简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Here’s why Bitcoin bulls will defend $42K ahead of Friday’s $3.3B BTC options expiry

Abstract:Holding $42,000 will help determine whether BTC bulls bag a $175 million profit in March 25’s $3.34 billion options expiry.

Over the past two months, Bitcoin (BTC) has respected an ascending triangle formation, bouncing multiple times from its support and resistance lines. While this might sound like a positive, the price is still down 11% year-to-date. As a comparison, the Bloomberg Commodity Index (BCOM) gained 29% in the same period.

The broader commodity index benefited from price increases in crude oil, natural gas, corn, wheat and lean hogs. Meanwhile, the total cryptocurrency market capitalization was unable to break the $2 trillion resistance level and currently stands at $1.98 trillion.

In addition to 40-year record high inflation in the United States, a $1.5 trillion spending bill was approved on March 15, enough to fund the government through September. Worsening macroeconomic conditions pressured the supply curve, which, in turn, pushed commodities prices even higher.

For these reasons, cryptocurrency traders are increasingly concerned about the U.S. Federal Reserve rate hikes expected throughout 2022 to contain inflationary pressure.

If the global economies enter a recession, investors will seek protection in U.S. Treasuries and the U.S. dollar, itself, moving away from risk-on asset classes like cryptocurrencies.

Bulls placed their bets at $100,000 and higher

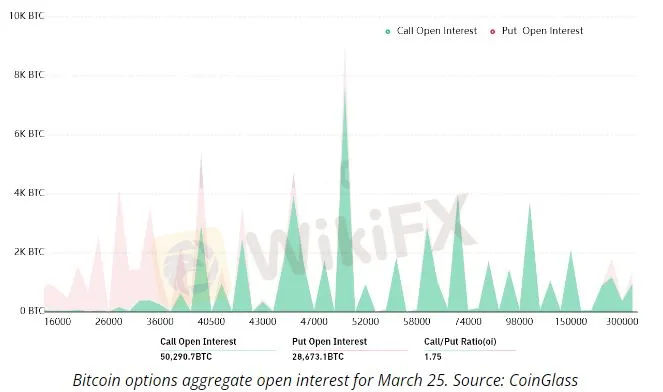

The open interest for the March 25 options expiry in Bitcoin is $3.34 billion, but the actual figure will be much lower since bulls were overly-optimistic.

These traders might have been fooled by the short-lived pop to $45,000 on March 2, as their bets for March 25's options expiry extend beyond $100,000.

Even Bitcoin's recent rally above $42,000 took bears by surprise because only 16% of the bearish option bets for March 25 have been placed above this price level.

The 1.75 call-to-put ratio shows more sizable bets because the call (buy) open interest stands at $2.13 billion against the $1.21 billion put (sell) options. Nevertheless, as Bitcoin stands near $42,000, most bearish bets will likely become worthless.

For instance, if Bitcoin's price remains above $42,000 at 8:00 am UTC on March 25, only $192 million worth of these put (sell) options will be available. This difference happens because there is no use in a right to sell Bitcoin at $40,000 if it trades above that level on expiry.

Bulls are aiming for a $280 million profit

Below are the three most likely scenarios based on the current price action. The number of options contracts available on March 25 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

Between $39,000 and $42,000: 6,300 calls vs. 6,300 puts. The net result is balanced between the call (bull) and put (bear) instruments.

Between $42,000 and $44,000: 8,700 calls vs. 4,600 puts. The net result favors bulls by $175 million.

Between $44,000 and $45,000: 10,600 calls vs. 4,300 puts. Bulls boost their gains to $280 million.

This crude estimate considers the put options used in bearish bets and the call options exclusively in neutral-to-bullish trades. Even so, this oversimplification disregards more complex investment strategies.

For example, a trader could have sold a put option, effectively gaining positive exposure to Bitcoin above a specific price, but unfortunately, there's no easy way to estimate this effect.

Related: Terra may be about to repeat $125M BTC buy that sparked Bitcoin's run to $43.3K

Bears will want to pin BTC below $42,000

Bitcoin bears need to pressure the price below $42,000 on March 25 to avoid a $175 million loss. On the other hand, the bulls' best case scenario requires a push above $44,000 to increase their gains to $280 million.

Bitcoin bears had $150 million leverage short positions liquidated on March 22, so they should have less margin required to drive Bitcoin price lower. With this said, bulls will undoubtedly try to defend $42,000 until the March 25 options expiry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Check Yourself: Are You Always Rushing for Trades?!

With market fluctuations happening in real-time and profits hinging on split-second decisions, many traders develop an impulse to act quickly. But have you ever stopped to ask yourself: Am I rushing into trades? If you’re constantly clicking “Buy” or “Sell” in a flurry of excitement or anxiety, you may be falling into a dangerous trap that could cost you more than you realise.

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

In the age of digital finance, the promise of financial freedom through trading has never been more alluring. Social media is flooded with advertisements for trading academies claiming to turn beginners into expert traders in weeks, offering ‘guaranteed’ profits and ‘exclusive’ strategies. However, behind the glossy marketing lies a sinister reality as many of these so-called academies are nothing more than elaborate scams designed to exploit unsuspecting traders.

These 5 Mental Biases Are Sabotaging Your Trades

Discover how five cognitive biases silently sabotage your trading decisions, impacting profits and increasing the risk of losses.

What Can Expert Advisors Offer and Risk in Forex Trading?

Know the pros and cons of Expert Advisors in Forex trading—automation boosts efficiency, but risks like over-reliance and glitches require careful balance.

WikiFX Broker

Latest News

Robinhood Launches Prediction Markets Hub for Trading Events

Key Points Every Forex Beginner Must Know

Things You Need to Know About Capital88

Gold Hits New Highs: Is Now the Time to Buy?

Why US Lawmakers Urge Trump to Drop Crypto Before It Harms America

CME Group Adds Solana Futures in Both Standard and Micro Contracts

BaFin Warns Consumers About EmexFunding’s Unauthorized Services

Trade, Compete, Win: Enter the WikiFX World Elite Trading Championship

Kraken Eyes $1.5B Acquisition of NinjaTrader for Futures Trading

Dark Side of Finfluencers: They Aren’t Your Financial Friends!!

Currency Calculator