简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

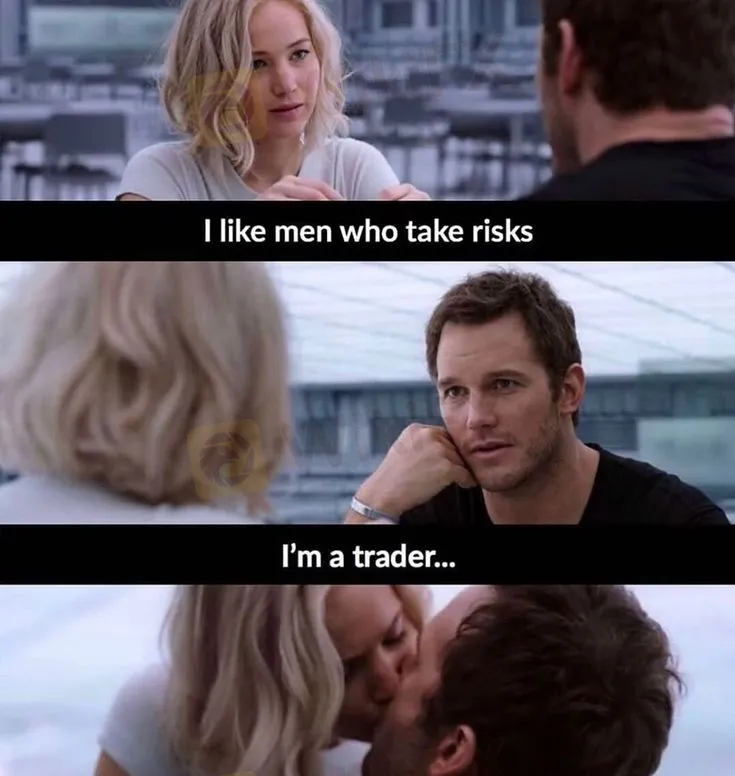

Avoid These Trader Blunders (Part 1)

Abstract:You need to know that just like many other businesses that promise great profit potential, the forex trading business also requires time and patience to gain the success. This is probably why not too many beginners can really master the forex trading business on the first try. Besides, there are some factors that make your trading fail.

Fear is a natural reaction that we show to a threat that can harm us. In fact, this fear is also considered as an important thing for our survival. Without fear, it will be difficult for us to see the danger and avoid danger.

On the other hand, that fear can be a dangerous thing, especially if the cause of that fear pushes us to make an irrational, and unreasonable decision.

Instead of motivating traders to trade without emotion, fear often triggers traders to stay away from trading. Moreover, fear also ultimately triggers traders to blame all the analysis and the time they have spent searching for entry opportunities. Worse yet, this often leads traders to the more adverse trading side.

Another type of fear is the fear of missing out on good entry opportunities. It often makes traders open positions at any price, and without waiting for profitable trading opportunities. A trader who has fear like this also often neglects to trade rationally and is more concerned with his ego.

The last type of fear, and even more dangerous, is fear of loss. This fear will cause the trader to psychologically fear, and give a horrible picture of trading even before making a trading decision.

Greed

Did you know that greed in forex trading is something more dangerous than fear? This happens because greed is a selfish emotion that drives you to always want huge profits when trading. According to FX Street, greed is often considered the most dangerous emotion for traders.

Although profit is the ultimate goal of a trader, the profit to be achieved certainly must be rational. In the end, if a trader prefers greed in trading, then it can become a double-edged sword that can destroy his trading account at any time.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

TradingView Brings Live Market Charts to Telegram Users with New Mini App

TradingView has launched a mini app on Telegram, making it easier for users to track market trends, check price movements, and share charts.

March Oil Production Declines: How Is the Market Reacting?

Oil production cuts in March are reshaping the market. Traders are closely watching OPEC+ decisions and supply disruptions, which could impact prices and future production strategies.

How to Calculate Leverage and Margin in the Forex Market

Leverage amplifies both potential profits and risks. Understanding how to calculate leverage and margin helps traders manage risks and avoid forced liquidation.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator