简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KVB Today's Analysis: USD/JPY Eyes Volatility Ahead of BoJ Policy Meeting and US Data

Zusammenfassung:The USD/JPY pair rises to 154.35 during the Asian session as the Yen strengthens against the Dollar for the fourth consecutive session, nearing a 12-week high. This is due to traders unwinding carry trades ahead of the Bank of Japan's expected rate hike and bond purchase tapering. Recent strong US PMI data supports the Federal Reserve's restrictive policy. Investors await US GDP and PCE inflation data, indicating potential volatility ahead of key central bank events.

Product: XAU/USD

Prediction: Increase

Fundamental Analysis:

Gold price rose to $2,395 during early Asian trading, boosted by expectations of a Federal Reserve interest rate cut in September after cooling US inflation data.

Markets are pricing in a Fed rate cut in September, even with strong US economic growth, as disinflation continues. Gold initially fell after the US GDP release but rebounded on softer US core PCE inflation.

However, the persistent weakness in the USD/JPY pair provided some respite for gold buyers.

Upcoming US core PCE inflation data is expected to show a slight softening, which could support gold prices. Overall, the gold market is volatile as investors adjust positions ahead of key economic events.

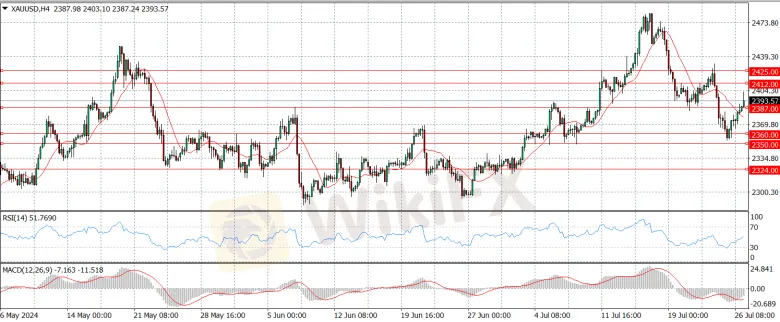

Technical Analysis:

Gold sellers are still in control , with the 14-day RSI below the 50 level. They are targeting the key 50-day SMA at $2,360, and a daily close below that could trigger a fresh downtrend toward the 100-day SMA support at $2,324.

Buyers may find support at the $2,350 psychological level. On the upside, the immediate resistance is the previous 21-day SMA support at $2,387, and a break above that could retest the $2,400 mark.

The next recovery targets are the $2,412 area and the $2,425 static resistance level. The current price action suggests a potential tug-of-war between buyers and sellers around the key technical levels.

Product: EUR/USD

Prediction: Increase

Fundamental Analysis:

The EUR/USD pair trades around 1.0860, edging higher as traders anticipate a September Fed rate cut, which weighs on the US dollar. After recovering to 1.0870 last Thursday, the pair lost momentum and closed near 1.0850 as the US dollar benefited from upbeat data.

The US Q2 GDP grew 2.8%, exceeding market forecasts, helping the dollar stay resilient. Later, the monthly PCE Price Index data is unlikely to significantly impact the pair, as the quarterly figure was already accounted for in the GDP report.

However, changes in risk sentiment ahead of the weekend could drive EUR/USD's action, as a bullish opening in Wall Street could help the pair hold its ground.

Technical Analysis:

EUR/USD failed to reclaim the 100-period SMA for the second consecutive day , with the RSI indicator on the 4-hour chart edging lower after touching 50, suggesting a lack of buyer interest.

On the downside, the 100-day and 200-day SMAs form strong support around 1.0800-1.0790, followed by 1.0700 (psychological level). Resistances could be seen at 1.0860 (100-period SMA), and 1.0900 (psychological level).

The current price action indicates a potential struggle for control between buyers and sellers, with the key technical levels likely to play a crucial role in the near-term direction of the EUR/USD pair.

Product: USD/JPY

Prediction: Decrease

Fundamental Analysis:

The USD/JPY pair jumps to 154.35 during the Asian session, as the Japanese Yen extends its upward trend against the US Dollar for the fourth straight session, hovering near its 12-week high. This is likely due to traders unwinding carry trades ahead of the Bank of Japan's (BoJ) policy meeting next week, where the BoJ is expected to raise interest rates and outline plans to taper bond purchases.

