简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices Sink as White House Weighs Plan to Release a Million Barrels Daily

Abstract:CRUDE OIL, WTI, WHITE HOUSE, STRATEGIC RESERVES, INFLATION - TALKING POINTS:

Crude oil prices sink as White House weighs releasing more strategic reserves

This plan outlines one million barrels of oil per day to help alleviate inflation

WTI continues to trade within a Symmetrical Triangle, watch for a breakout

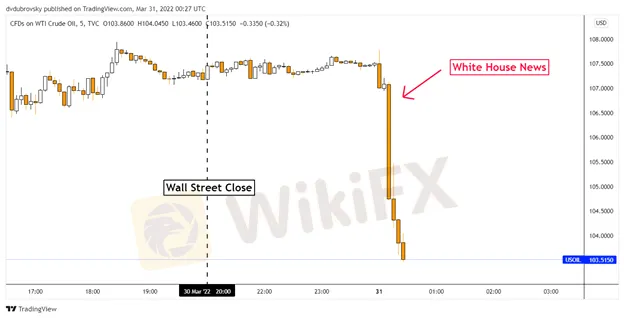

WTI crude oil prices sank as much as 5 percent during early Thursday Asia-Pacific trade after reports crossed the wires that the White House is weighing another plan to help alleviate rising prices at the pump. According to Bloomberg, the Biden administration is looking into releasing one million barrels of oil daily from strategic reserves for several months.

This follows strong gains in the commodity since November, which picked up pace as Russia attacked Ukraine. During this period, the price of WTI climbed from a low of USD 62.46 to a high of 129.42 in early March. Since then, fading European geopolitical escalation concerns have seen the commodity fall about 20% from the latest high.

Still, this has not been enough to bring down prices at United States gas stations materially. According to data from the US Energy Information Administration (EIA), the average price of regular gasoline, which is in dollars per gallon, clocked in at 4.23 for the week ending March 28th. This is up from 3.53 before the Russian attack, which represents a 19.8% increase.

Prices have fallen from the week ending March 14th, which was 4.32, but this only represents a 2% decrease. According to the report, the total amount could come up to 180 million barrels. For comparison, the Biden administration has released about 80m over the past 6 months from similar efforts. All eyes now turn to a potential announcement over the coming 24 hours.

WTI MARKET REACTION – 5MIN CHART

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Prices Fluctuate: What Really Determines Their Value?

Gold prices have been fluctuating recently, influenced by multiple factors. Since the beginning of 2025, gold has risen by 11%, hitting new historic highs multiple times in the first quarter.

Investors Beware! A Trillion Naira Wiped Out in a Week

Market takes a hit: a trillion naira wiped out—what happened?

Dollar Under Fire—Is More Decline Ahead?

The dollar faces its biggest decline of the year, strong-dollar logic challenged.

What Impact on Investors as Oil Prices Decline?

Oil prices have come under pressure amid mounting concerns over U.S. import tariffs and rising output from OPEC+ producers. With tariffs on key trading partners and supply increases dampening fuel demand expectations, investor appetite for riskier assets has cooled. This shift in sentiment poses a range of implications for different segments of the investment landscape.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

What Impact on Investors as Oil Prices Decline?

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Currency Calculator