简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Marketmind: This is what it sounds like when doves cry

Abstract:Operation shock and awe: June 2022 will most likely be remembered as the month central banks finally decided to bring out the big guns to shoot down soaring inflation.

Within 48 hours, the U.S. Federal Reserve made its biggest rate hike since 1994, the Swiss National Bank raised its policy interest rate for the first time in 15 years and the European Central Bank announced fresh emergency tools to support the blocs indebted south while it tightens monetary policy.

The Bank of England also rose borrowing costs for the fifth time since December and its benchmark interest rates is now at its highest since January 2009 even as the economy lurches into recession.

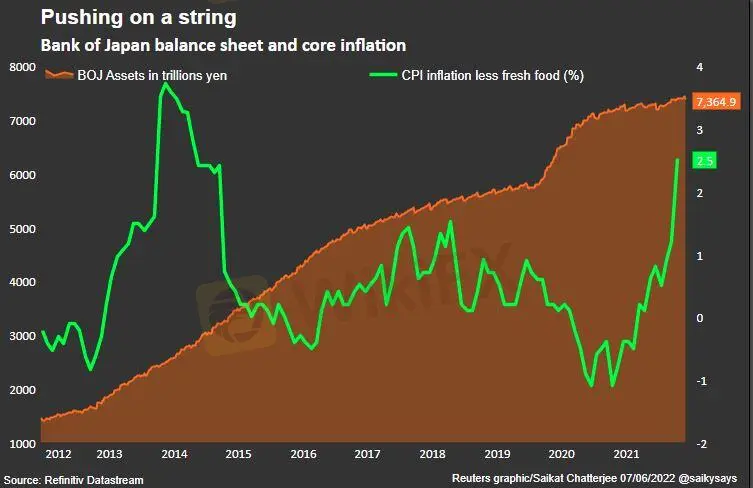

With the glaring exception of the Bank of Japan which has steadfastly stuck to its ultra-dovish policy, the hawks of monetary policy are now clearly running the show globally.

A quick look at the state of financial markets gives a pretty clear idea of, as late musician Prince used to sing, what it sounds like when doves cry.

The yield of Germany‘s bund’s at one point yesterday surged by a whopping 20 basis point, the Swiss franc jumped a rare 2% against the euro and a multitude of equity indexes confirmed a bear market.

All in all world stocks are heading for their worst week since the March 2020 pandemic meltdown as investors worry about the economic consequences of fast-rising interest rates.

Speaking of which, the Philadelphia Federal Reserves manufacturing activity index got its first negative reading since the early months of the coronavirus pandemic and the outlook for the next six months was the lowest since February 2008.

Adding to the gloom, U.S. homebuilding fell to a 13-month low in May and permits tumbled, suggesting the housing market was cooling as surging mortgage rates reduce affordability for many first-time homebuyers.

Key developments that should provide more direction to markets on Friday:

– Shanghais economy shrinks again in May but at slower pace

– Britains Tesco reaffirms profit guidance despite sales fall

– Swedens Riksbank policy meeting

– U.S. industrial production

– Santander appoints Hector Grisi as new CEO

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

Bitpanda Secures Full Broker-Dealer License in Dubai

Bitpanda has officially obtained a full broker-dealer license from the Dubai Virtual Assets Regulatory Authority (VARA), marking a significant milestone in its international expansion. This approval, which follows preliminary authorization granted three months earlier, enables the European digital asset exchange to introduce its comprehensive suite of virtual asset services to investors in the United Arab Emirates (UAE).

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Gold Surges to New Highs – Is It Time to Buy?

Currency Calculator