简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

dxFeed Upgrades Offering with 5th Generation of Market Data Platform

Abstract:Market data provider dxFeed today launched the fifth generation of its cloud market data platform, which provides buy-side and sell-side institutions with access to real-time price information.

The upgraded platform unifies access to market data feeds from a variety of global exchanges.

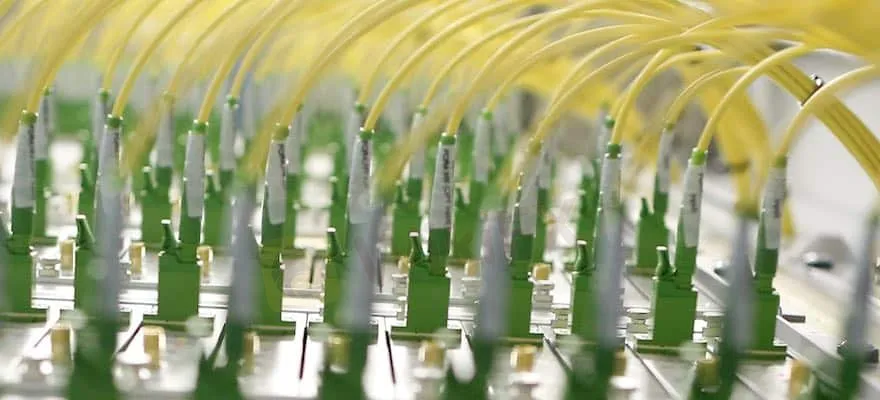

The upgraded platform caters to business needs of brokers, banks, institutional and algorithmic trading clients. Specifically, it unifies access to market data feeds from a variety of global exchanges and delivers streaming, tick-by-tick data in a consolidated format, accessible via APIs with low latency.

dxFeed data bundles, which include depth of market data along with bid/ask and traded volume information, now incorporates solutions for the storage and retrieval of historical data. Its interface offers insights into the behavior of other market participants, which influence the price movement, and allows users to analyze the historical order book evolution, track DOM Liquidity and HFT algorithms.

The new additions include tick-level market replay technology, providing a trading strategy back-testing facility for companies trying to enter new markets.

“While many firms only now recognized the power of the cloud in the post-COVID-19 world, dxFeed has been doing this since 2009, when we first rolled out our historical data storage and replay service on Amazon Web Services (AWS),” said Oleg Soldukhin, CEO of dxFeed.

dxFeed is specializing in providing data on equity options, equities, futures, indices, mutual funds and FX from multiple exchanges worldwide. The company is a daughter company of trading technology provider, Devexperts.

It has recently announced a partnership with Cboe Global Markets to make its EDGX Depth market data product available for distribution across dxFeed Bookmap, a financial data visualization and Trading Platform with heatmap technology.

Both firms said the partnership is the result of high demand from retail and institutional investors looking to gain deeper insights into the U.S. equities market on a single platform.

The combined offering allows users to detect hidden patterns, understand the situation, and liquidity at every price level, arming them with a more robust offering that greatly increases the visibility and adoption of market data.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

The internet is inundated with advertisements and promotions from self-proclaimed trading gurus who promise to teach you how to become a successful trader and earn a substantial secondary income. These individuals often claim that their trading techniques can make you rich, even if you have zero experience. However, these assertions are typically false, and many people fall victim to these scams. This article aims to expose these fake trading gurus, explain how they operate, and provide tips on how to avoid being scammed.

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

WikiFX Broker

Latest News

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

Gold Surges to New Highs – Is It Time to Buy?

Bitpanda Secures Full Broker-Dealer License in Dubai

Lost Money to Scam Recently?! This Article Could Help You!

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Currency Calculator