简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KVB Market Analysis | 1 August: Gold Prices Surge Amid Fed Rate Cut Speculation and Geopolitical Tensions

Zusammenfassung:Gold prices surged on Wednesday after the Federal Reserve suggested a potential rate cut in September. A decline in US Treasury yields and the US dollar, which hit its lowest level since July 18, further increased the appeal of gold. Investors are closely monitoring the Fed's upcoming policy decision. Geopolitical tensions in the Middle East, particularly between Israel and Iran, also drove investors towards the safe-haven asset, adding to gold's rise.

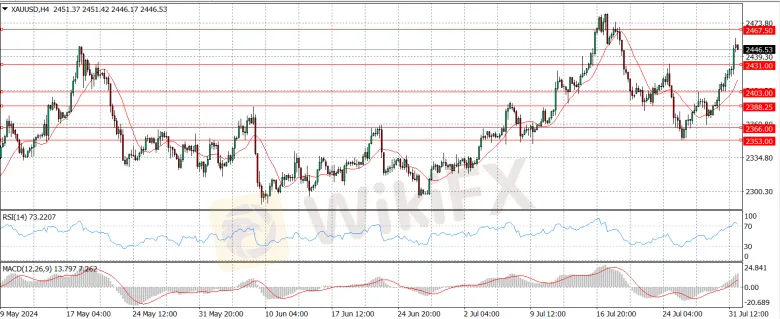

Product: XAU/USD

Prediction: Increase

Fundamental Analysis:

Gold prices gained significant traction on Wednesday after the Federal Reserve hinted at the possibility of reducing borrowing costs as early as September. The drop in US Treasury yields and the weakening of the US dollar, which fell to its lowest level since July 18, further boosted the appeal of the non-yielding yellow metal.

Investors are closely watching the Fed's monetary policy decision later in the day. Geopolitical tensions in the Middle East, with fears of an escalation between Israel and Iran, also contributed to gold's rise as investors sought safe-haven assets. The decline in the US dollar and yields provided additional support to the gold price.

Technical Analysis:

Gold prices are trading within a slightly rising channel on the daily timeframe, but have generally been ranging sideways for over three months. The 50-day Exponential Moving Average (EMA) near $2,366 continues to provide support to the gold bulls.

The 14-day EMA oscillates in the 40.00-60.00 range, indicating indecision among market participants. A breakout above the all-time high of $2,483.75 would send gold into uncharted territory and signal fresh upside momentum. On the downside, support is seen near the upward-sloping trendline around $2,225, which is plotted from the October 6 low near $1,810.50.

The overall technical picture suggests a consolidation phase for gold in the near term.

Product:EUR/USD

Prediction: Increase

Fundamental Analysis:

The EUR/USD pair traded near key technical levels on Wednesday after the Federal Reserve kept rates unchanged, as widely expected. The US dollar came under renewed selling pressure following a hawkish Bank of Japan meeting and signals that the Fed might start cutting rates in September.

The dollar's offered stance remained constant after the Fed acknowledged that inflation remains “somewhat” excessive and reaffirmed it will not decrease rates until it is more confident that inflation is returning to the 2% target. However, the policy divergence between the Fed and the ECB is likely to persist, with both central banks expected to cut rates soon.The Eurozone's inflation data, while coming in stronger than expected, is unlikely to deter the ECB's plans to reduce rates in September.

Technical Analysis:

On the downside, the key support levels for EUR/USD are the weekly low of 1.0798, the 100-day SMA at 1.0793, and the June low of 1.0666, before reaching the May low of 1.0649.

On the upside, the initial resistance is the July high of 1.0948, followed by the March top of 1.0981 and the psychological 1.1000 level.

The broader bearish bias for the pair will likely return if it remains below the critical 200-day SMA at 1.0822.

In the near term, the pair is consolidating, with the 55-SMA at 1.0853 providing a temporary hurdle, before the resistance levels of 1.0948, 1.0981, and 1.1000. On the downside, 1.0798 is the first support, followed by 1.0709.

Product:USD/JPY

Prediction: Decrease

Fundamental Analysis:

The USD/JPY pair is going below 149.00 in the Asian session, hitting a four-month low near 148.50. This reflects the ongoing policy divergence between the Fed and the Bank of Japan (BoJ), as well as rising geopolitical tensions in the Middle East.

