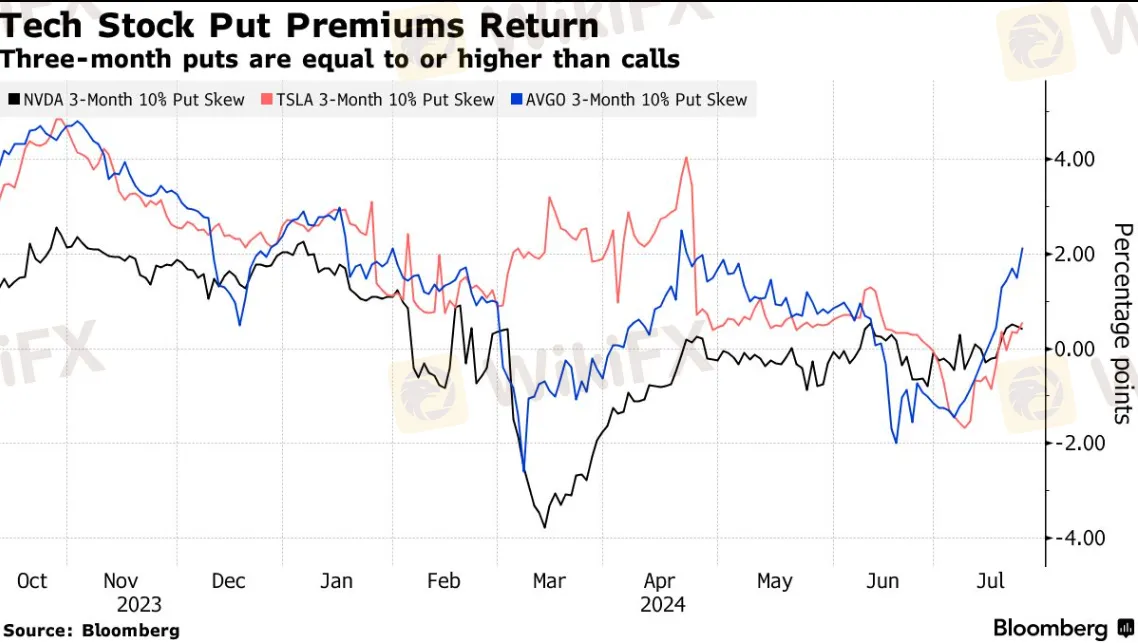

Mapsignals Chief Investment Strategist Alec Young said, “The most important question is, where is the return on investment for all the artificial intelligence infrastructure spending? Too much money is being spent now. Maybe there will be a return in a few years. But I think investors realize that returns take time to materialize, and the profits of hyperscale companies will be damaged in the short term by their spending in this area.” As a result, traders now have to pay a higher price to hedge against the volatility of tech stocks. NVIDIA's option volatility has risen to its highest level since mid-March, and Broadcom's put option premiums have reached their highest in three months.

Two weeks ago, the U.S. inflation data released were lower than expected, triggering a massive rotation from tech stocks to companies that would benefit most from a Fed rate cut (mainly small-cap stocks). On Wednesday of this week, small-cap stocks outperformed large-cap stocks for the fourth consecutive trading day, and this was the 10th time in 11 days that small caps have outperformed large caps. The Russell 2000 index rose by 0.5% this week, while the S&P 500 index fell by 1.5%, and the NASDAQ 100 index fell by 2.6%. Although the rotation of tech stocks continues, the sharp volatility is enough to indicate that there is more to the story. Specifically, investors seem to be heeding the growing voices in some Wall Street circles that the rise of artificial intelligence has fueled a bubble in the past year, adding $9 trillion to the S&P 500 index, and the rise of artificial intelligence will inevitably burst. Although Wednesday may not have been the beginning of the burst, the magnitude of the drop is worrying.

Allspring Global Investments Portfolio Manager Neville Javeri said, “In the short term, there may be a bit of artificial intelligence fatigue, as some investments of large technology companies in artificial intelligence may not be returned within the time expected by investors.” Hardware manufacturers for artificial intelligence computing suffered some of the largest declines on Wednesday after surging earlier this year. Super Micro Computer Inc. (SMCI) fell by 9.15%, NVIDIA fell by 6.8%, and Broadcom fell by 7.6%. High market value stocks also retreated, with Meta Platforms (META) falling by 5.6%, Microsoft (MSFT) falling by 3.6%, and Apple (AAPL) falling by 2.9%.

However, other traders believe these movements are only temporary. Chief Investment Officer of Silvant Capital Management, Michael Sansoterra, said, “I think what you're seeing is just some of the stocks with particularly good performance and very solid year-to-date returns experiencing some profit-taking in the absence of any major surprises from Google.”This plunge has caused the so-called “Big Seven Tech Stocks” index to fall by 5.9%, breaking below the average price of the past 50 days for the first time since May. Since the beginning of this year, the index is still up by 33%. Growing concerns about an artificial intelligence bubble, with more market professionals believing that the commercial hopes for artificial intelligence have been exaggerated and questioning the huge costs required to build the infrastructure needed to run and train large language models. Jim Covello, head of equity research at Goldman Sachs Group, is one of them.

Activity in the derivatives market has fueled talk of an artificial intelligence bubble, with investors buying call options on indexes and individual stocks, especially NVIDIA, which have acted like “rocket fuel” in the rally. As the rotation of technology stocks speeds up, this sentiment has also changed, potentially exacerbating Wednesday's decline. For example, last week's demand for NVIDIA put options exceeded call options, reaching the highest level in five months. Tail risk hedging for profiting from a stock market crash (with a possible drop of up to 30%) is rising at the fastest pace since last October. The cost of preventing a stock price drop of about 10% has reached its highest level since August 2023.

The valuation of technology stocks has entered the most bubble-like territory in history. Two weeks ago, the price-to-earnings ratio of the S&P 500 Information Technology Index reached its highest point since 2002. Despite the sell-off, the prices of many large technology stocks are still at astonishing levels. NVIDIA's expected profit for the next 12 months is 36 times, while the average for the S&P 500 index is 21 times. Both Apple and Microsoft's prices exceed 30 times. At an awkward moment when the profit growth of technology giants is slowing down, this increases the risk of profitability.

Although Alphabet's performance has dimmed hopes that artificial intelligence will make a greater contribution to the financial performance of giant companies, investors have not yet heard from other giants. Microsoft will release its earnings report on July 30, followed by Meta Platforms, Apple, and Amazon. NVIDIA, the biggest beneficiary of AI spending, will release its last report on August 28. Cayla Seder, a macro multi-asset strategist at State Street, said, “We still stick to the view of large-cap stocks, quality stocks, and growth stocks. Because even if people are uneasy about the earnings of technology stocks, they are a more attractive choice in terms of earnings growth and fundamentals.”

It can be seen that the current financial market is full of uncertainty. On the one hand, investors are highly concerned about the Federal Reserve's interest rate cut expectations and policy changes, and on the other hand, concerns about the prospects of artificial intelligence technology and investment returns are also affecting the performance of the stock market. These factors work together to form a complex and changeable market environment, and investors need to make decisions more cautiously.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Ich war auf der billigsten und der teuersten Kreuzfahrt derselben Reederei – das waren die größten Unterschiede

Solaris: Weiteres Millionen-Funding noch dieses Jahr – auch Verkauf steht im Raum

KI-Blase, Milliarden-schwere US-Konkurrenz – warum DeepLs Jarek Kutylowski trotzdem keine Angst hat

Volocopter: Laut Bericht steht das Flugtaxi-Startup kurz vor einer Übernahme aus China

Nur 100 Euro im Monat: So habe ich 4000 Euro Gewinn in 5 Jahren mit einem ETF-Depot für meine Kinder gemacht

Ethereum: Deflationstrend und ETF-Euphorie könnten Rallye entfachen

85 Prozent Plus in einer Woche: Die 5 größten Altcoin-Gewinner im Bitcoin-Boom

Ripple XRP: Die Rally nimmt Fahrt auf – warum der Kurs jetzt explodiert

Ethereum: Rekordzuflüsse bei ETFs und Risiken durch unstaked ETH – Wohin geht der Kurs?

Statt in den Ruhestand zu gehen, kauften meine Frau und ich eine Pension: Es half uns, einen neuen Lebenssinn zu finden

Wechselkursberechnung