Recent strong US PMI data gives the Federal Reserve more leeway to maintain its restrictive policy stance. Investors are closely monitoring the upcoming US GDP and PCE inflation data, which are expected to provide new insights into the economic conditions.

The current price action suggests potential volatility ahead of the key central bank events.

Technical Analysis:

The USD/JPY pair trades around 153.3 this morning, having breached below the descending channel, indicating a strengthening of the dovish bias. The 14-day RSI is around 30, suggesting an oversold situation and a potential short-term rebound.

The pair may find significant support near May's low of 151.86 and the psychological level of 151.00. On the upside, it may test the lower boundary of the descending channel around 154.00, and a return to the channel could weaken the bearish bias, potentially testing resistance at the 9-day EMA of 155.90 and the upper channel boundary around 156.80.

The current technical analysis points to a period of potential volatility and consolidation for the USD/JPY pair.

Product: GBP/USD

Prediction: Increase

Fundamental Analysis:

GBP/USD maintains recovery momentum, trading above 1.2850 in the American session on Friday, as the positive shift in risk mood doesn't allow the US Dollar to preserve its strength. The pair struggled to gain traction on Thursday, trading slightly below 1.2900, as safe-haven flows dominate the financial markets amid concerns over a gloomy economic outlook. The People's Bank of China unexpectedly loosened its policy last week, which is reflected in the risk-averse market atmosphere. Investors are closely watching the upcoming US GDP and Jobless Claims data, which could impact the USD's performance and GBP/USD's upside potential in the near term.

Technical Analysis:

GBP/USD is currently holding slightly above 1.2880, where the Fibonacci 38.2% retracement level of the latest uptrend and the 100-period SMA are located. If this support level fails, the pair could potentially target 1.2830 (Fibonacci 50% retracement) and the 1.2800-1.2790 area (psychological level, 200-period SMA) as the next bearish targets.

On the upside, the immediate resistance is at 1.2900 (20-period SMA, psychological level, static level), followed by 1.2940-1.2950 (Fibonacci 23.6% retracement, 50-period SMA). The current technical analysis suggests a potential consolidation or reversal for the GBP/USD pair in the near term, depending on its ability to hold the key support levels.

Market Analysis Disclaimer:

The market analysis provided by KVB Prime Limited is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any financial instrument. Trading forex and other financial markets involves significant risk, and past performance is not indicative of future results.

KVB Prime Limited does not guarantee the accuracy, completeness, or timeliness of the information provided in the market analysis. The content is subject to change without notice and may not always reflect the most current market developments or conditions.

Clients and readers are solely responsible for their own investment decisions and should seek independent financial advice from qualified professionals before making any trading or investment decisions. KVB Prime Limited shall not be liable for any losses, damages, or other liabilities arising from the use of or reliance on the market analysis provided.

By accessing or using the market analysis provided by KVB Prime Limited, clients and readers acknowledge and agree to the terms of this disclaimer.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Das ist der reichste Deutsche aus Baden-Württemberg – sein Unternehmen kennt ihr bestimmt

Personalisierte Werbung: Meta-Chef Mark Zuckerberg will mit Donald Trumps Hilfe EU-Gesetze umgehen

Japanischer Technologiekonzern Softbank dabei: OpenAI sichert sich Rekordinvestition von 40 Milliarden Dollar

Arztpraxis-Startup Doctorly meldet Insolvenz an

Deutschlands Wirtschaft schrumpft – doch einige Bundesländer zeigen überraschendes Wachstum

Consulting-Firmen wollen Milliarden einsparen – um der US-Regierung günstigere Preise bieten

Diese Folgen fürchten Ökonomen durch die US-Zölle – und welche sie für wenig gefährlich halten

Donald Trump verhängt Zölle gegen die ganze Welt – EU spricht von „schwerem Schlag und bereitet Gegenmaßnahmen vor

Verband der Automobilindustrie reagiert auf US-Zölle: „Das wird Arbeitsplätze betreffen

Wechselkursberechnung