The Japanese Yen has been strengthening for three straight weeks, driven by its safe-haven appeal amidst economic uncertainties. Going forward, the focus will be on the BoJ meeting, where policymakers are expected to hike rates by 10 basis points and announce plans to taper bond-buying operations.

Meanwhile, a slight recovery in the US Dollar has temporarily halted the major's upside, as investors turn cautious ahead of the upcoming Fed meeting, where the central bank is expected to leave rates unchanged but maintain a dovish stance.

Technical Analysis:

The BoJ is expected to raise interest rates, which could support the Japanese Yen and act as a headwind for the USD/JPY pair. Meanwhile, the Fed is anticipated to leave rates unchanged but provide guidance on future monetary policy, which will be closely monitored by the markets.

Traders are adopting a cautious stance, waiting for the outcomes of these key central bank meetings before making any significant moves in the USD/JPY pair.

Product: GBP/USD

Prediction: Increase

Fundamental Analysis:

The GBP/USD pair is retracing its recent losses, trading around 1.2840 during the Asian session. Analysis of the daily chart suggests the pair is in a consolidation phase or potential reversal within a descending channel.

After rising above 1.2850 on Tuesday, the pair lost momentum and closed the day in negative territory. It is currently moving sideways just below 1.2850, as investors remain cautious ahead of the upcoming monetary policy decisions from the Fed and the Bank of England.

The US Dollar has remained resilient, supported by stronger-than-expected US consumer confidence and job openings data, which further bolsters the currency's position against its rivals.

Technical Analysis:

The GBP/USD pair continues to trade below a descending trend line from mid-July, and the Relative Strength Index on the 4-hour chart remains below 40, indicating a bearish stance.

On the downside, the immediate support is at 1.2830 (Fibonacci 50% retracement of the latest uptrend). If this level turns into resistance, the pair could see further losses towards 1.2800 (200-period SMA and psychological level), 1.2780 (Fibonacci 61.8% retracement), and 1.2750 (static level).

If the pair manages to break above the descending trend line near 1.2840, it could face resistance at 1.2880 (Fibonacci 38.2% retracement) before testing 1.2900 (100-period SMA).

Market Analysis Disclaimer:

The market analysis provided by KVB Prime Limited is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any financial instrument. Trading forex and other financial markets involves significant risk, and past performance is not indicative of future results.

KVB Prime Limited does not guarantee the accuracy, completeness, or timeliness of the information provided in the market analysis. The content is subject to change without notice and may not always reflect the most current market developments or conditions.

Clients and readers are solely responsible for their own investment decisions and should seek independent financial advice from qualified professionals before making any trading or investment decisions. KVB Prime Limited shall not be liable for any losses, damages, or other liabilities arising from the use of or reliance on the market analysis provided.

By accessing or using the market analysis provided by KVB Prime Limited, clients and readers acknowledge and agree to the terms of this disclaimer.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Solaris: Weiteres Millionen-Funding noch dieses Jahr – auch Verkauf steht im Raum

Volocopter: Laut Bericht steht das Flugtaxi-Startup kurz vor einer Übernahme aus China

KI-Blase, Milliarden-schwere US-Konkurrenz – warum DeepLs Jarek Kutylowski trotzdem keine Angst hat

Ich war auf der billigsten und der teuersten Kreuzfahrt derselben Reederei – das waren die größten Unterschiede

Ethereum: Deflationstrend und ETF-Euphorie könnten Rallye entfachen

Nur 100 Euro im Monat: So habe ich 4000 Euro Gewinn in 5 Jahren mit einem ETF-Depot für meine Kinder gemacht

85 Prozent Plus in einer Woche: Die 5 größten Altcoin-Gewinner im Bitcoin-Boom

Ripple XRP: Die Rally nimmt Fahrt auf – warum der Kurs jetzt explodiert

Ethereum: Rekordzuflüsse bei ETFs und Risiken durch unstaked ETH – Wohin geht der Kurs?

Statt in den Ruhestand zu gehen, kauften meine Frau und ich eine Pension: Es half uns, einen neuen Lebenssinn zu finden

Wechselkursberechnung