简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Second Quarter 2019 Forecasts for the US Dollar, Pound, Gold, Equities, and More

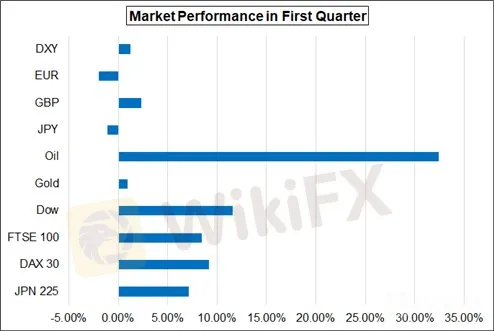

Abstract:The first quarter of 2019 produced significant technical reversals across multiple asset crosses, setting up what should be a crucial second quarter of 2019.

The first quarter of 2019 produced significant technical reversals across multiple asset crosses, setting up what should be a crucial second quarter of 2019. The sharp rebound in energy prices, gains across the boards in global equities, and a dip lower across global bond yields have produced confounding conditions for FX markets.

2019年第一季度在多个资产交叉点产生了重大的技术逆转,确定了2019年第二季度的关键时刻。能源价格的大幅反弹,全球股市的全面上涨以及下跌全球债券收益率下降为外汇市场带来了混乱的条件。

See all of the DailyFX Trading Guides from the Quarterly Forecasts to the Top Trading Opportunities, How to Trade Event Risk, Building Confidence in Trading and so much more.

查看所有DailyFX交易指南从季度预测到最佳交易机会,如何交易事件风险,建立交易信心等等。

US Dollar Q2 Forecast: Dollar Either Principal Safe Haven or Falling Star

美元Q2预测:主要是安全避风港还是主星

Even though the Federal Reserve took a step back from its hawkish monetary policy, their shift must be put into context: they‘ve been the most hawkish central bank for several years, including in 2018, when they hiked rates three times. But the concerns that have provoked the Fed – global growth – also increase the US Dollar’s appeal as a safe haven currency.

尽管美联储从强硬的货币政策中退了一步,但必须将其转变为背景:他们多年来一直是最强硬的中央银行,包括2018年,当他们三次加息时。但引发美联储全球经济增长的担忧也增加了美元作为避险货币的吸引力。

Euro Q2 Forecast: Weak Price Outlook amid Political Uncertainty, Heightened Growth Concerns

欧元区第二季预测:政治不确定性增长疲软,增长加快关注

The Euro hasn‘t been at the center of attention in recent months, but it’s still being weighed down by issues growing within. Political fissures are cropping up, and in absence of fiscal leadership, the ECB is stepping into the void with another TLRO program.

欧元近几个月来一直没有成为人们关注的焦点,但它仍然受到内部问题的影响。政治裂痕正在出现,在没有财政领导的情况下,欧洲央行正在通过另一项TLRO计划进入虚空。

British Pound Q2 Forecast: Sterlings Future Defined by Brexit Outcome

英镑第二季预测:英镑未来由英国脱欧结果决定

The Brexit negotiations have pushed past their originally scheduled end date of March 29, and it appears that the UK parliament is stuck with limited options. While parliamentarians want to avoid a no deal, “hard Brexit,” there has been limited support for any options set forth thus far, and UK PM Mays deal has been a non-starter. More volatility is ahead for the British Pound, but the outlook may quickly turn depending upon how Brexit resolves itself.

英国脱欧谈判已超过原定于3月29日结束的日期,看来英国议会的选择有限。虽然议员们希望避免没有交易,“硬脱欧”,但到目前为止所提出的任何选择的支持都有限,而且英国首相梅斯的交易也是如此。一个非首发。英镑将面临更大的波动,但前景可能会迅速转变,这取决于英国脱欧如何自行解决。

Japanese Yen Q2 Forecast: A Haven in a World Which Needs One

日元第二季度预测:一个需要一个世界的避风港

The Japanese Yen enters the second quarter with a potential tailwind at its back, with global growth concerns rising and the protracted UK-EU divorce weighing on the region. Meanwhile, trade concerns are flourishing across the globe. For now, USDJPY remains in a symmetrical triangle though breakout potential is building.

日元进入第二季度,其背后可能出现顺风,全球增长担忧加剧,英国与欧盟的长期离婚对该地区构成压力。与此同时,全球贸易问题正在蓬勃发展。目前,美元兑日元仍然处于对称三角形,虽然突破潜力正在建立。

{10}

Oil Q2 Forecast: How Will Crude Oil Prices Budge Between Weak Growth, Undersupply?

{10}

Energy markets shook off their collapse in the fourth quarter of 2018 by posting exceptionally strong gains in the first quarter of 2019. With OPEC maintaining its supply cuts until at least June, and stress in the Iranian and Venezuelan supply chains, oil prices will have a positive catalyst contending with overarching concerns of a slowing global economy.

能源市场在2018年第四季度通过在2019年第一季度出现异常强劲的增长而摆脱了崩溃。欧佩克至少在6月份保持供应减少,并且伊朗和委内瑞拉供应受到压力连锁,油价将有一个积极的催化剂,与全球经济放缓的首要担忧相抗衡。

{12}

Gold Q2 Forecast: Bets for Fed Rate-Cut Fosters Bullish Outlook

{12}

The Federal Reserve has backed off its plans to raise rates gradually, and rates markets are pricing-in a cut later this year. The price for bullion may exhibit a more bullish behavior over the coming months as a result of the path of rate hikes being stunted.

美联储已经放弃了逐步提高利率的计划,而且市场正在定价 - 今年晚些时候会降价。由于加息路径受阻,未来几个月金条价格可能表现出更加看涨的行为。

Equities Q2 Forecast: Stock Markets Feel Pressure of Waning Global Growth, Yield Curve

股市Q2预测:股市感受全球衰退的压力增长,收益率曲线

Global equities had a very strong first quarter, thanks largely to central banks stepping into markets to keep liquidity conditions buoyant. Now that global growth concerns are filtered into the conversation, it seems likely that central banks will push forward with more dovish commentary and policies, which could prove supportive for stocks into the second quarter.

全球股市第一季度表现非常强劲,主要得益于央行进入市场以保持流动性状况的活跃。现在全球经济增长的担忧已经被过滤到对话中,央行似乎可能会推出更多温和的评论和政策,这可能会证明对第二季度股票的支持。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 15 August: Gold Prices Drop Sharply Following U.S. CPI Report and Fed Rate Cut Expectations

Spot XAU/USD dropped nearly $18, closing below $2,450, after the latest U.S. CPI report reduced hopes for a significant Fed rate cut. The CPI rose 0.2% in July, with a notable increase in rent, particularly "owner's equivalent rent," which accelerated to 0.36%, contributing to the market's disappointment.

Global Economic and Financial Highlights: July 18, 2024

Today's news covers significant developments in global markets and politics. President Biden's campaign faces challenges due to a COVID-19 diagnosis, while China's economic strategies and tech advancements remain in focus. Key updates include the impact of US semiconductor restrictions, rising tensions in global trade, and significant shifts in corporate strategies and financial markets. The news reflects the dynamic and interconnected nature of the global economy.

Special Article: Analysis of FOMC Minutes

The FOMC minutes highlighted financial strains on low-to-moderate-income households, the Fed's data-dependent approach, and the impact of geopolitical risks. Discussions included immigration's positive impact on the labor force and modest progress toward disinflation. Potential rate cuts were mentioned if the job market deteriorates significantly. This cautious outlook emphasizes balancing inflation control and economic support.

Today's analysis: XAUUSD Faces Potential Decline Amid Fed's Rate Uncertainty

Gold (XAU/USD) is predicted to decrease due to a mix of economic factors and technical indicators. Lower-than-expected US PPI and CPI data suggest potential Fed rate cuts, initially supporting gold, but a cautious Fed outlook has pulled prices back. Technically, a bearish Head-and-Shoulders pattern suggests a trend reversal, with a break below $2,279 confirming downside targets at $2,171 and $2,106. However, a rise above $2,345 could challenge this pattern and push prices back toward $2,450.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

HTFX Spreads Joy During Eid Charity Event in Jakarta

How Will the Market React at a Crucial Turning Point?

Australian Authorities Joins Forces with Philippine Authorities to Combat Cyber Scams

Currency Calculator