简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

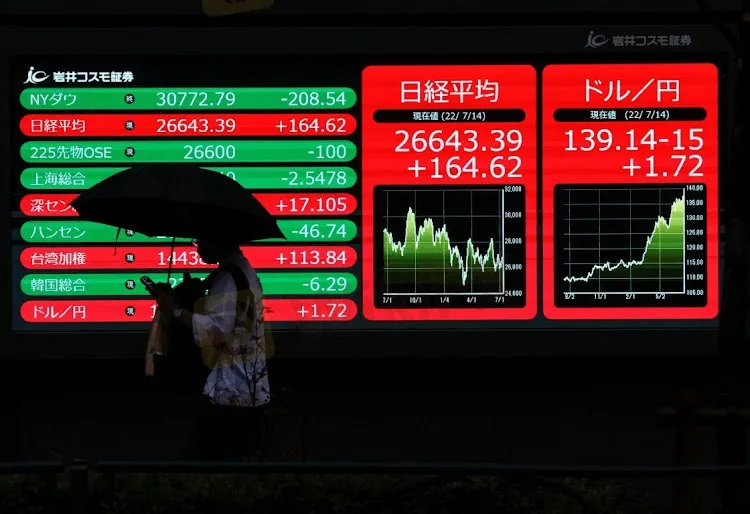

Bullish Bets On Asian Assets Skyrocket

Abstract:The restoration of China's economic activities is predicted to result in a total surplus of $836 billion. As other major central banks continue to tighten policy, fears of a worldwide recession may diminish. Skeptics, on the other hand, are concerned that a hawkish Federal Reserve will continue to control financial markets and the global economy.

Asian stocks and equities have plenty more space to go.

When China switched to pro-growth policies in late 2022, global markets got a sugar rush. Other Asian assets argue that it is never too late to participate in the rally.

Chinese stocks account for another 20% of the increase. Furthermore, if demand in the world's second-largest economy rebounds, the oil may rise beyond $100 per barrel and copper could reach $10,000 per pound. A flood of forecasts has been made by strategists and money managers. Emerging market shares and some Asian currencies are also expected to rise.

The restoration of China's economic activities is predicted to result in a total surplus of $836 billion. As other major central banks continue to tighten policy, fears of a worldwide recession may diminish. Skeptics, on the other hand, are concerned that a hawkish Federal Reserve will continue to control financial markets and the global economy.

Morgan Stanley and Goldman Sachs Group Inc. predict that the MSCI China Index would rise by 10%. Meanwhile, Citi Global Wealth Investments anticipates a 20% increase in 2023 when compared to its global rivals.

Others, on the other hand, feel that Asian stocks will continue to increase even after the bull market has begun. South Korean and Taiwanese exporters would profit, as will Southeast Asian nations that rely on Chinese tourism, such as Thailand.

Another currency increase is on the way.

Since China relaxed virus restrictions in November, the offshore yuan has increased by almost 6%. According to UBS Global Wealth Management, if economic growth exceeds the trend in the second half of this year, the yen might reach 6.50 per dollar.

A 60-day correlation measure between the yuan and emerging-market currencies has risen to 0.70, the highest level in five months. The Thai baht and the South Korean won, both of which benefit from Chinese tourists, may profit from the reopening. The Chilean peso is projected to climb in reaction to the rising Chinese demand for copper.

Alan Wilson of Eurizon SLJ Capital is a money manager. According to him, the Chinese economy, its underlying assets, and the larger emerging market universe are at a tipping point.

Download the link for the mobile app

https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

TradingView Brings Live Market Charts to Telegram Users with New Mini App

TradingView has launched a mini app on Telegram, making it easier for users to track market trends, check price movements, and share charts.

March Oil Production Declines: How Is the Market Reacting?

Oil production cuts in March are reshaping the market. Traders are closely watching OPEC+ decisions and supply disruptions, which could impact prices and future production strategies.

How to Calculate Leverage and Margin in the Forex Market

Leverage amplifies both potential profits and risks. Understanding how to calculate leverage and margin helps traders manage risks and avoid forced liquidation.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator