简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

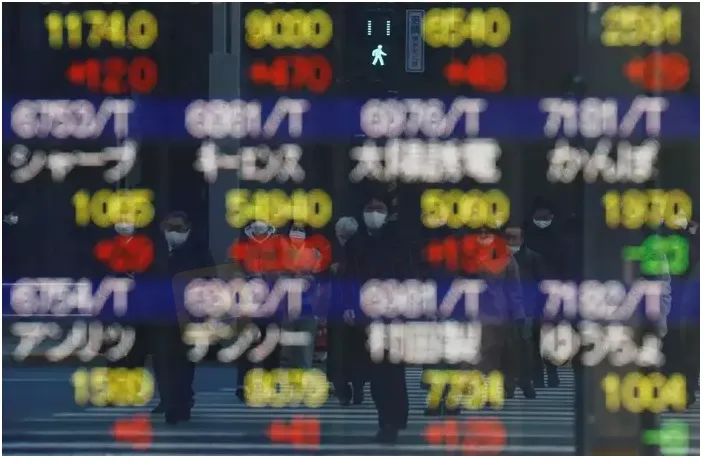

Asian stocks buoyed by Wall Street gains as easing oil cools inflation fears

Abstract:Stocks gained in Asia on Monday amid improved risk sentiment after Wall Street rebounded strongly at the end of last week as oil prices eased, tempering fears of prolonged inflation and the accompanying aggressive Federal Reserve tightening.

Treasury yields remained subdued and the dollar hovered near the lowest in more than a week as investors continued to assess the outlook for U.S. rate hikes, and the potential for a recession.

Japan‘s Nikkei rallied 1.04%, while Australia’s benchmark jumped 1.69%.

Chinese blue chips rose 0.54% and Hong Kongs Hang Seng advanced 1.46%.

South Koreas Kospi gained 1.65%.

MSCIs broadest index of Asia-Pacific shares rose 1.31%.

However, U.S. stock futures point to a 0.25% decline when those markets reopen. On Friday, the S&P 500 surged more than 3%, adding to an almost 1% gain on Thursday.

“We‘ve had a decent end to the week in the U.S. markets and I think that’s going to be the main scene for Monday here in Asia,” amid a dearth of news or other new drivers, said Rob Carnell, chief economist for Asia-Pacific at ING.

“We‘ve had two decent equity days on the run now. It’s perhaps notable that youve had some consistency there.”

Crude oil fell in volatile trading on Monday as the market grapples with concerns that a global economic slowdown could depress demand versus worries about lost Russian supply amid sanctions over the Ukraine conflict.

Both Brent and U.S. West Texas Intermediate (WTI) futures fell more than a dollar earlier. But, prices have rebounded with Brent at $112.78 a barrel, down 34 cents, and WTI at $107.17, down 45 cents. [O/R]

U.S. long-term Treasury yields hovered around 3.13% after bouncing off a two-week low just above 3% at the end of last week as traders removed bets for hikes next year, but still pondered if aggressive tightening this year could trigger a recession.

Yields have dropped from 3.456%, the highest in more than a decade, reached before the mid-month Fed meeting. Then, the central bank hiked rates by 75 basis points, the biggest increase since 1994, and signalled that a similar move is possible in July.

“The market remains focused in the trade-off between the policy response to high inflation and fears of a hard landing,” Westpac rates strategist Damien McColough wrote in a client note.

“There will be ongoing discussions as to whether long-end yields have peaked, however we would not yet expect 10-year yields to fall materially or sustainably below 3%.”

The dollar was steady on Monday, continuing to consolidate near the lowest since the middle of the month against major peers.

The dollar index – which measures the currency versus six rivals – was little changed at 104.01, after gradually gravitating over the past few sessions toward the June 17 low of 103.83.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Prices Fluctuate: What Really Determines Their Value?

Gold prices have been fluctuating recently, influenced by multiple factors. Since the beginning of 2025, gold has risen by 11%, hitting new historic highs multiple times in the first quarter.

Investors Beware! A Trillion Naira Wiped Out in a Week

Market takes a hit: a trillion naira wiped out—what happened?

Dollar Under Fire—Is More Decline Ahead?

The dollar faces its biggest decline of the year, strong-dollar logic challenged.

What Impact on Investors as Oil Prices Decline?

Oil prices have come under pressure amid mounting concerns over U.S. import tariffs and rising output from OPEC+ producers. With tariffs on key trading partners and supply increases dampening fuel demand expectations, investor appetite for riskier assets has cooled. This shift in sentiment poses a range of implications for different segments of the investment landscape.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

What Impact on Investors as Oil Prices Decline?

Dollar Under Fire—Is More Decline Ahead?

Gold Prices Fluctuate: What Really Determines Their Value?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Currency Calculator