简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

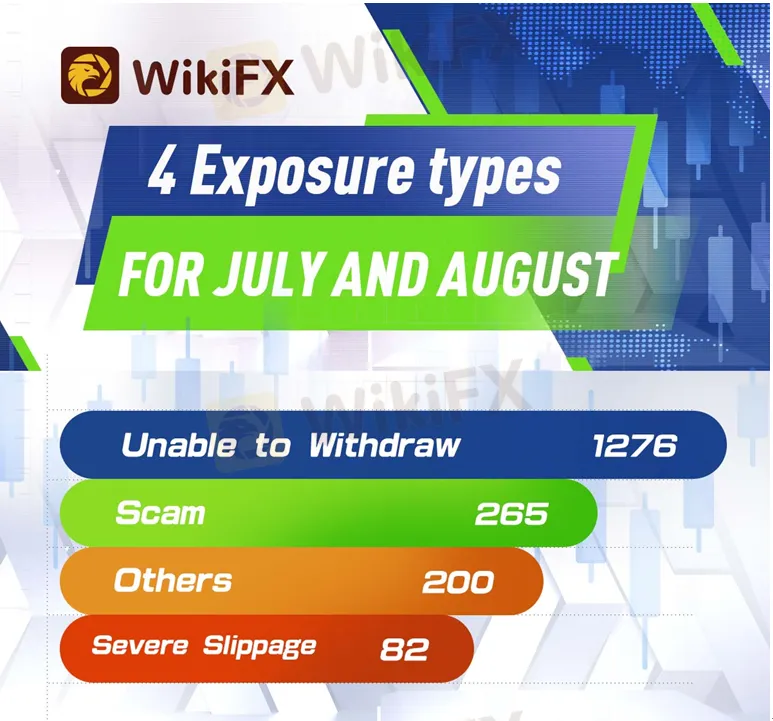

Summary of WikiFX exposure data and types for July and August

Abstract:In order to facilitate our targeted help, WikiFX divides complaints from investors into four types based on the victim's reason for complaining. Throughout July and August, WikiFX has collected nearly 2,000 complaints. A question has been raised in our mind: what type of exposure appears most frequently? In this article, WikiFX will rank the exposure categories according to their severity.

In order to facilitate our targeted help, WikiFX divides complaints from investors into four types based on the victim's reason for complaining. Throughout July and August, WikiFX has collected nearly 2,000 complaints. A question has been raised in our mind: what type of exposure appears most frequently? In this article, WikiFX will rank the exposure categories according to their severity.

About WikiFX

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX can evaluate the safety and reliability of more than 38,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

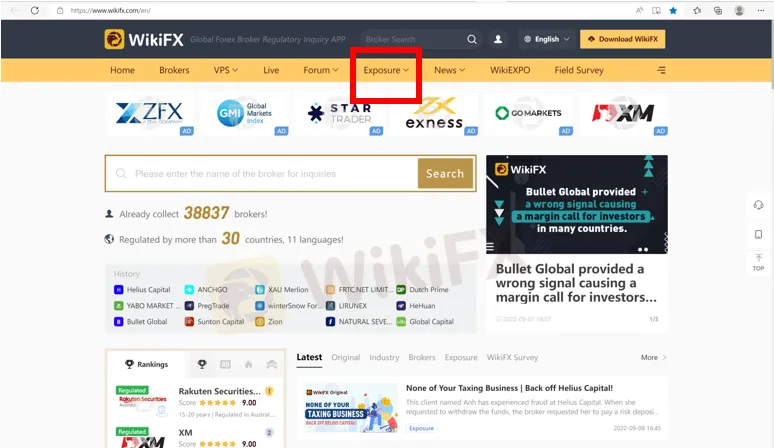

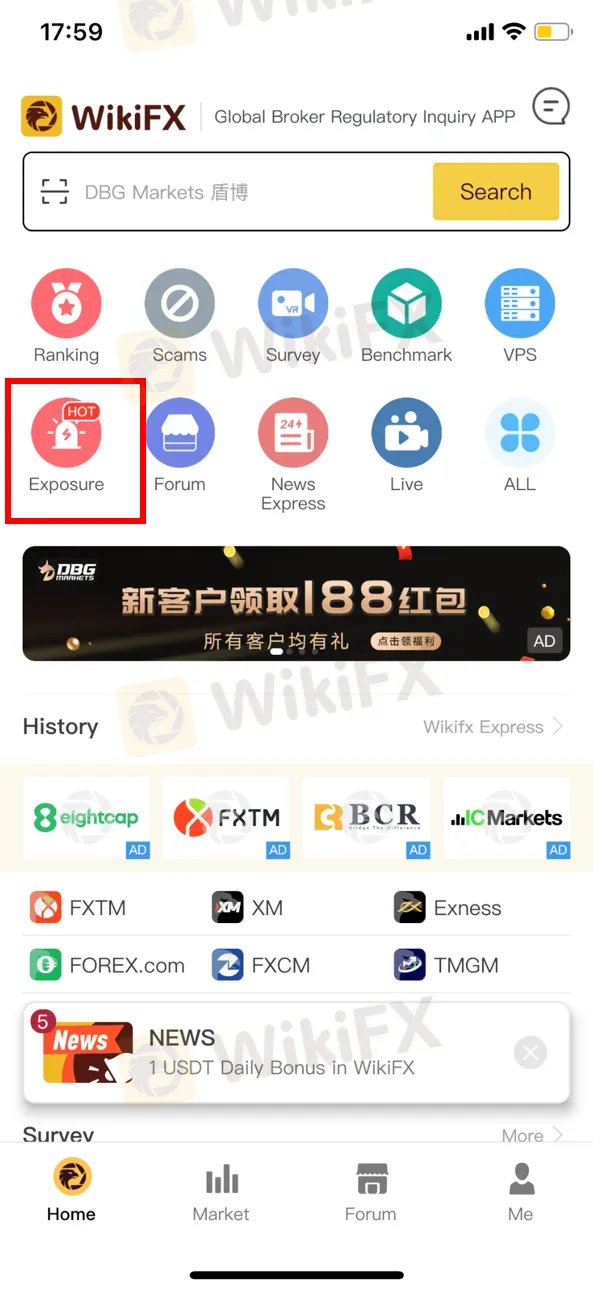

Exposure on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

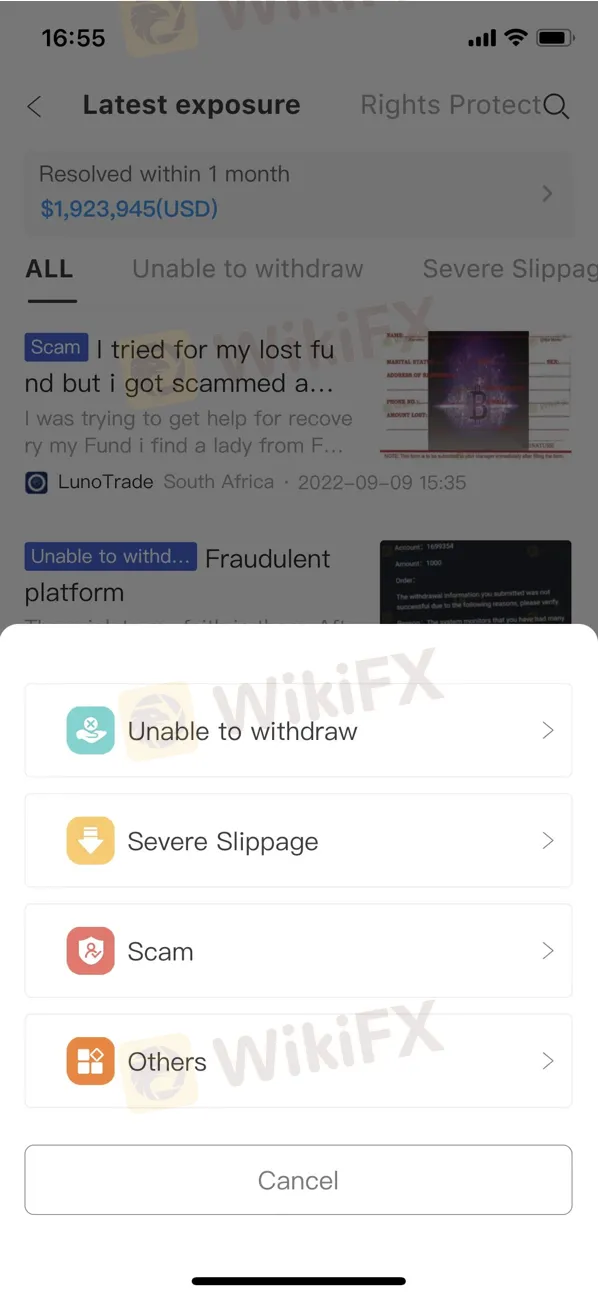

Ranking of 4 exposure types for July and August

1. Unable to Withdraw (1276)

As of September 8, 2022, WikiFX has received 1276 exposures related to “Unable to Withdraw” from July to August.

It is no doubt that withdrawal rejection is the most serious and common problem that many investors met when they invest in an unreliable broker. Refusing to allow clients to withdraw is the typical trick that scam brokers do. Scammers take clients‘ funds away fraudulently. And make unacceptable excuses to delay and reject clients’ withdrawal requests.

Some scam brokers ask investors to pay extra tax or risky fees if the investors insisted on withdrawal. Tax scams are one of the common tactics used by unreliable forex brokers. WikiFX has witnessed many cases wherein a fraudulent forex broker scared their trading clients about having tax payments in arrears and urged them to pay quickly before being punished by the authorities. However, it is rare to see a forex broker that uses this as an ultimatum, or rather “threat” towards its client. These brokers threatened to freeze traders' accounts by demanding that they pay their taxes by a specified date.

WikiFX currently has made an article about the scam brokers rejecting victims withdrawal requests and even putting forward unacceptable demands. Please feel free to read this article via the link. https://www.wikifx.com/en/newsdetail/202209079914856356.html

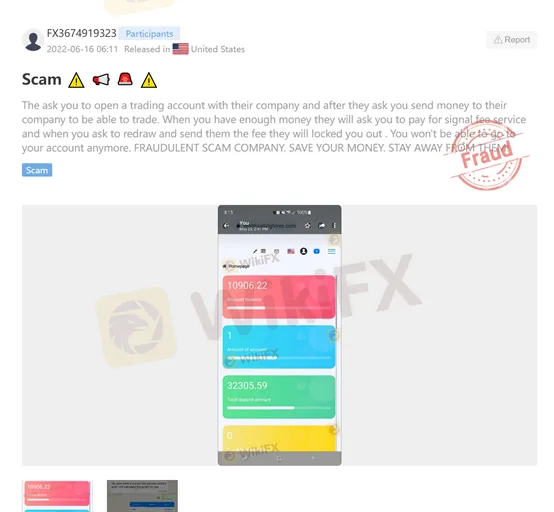

2. Scam (265)

As of September 8, 2022, WikiFX has received 265 exposures related to “Scam” from July to August.

Usually, the investors accused brokers of scams because they have terrible customer service. The agents do not help efficiently or they do not respond at all.

Those brokers may use tempting offers to persuade you to open an account, and eventually make you deposit more money by giving some rewards at the beginning. Once the scam becomes so obvious, they will take your money away without giving you any response.

Sometimes, the withdrawal problem also can be listed as a “scam”

3. Others (200)

As of September 8, 2022, WikiFX has received 200 exposures related to “other issues” from July to August, which makes traders upset. For example, some victim claimed that the website of some brokers is fake; The regulatory license of some brokers is a suspicious clone, etc.

4. Severe Slippage (82)

As of September 8, 2022, WikiFX has received 82 exposures related to “Slippage” from July to August. These brokers usually have the poor ability in risk management. Or they are just scammers manipulating the trading process causing huge losses to the traders.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Will natural disasters have an impact on the forex market?

The forex market is known for its rapid responses to global events, but the influence of natural disasters, such as earthquakes and typhoons, can be less straightforward. While headlines may scream about catastrophic damage and economic disruption, the long-term effects on currency values often depend on a blend of immediate shock and underlying economic fundamentals.

Why does your mood hinder you from getting the maximum return from an investment?

Investment decisions are rarely made in a vacuum. Aside from the objective data and market trends, our emotions—and our overall mood—play a crucial role in shaping our financial outcomes. Whether you’re feeling overconfident after a win or anxious after a loss, these emotional states can skew your decision-making process, ultimately affecting your investment returns.

Stock Market Trading Volume Drops by 97.58 Billion Naira This Month

In February, Nigeria's stock market trading volume dropped by 97.58 billion naira, with foreign investors pulling back. Can domestic investors sustain the market?

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator