简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Scam Alert: FCA Issued a Warning Against FLEXO!!!

Abstract:FLEXO was officially exposed as a scam by the British regulator FCA, which issued a warning against the brokerage. Blacklisted brokers are fraudulent and should be avoided no matter what!

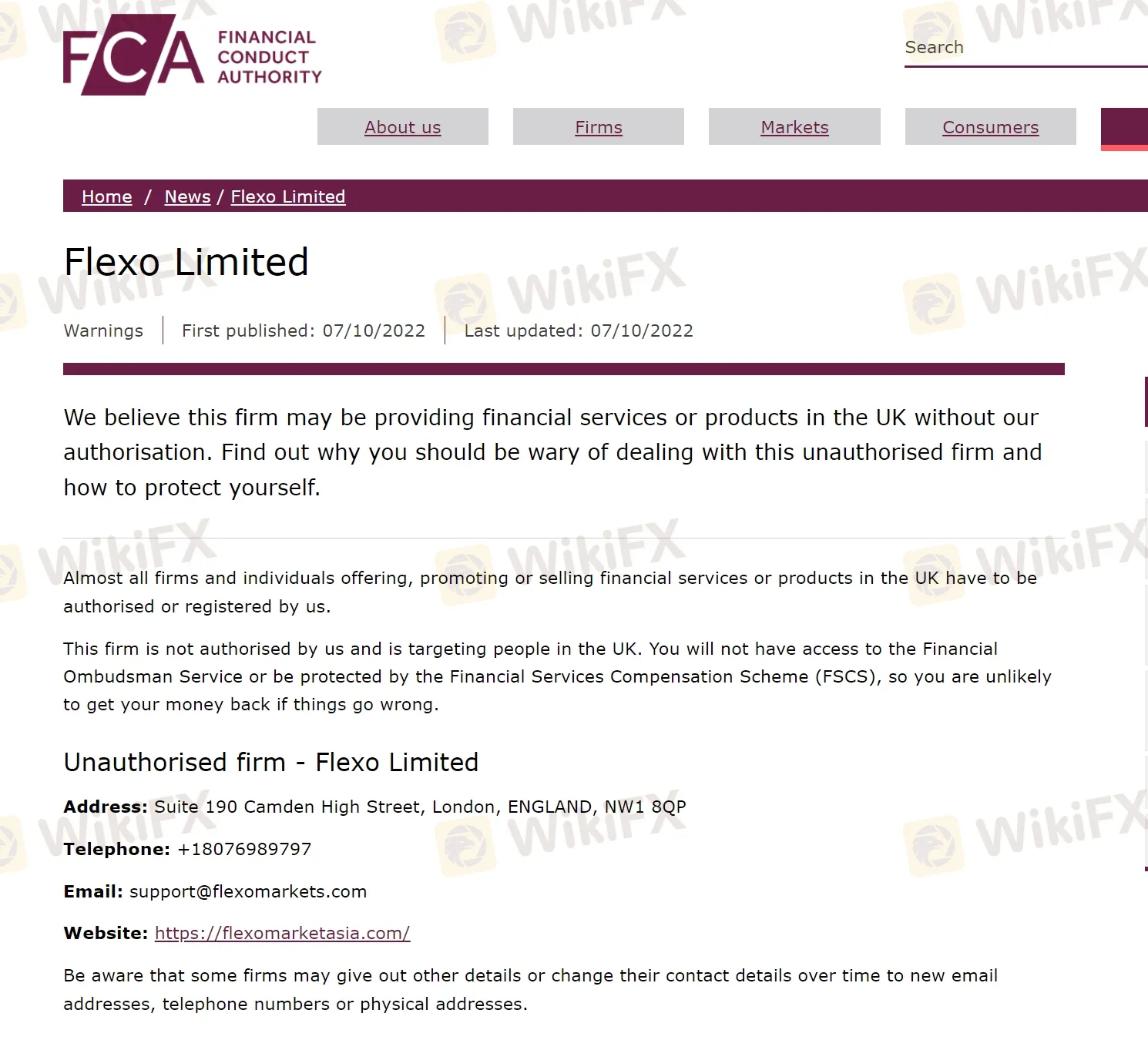

Breaking News! FLEXO has come to the attention of the Financial Conduct Authority in the UK, which warned on October 7th that FLEXO was not licensed but was providing financial services to the public in the UK. You can see the warning in the screenshot below.

“ This firm is not authorised by us but still was providing financial services to the public in the UK, the FCA says adding that you will not have access to the Financial Ombudsman Service or be protected by the Financial Services Compensation Scheme (FSCS), so you are unlikely to get your money back if things go wrong”.

The FCAs warnings prove with almost absolute certainty that a company is running some sort of scam – so refrain from enterprises that have received the negative attention of reputable financial authorities like the FCA. The only way to be sure that your investment is in good hands and that you would be treated fairly and in accordance with all laws would be to turn to a licensed, legitimate broker.

WikiFX also paid a visit to the brokers official website to learn more. FLEXO tries to convince you that they are a legitimate and trustworthy broker, but it turned out to be the opposite.

FLEXO promises to provide a world-winning trading platform. However, the download link are nowhere to be found throughout the website and WikiFX could not even reach this trading platform. Obviously, this is just a ruse by FLEXO, which doesn't have a “world class trading platform” like MT4, the industry standard. Acctually, this is a red flag because legitimate brokers always allow clients to sign up, open a demo account, and test trading software before depositing it.

Besides, FLEXO sets the leverage ratio to 1:500. It's well know that no legitimate UK'broker would let you do that. Leverage caps in the EU and England ban brokers from offering leverage higher than 1:30 on forex majors to retail traders. This only goes to show once again that FLEXO is not a legitimate British broker. Trading with extremely high leverage can be very dangerous and lead to huge losses – which is why you should always be careful with your leverage settings.

Moreover, in order to find out more about FLEXO, WikiFX made an attempt to access the domain tool to learn about the domain information.

It can be found by tracking its website information that its official website domain name is up to date -- it was registered on August 2, 2022, just two months ago. Besides, the domain is only valid for one year - until August 2, 2023. It's easy to see that when FLEXO was registered, it didn't intend to stay in business for long. It expected to get money and then switch to a new domain name and continue scamming.This is a very simple but very effective strategy because the cost of a new website is very low and it doesn't take much time to run a black platform, which is why the number of scammers like FLEXO is on the rise!

Now let's search “FLEXO” on WikiFX APP to find out more about this broker. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/3739021497.html), LotsFX currently has no valid regulatory license and the score is rather negative - only 1.02/10! WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

Please note that WikiFX is also reminding the majority of users: low scores, please stay away!

Investors are advised to search relevant information on WikiFX APP about the broker you are inclined to trade with before finally deciding whether to make investment or not. Compared with official financial regulators which might lag behind, WikiFX is better at monitoring risks related to certain brokers - the WikiFX compliance and audit team gives a quantitative assessment of the level of broker regulatory through regulatory grading standards, regulatory actual values, regulatory utility models, and regulatory abnormality prediction models. If investors use WikiFX APP before investing in any broker, you will be more likely to avoid unnecessary trouble and thus be prevented from losing money! The importance of being cautious and prudent can never be stressed enough.

From all the above information we can know that trusting a broker like FLEXO is simply not worth it – you will certainly end up robbed. WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing.

You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed. In addition, scam victims are advised to seek help directly from the local police or a lawyer.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator