简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/CAD Rate Reverses Ahead of January Low to Defend 2022 Opening Range

Abstract:USD/CAD halts the series of series of lower highs and lows from the previous week after depreciating for nine consecutive sessions, and the exchange rate appears to be defending the opening range for 2022 as it reverses ahead of the January low (1.2450).

CANADIAN DOLLAR TALKING POINTS

USD/CAD RATE REVERSES AHEAD OF JANUARY LOW TO DEFEND 2022 OPENING RANGE

USD/CAD extends the rebound from the monthly low (1.2465) as the Greenback appreciates against all of its major counterparts, and the exchange rate may track the yearly range over the coming months as both the Federal Reserve and Bank of Canada (BoC) plan to further normalize monetary policy in 2022.

It seems as though the Federal Open Market Committee (FOMC) will adjust its exit strategy as Chairman Jerome Powell acknowledges that the central bank could “move more aggressively by raising the federal funds rate by more than 25 basis points,” and it remains to be seen if the BoC will do the same as Deputy GovernorSharon Kozicki insists that “the timing and pace of further increases in the policy rate, and the start of QT (quantitative tightening), will be guided by the Banks ongoing assessment of the economy and its commitment to achieving the 2% inflation target.”

Deputy Governor Kozicki went onto say that “the pace and magnitude of interest rate increases and the start of QT to be active parts of our deliberations at our next decision in April” while speaking at the Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference, and it seems as though the BoC will unveil a more detailed exit strategy as “the Bank will use its monetary policy tools to return inflation to the 2% target and to keep inflation expectations well anchored.”

Until then, USD/CAD may continue to retrace the decline from the monthly high (1.2901) as it defends the opening range for 2022, but the tilt in retail sentiment looks poised to persist as retail traders have been net-long the pair for most of the month.

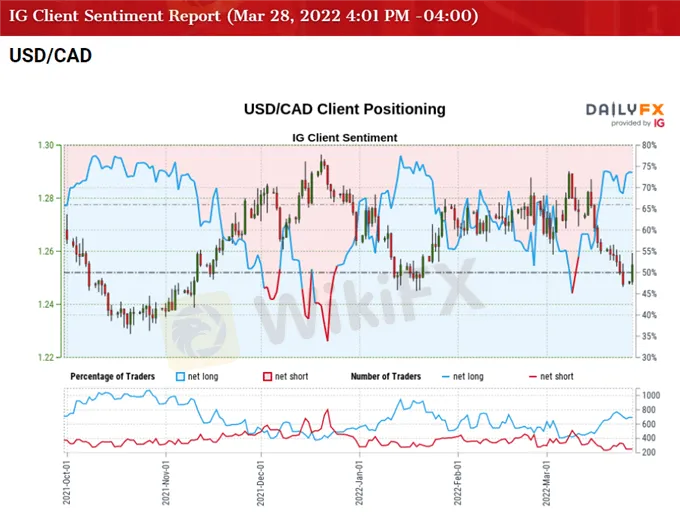

The IG Client Sentiment report shows 73.18% of traders are currently net-long USD/CAD, with the ratio of traders long to short standing at 2.73 to 1.

The number of traders net-long is 3.26% lower than yesterday and 5.54% lower from last week, while the number of traders net-short is 1.21% higher than yesterday and 13.19% lower from last week. The decline in net-long position comes as USD/CAD marks the longest stretch of decline since 2016, while the drop in net-short interest has fueled the tilt in retail sentiment as 65.85% of traders were net-long the pair last week.

With that said, USD/CAD may continue to extend the rebound from the monthly low (1.2465) as it snaps the series of lower highs and lows from last week, and the exchange rate may further retrace the decline from the yearly high (1.2901) as it defends the opening range for 2022.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Interactive Brokers introduces Forecast Contracts in Canada, enabling investors to trade on economic, political, and climate outcomes. Manage risk with ease.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Currency Calculator