简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】The Federal Reserve's Interest Rate Cut Expectations and the Turbulent Precious Metals Market, Opportunities and Challenges for Investors!

Zusammenfassung:The easing of global monetary policy, especially the expectation of interest rate cuts by the Federal Reserve, has brought new vitality to the gold and silver markets. Despite some uncertainties, such as the resilience of the US dollar and geopolitical risks, analysts generally have a positive outlook for the long-term prospects of precious metals. Investors should pay close attention to the policy trends of the Federal Reserve and changes in the global economic and political environment when co

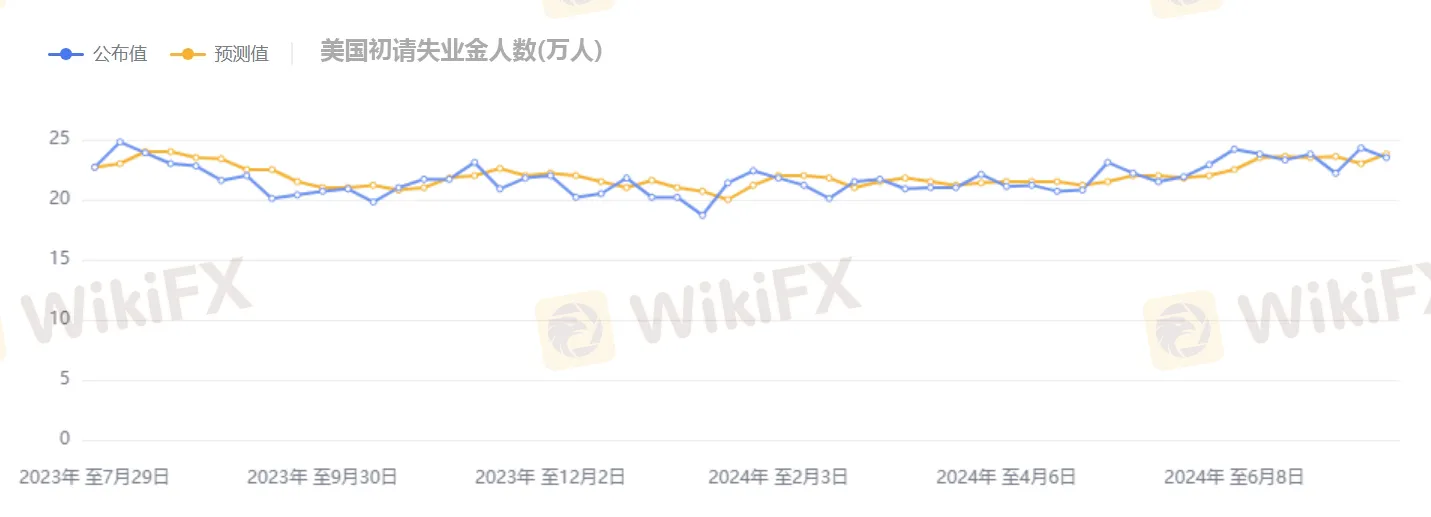

The U.S. labor market has exhibited some unique changes following the COVID-19 pandemic, posing difficulties for economic analysts in determining whether the rise in unemployment rates is a harbinger of economic issues. The upcoming release of July's non-farm employment data may further intensify this debate. The market expects an increase of 185,000 in non-farm employment for July, slightly lower than the 206,000 in June, with the unemployment rate expected to remain at 4.1%. Notably, employment data over the past year and a half has frequently exceeded market expectations.

Mike Reynolds, Senior Vice President of Investment Strategy at Glenmede, emphasizes that if the Federal Reserve hopes to achieve a soft economic landing, the labor market needs to show some signs of weakness moderately, without getting out of control and triggering a negative cycle. The unemployment rate has been rising for the past three months and is now approaching the economic recession warning line set by former Federal Reserve economist Sam, a rule that has an impeccable record over the past 50 years. According to Sam's rule, if the average unemployment rate over three months is 0.5 percentage points higher than the lowest point in 12 months, the economy is likely already in recession.

Federal Reserve Chairman Powell mentioned in his recent speech that the supply and demand gap in the labor market has nearly reached balance, with the ratio of vacant positions to available employees dropping to 1.2:1, a significant decrease from the 2:1 ratio during the inflationary period a few years ago. If this balance can be sustained and inflation indicators show improvement, Powell hinted at the possibility of an interest rate cut in September. The market is also watching the growth of wages, expecting a monthly increase of 0.3% and an annual increase of 3.7% in July. If the forecast is accurate, this will be the lowest wage increase since May 2021. BeiChen Lin, an investment strategist at Russell Investments, believes that even if wage growth remains stable or accelerates slightly, the progress the Federal Reserve has made in inflation, along with the subsequent data released, will provide opportunities for an interest rate cut in September.

The U.S. unemployment rate has risen from a low of 3.4% at the beginning of 2023 to 4.1% in June and is expected to remain at this level in July, despite the slowdown in wage growth. Nevertheless, the rise in the unemployment rate has intensified the debate about interest rate levels. Other traditional warning indicators, such as temporary employment and turnover rates, also show warning signals. However, many analysts believe that the deterioration of these indicators can be interpreted as a natural cooling of the job market after the pandemic. Prominent economists such as former Federal Reserve Vice Chairman Blinder, Goldman Sachs Chief Economist Hazus, and former New York Federal Reserve Chairman Dudley advocate for an early interest rate hike, partly based on the latest developments in the job market. Another view is that due to the strict immigration restrictions in the early stages, many Americans withdrew from the labor market during the pandemic, artificially lowering the unemployment rate. With the reversal of these trends, the rebound in labor force participation means that the unemployment rate is returning to a more natural level.

Powell pointed out that in the post-COVID-19 era, many traditional rules and wisdom no longer apply because the situation is very unusual. The market may not be very tolerant of this situation. If the so-called “Sam Rule” is triggered, the market may quickly digest the possibility of a hard economic landing. Currently, workers have lost the advantages they had in recent years after the pandemic, job seekers need a longer time to find new jobs, and the pace of wage growth has returned to pre-pandemic levels. Sarah House, a senior economist at Wells Fargo, said that whether or not a recession occurs, the labor market is experiencing a real cooling.

For gold, Daniel Ghali, a commodity strategist at TD Securities, pointed out that geopolitical risks have increased the demand for safe-haven assets, but the rise in gold prices is mainly supported by the weakness of the US dollar and strong demand in the bond market, rather than the demand for gold itself. In addition, if the geopolitical situation in the Middle East eases, it may damage the gold bulls. The strengthening of Asian currencies is also reducing the demand for precious metals as a hedge against currency devaluation. From a technical point of view, if the non-farm data and wage growth are lower than expected, it may enhance the market's expectation that the Federal Reserve will cut interest rates by 50 basis points in September, which could trigger a new round of gold price increases. The gold price may retest the high of $2475 on July 18 and may break through the historical high of $2484. However, if the non-farm data is stronger than expected, it may weaken the expectation of interest rate cuts, leading to a significant drop in gold prices to the support level of $2425.

Against the backdrop of a global monetary policy shift towards easing, the precious metals market, especially the gold market, is experiencing a series of significant changes. Western investors' interest in gold has been reignited, especially exchange-traded funds (ETFs) backed by gold, which have once again become popular in the market. According to data from Bloomberg, the inflow of funds into gold ETFs in July reached the highest level since March 2022, a sharp contrast to the outflow of funds from gold ETFs in the first half of the year, which was the largest since 2013.

This year, the price of gold has hit new highs, driven by central bank buying and a surge in demand from China and other emerging markets. The buying behavior of central banks and the demand for physical gold from private investors, including jewelry and bars, have jointly supported the rise in gold prices. However, at the same time, many American and European investors have chosen to wait and see or take profits as the price of gold continues to climb, indicating that the market's interest in gold is not universally consistent. The market currently generally expects the Federal Reserve to cut interest rates in September, and this expectation has brought new momentum to the precious metals market. Bond traders are fully convinced that the Federal Reserve will cut interest rates three times this year, and the yield on 10-year U.S. Treasury bonds has fallen below 4% for the first time since February, adding evidence that the U.S. labor market is cooling down.

Federal Reserve Chairman Powell discussed the decision to maintain interest rates as expected at a press conference and said that “it may be proposed” to cut interest rates at the next meeting on September 18. The rise in geopolitical risks, such as the tension in the Middle East after Israel assassinated Hamas political leaders in Tehran, may also stimulate Western investors' interest in gold. Gold is an asset sought after during periods of economic, financial, and geopolitical pressure, and these factors may further drive investors' sentiment towards gold.

Although gold has attracted most of the investors' attention, WisdomTree expects silver to continue to outperform other precious metals in 2025. Analysts pointed out that despite the high volatility, silver's performance this year is still better than gold, with an increase of more than 22%, while the gold price has risen by 13%. The industrial demand for silver has reached a historical high, driven by photovoltaic demand and applications in 5G and automotive electronics, and it is expected that the market demand for silver will exceed its supply in 2024. WisdomTree's analysts also mentioned that since 2021, silver has been in a state of supply shortage every year, and it is expected that the market demand for silver will exceed its supply in 2024, similar to 2023. It is expected that this supply and demand imbalance will support the price of silver in the first half of 2025.

The easing of global monetary policy, especially the expectation of interest rate cuts by the Federal Reserve, has brought new vitality to the gold and silver markets. Despite some uncertainties, such as the resilience of the US dollar and geopolitical risks, analysts generally have a positive outlook for the long-term prospects of precious metals. Investors should pay close attention to the policy trends of the Federal Reserve and changes in the global economic and political environment when considering investing in precious metals. At the same time, considering the supply and demand situation of the silver market and the growth of industrial demand, silver may become a highlight in the future precious metals market.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Solaris: Weiteres Millionen-Funding noch dieses Jahr – auch Verkauf steht im Raum

Volocopter: Laut Bericht steht das Flugtaxi-Startup kurz vor einer Übernahme aus China

KI-Blase, Milliarden-schwere US-Konkurrenz – warum DeepLs Jarek Kutylowski trotzdem keine Angst hat

Ich war auf der billigsten und der teuersten Kreuzfahrt derselben Reederei – das waren die größten Unterschiede

Goldman Sachs hat 95 Mitarbeiter zu Partnern befördert – wir haben 9 gefragt, wie sie gefeiert haben

Ethereum: Deflationstrend und ETF-Euphorie könnten Rallye entfachen

Nur 100 Euro im Monat: So habe ich 4000 Euro Gewinn in 5 Jahren mit einem ETF-Depot für meine Kinder gemacht

85 Prozent Plus in einer Woche: Die 5 größten Altcoin-Gewinner im Bitcoin-Boom

Solana auf dem Vormarsch: Bald mehr Wert als Ethereum?

Ripple XRP: Die Rally nimmt Fahrt auf – warum der Kurs jetzt explodiert

Wechselkursberechnung