简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

You Should Know: Forex Brokers & Their License

Abstract:As most forex traders are aware, it is always preferable to trade with a forex broker that is authorised and governed by a reputable national organisation, such as the Financial Conduct Authority (FCA), European Securities and Markets Authority (ESMA), Cyprus Securities Exchange Commission (CySEC), or a similar organisation. But it's common for a broker to have a licence and then lose it for not upholding the criteria of the licencing organisation.

Depending on what went wrong, different measures can be followed when a broker loses their license. The brokerage firm could be promptly dissolved if the broker is charged with fraud or guilty of scamming its clients. Depending on the country where the broker is located, the government may offer insurance to protect the cash stored by the brokerage and enable reimbursement for harmed clients. In certain situations, another financial institution might occasionally agree to purchase those assets and move customer accounts to the new business without much disruption.

While a brokerage may stop operating after losing its licence, this is not the sole option. If a broker loses its licence in one jurisdiction, it can continue to operate as an unlicensed offshore firm or apply for a new licence in another. In 2022, Union Standard International lost its FCA licence but continued to operate from a St. Vincent and the Grenadines-registered office under the terms of an offshore licence.

You might only be aware if an online broker chooses to continue operating under an offshore licence after losing its licence. Keep an eye on WikiFX as we timely update the profiles of forex brokers. We also regularly reveal brokers that claim licenses which they do not have anymore.

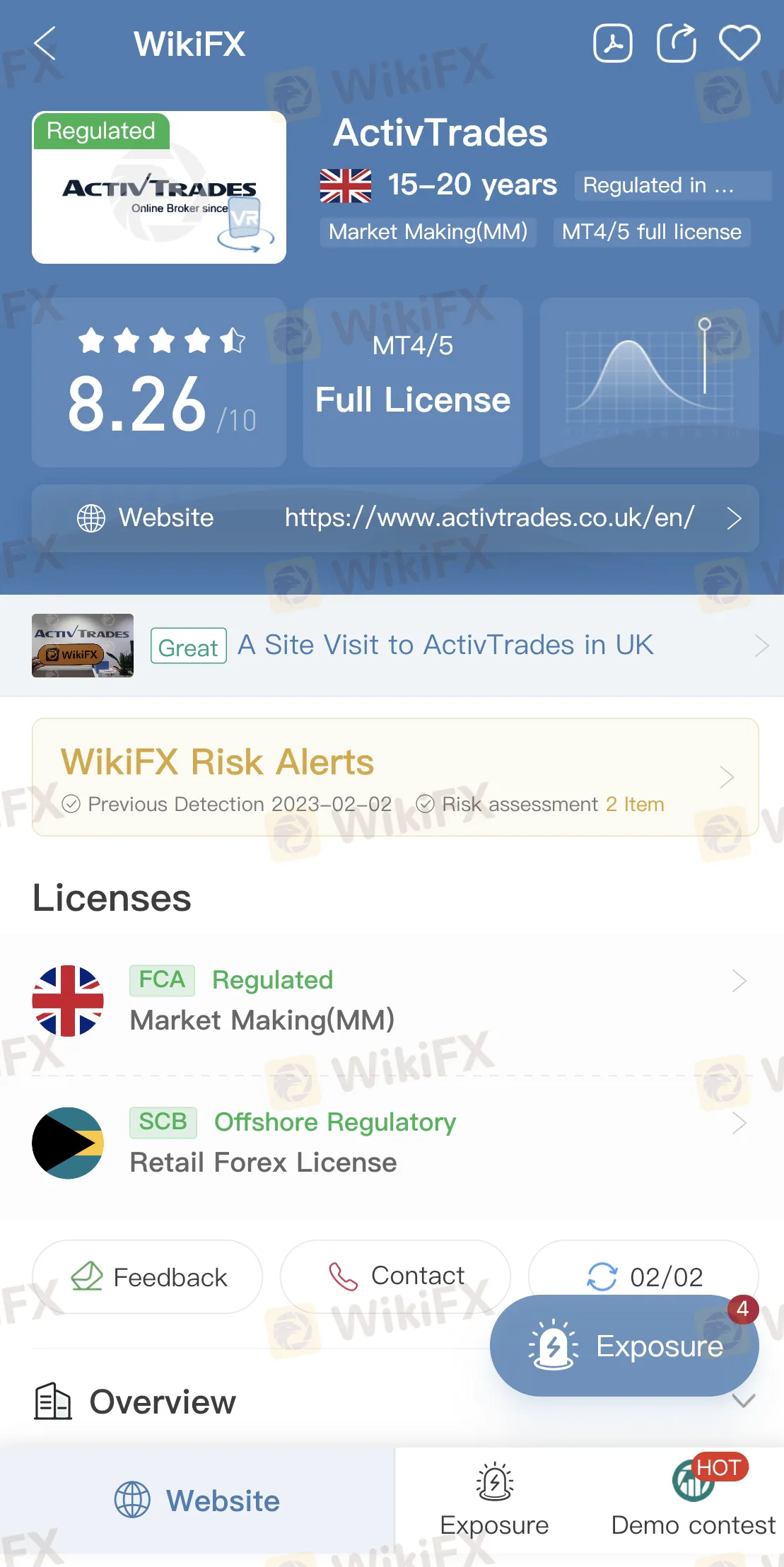

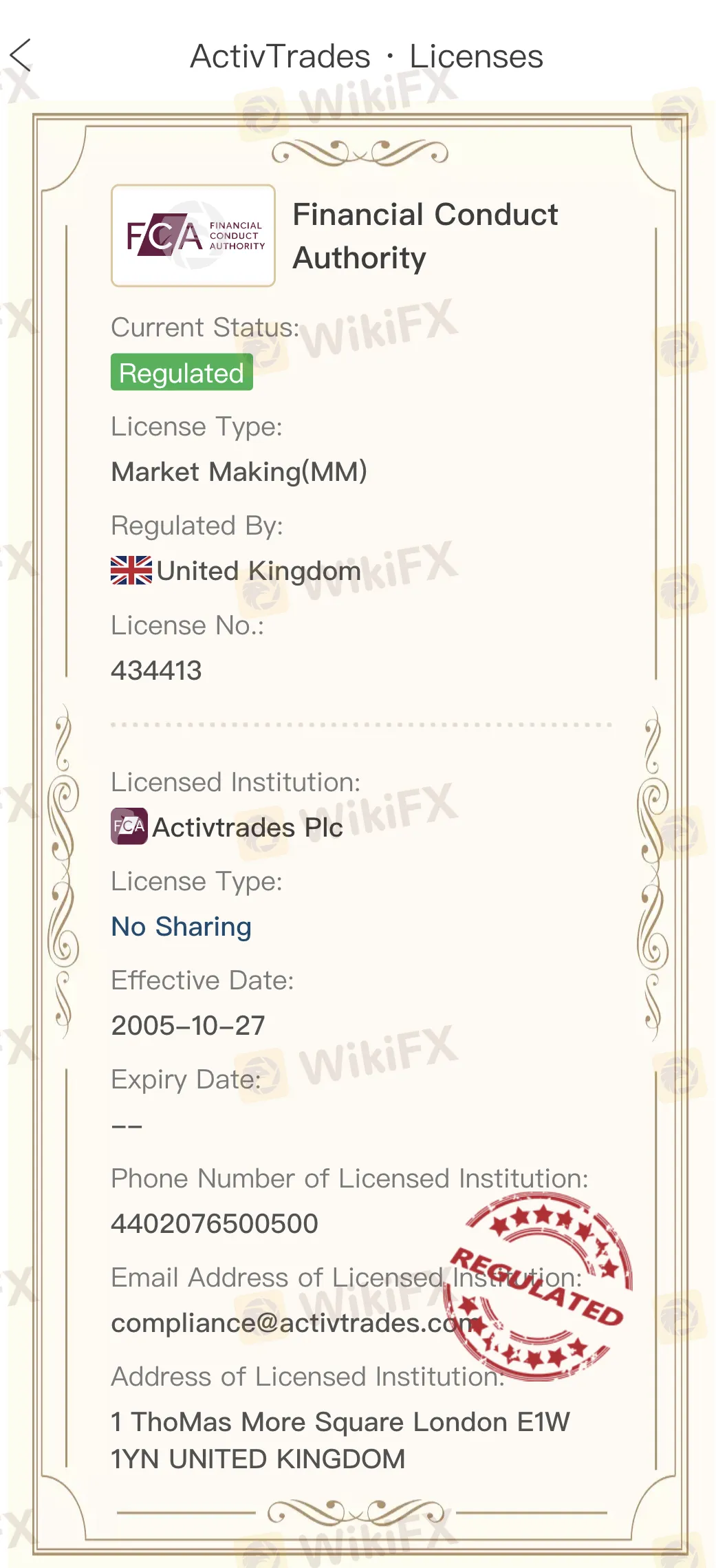

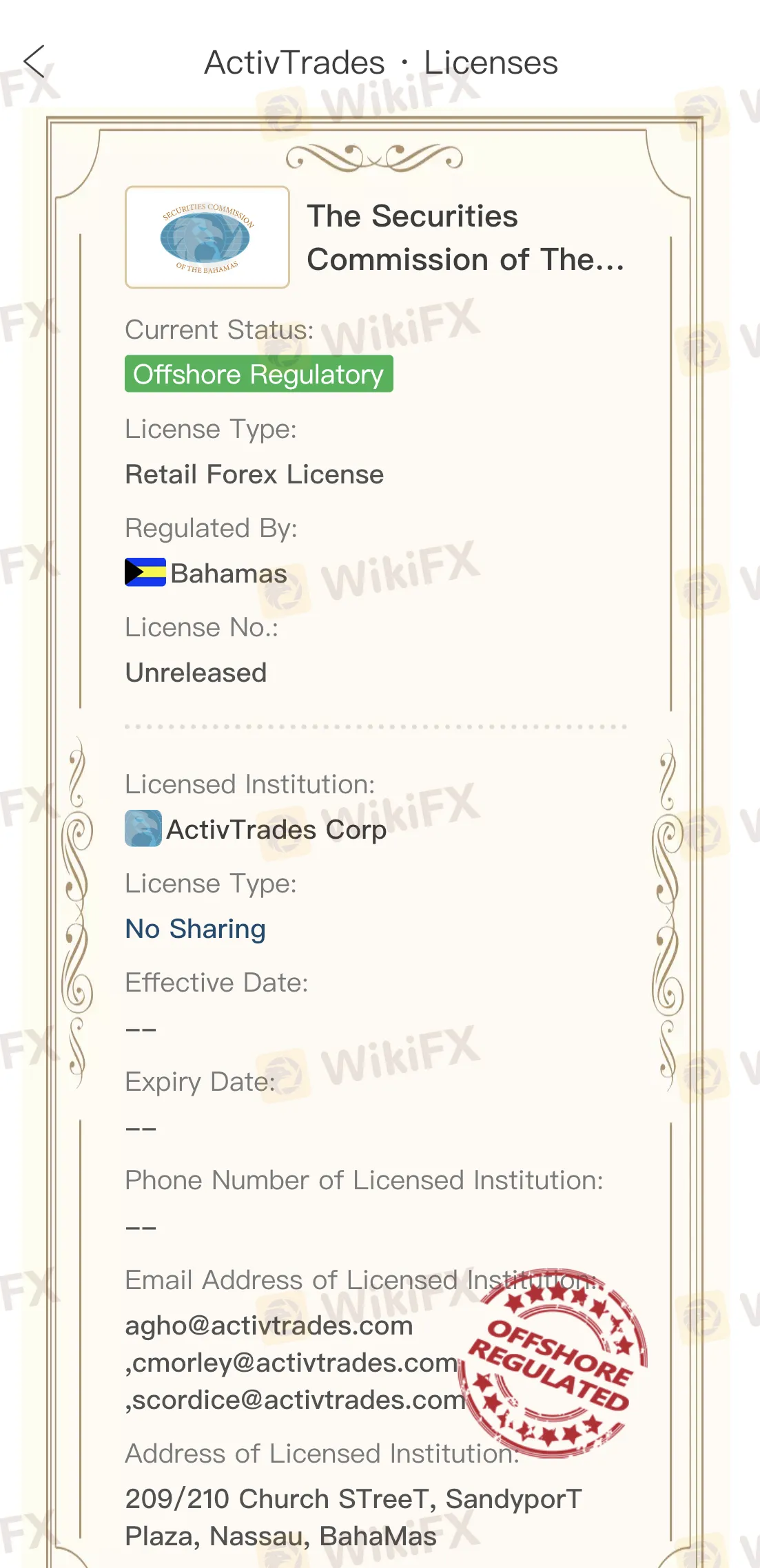

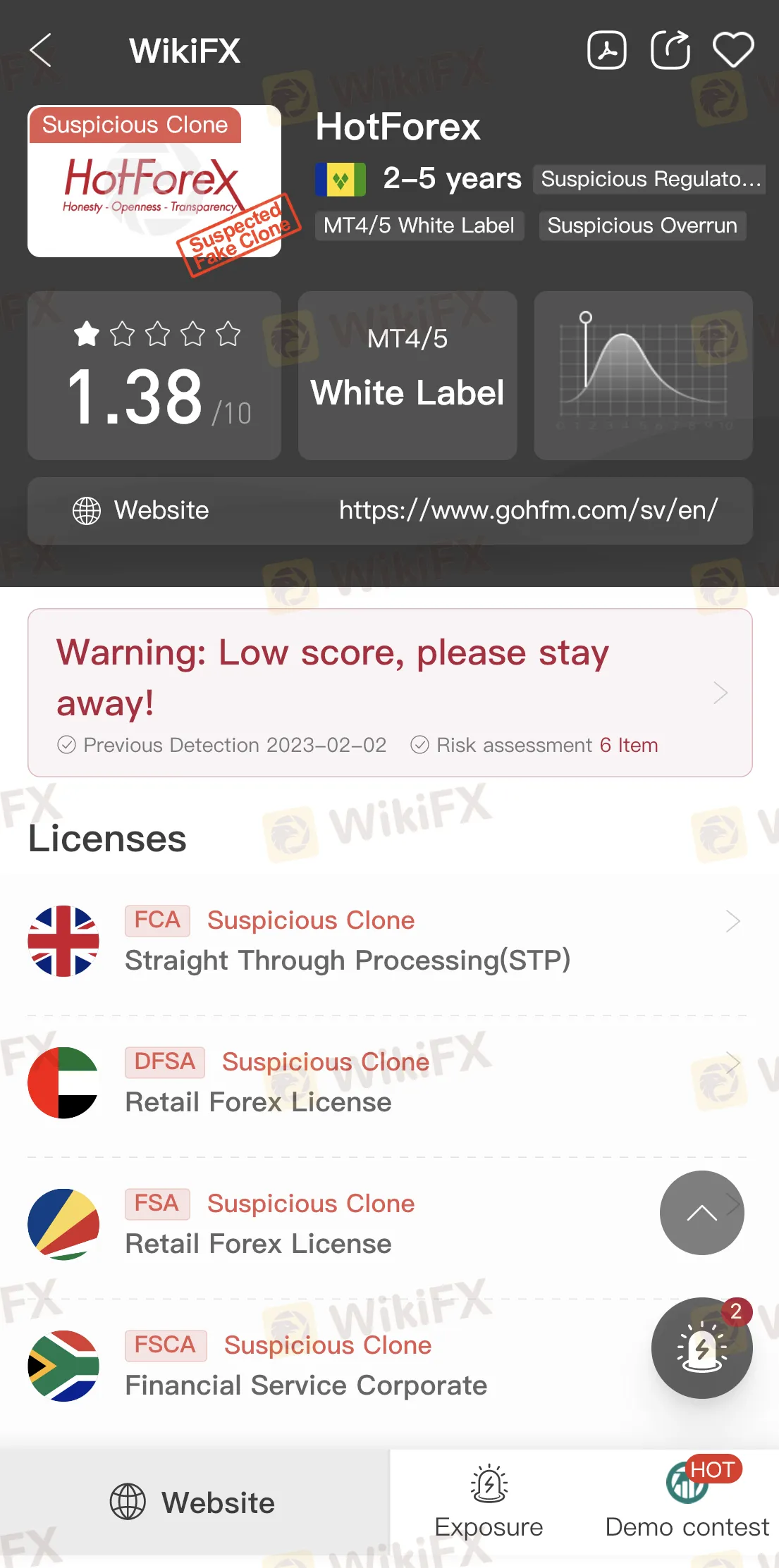

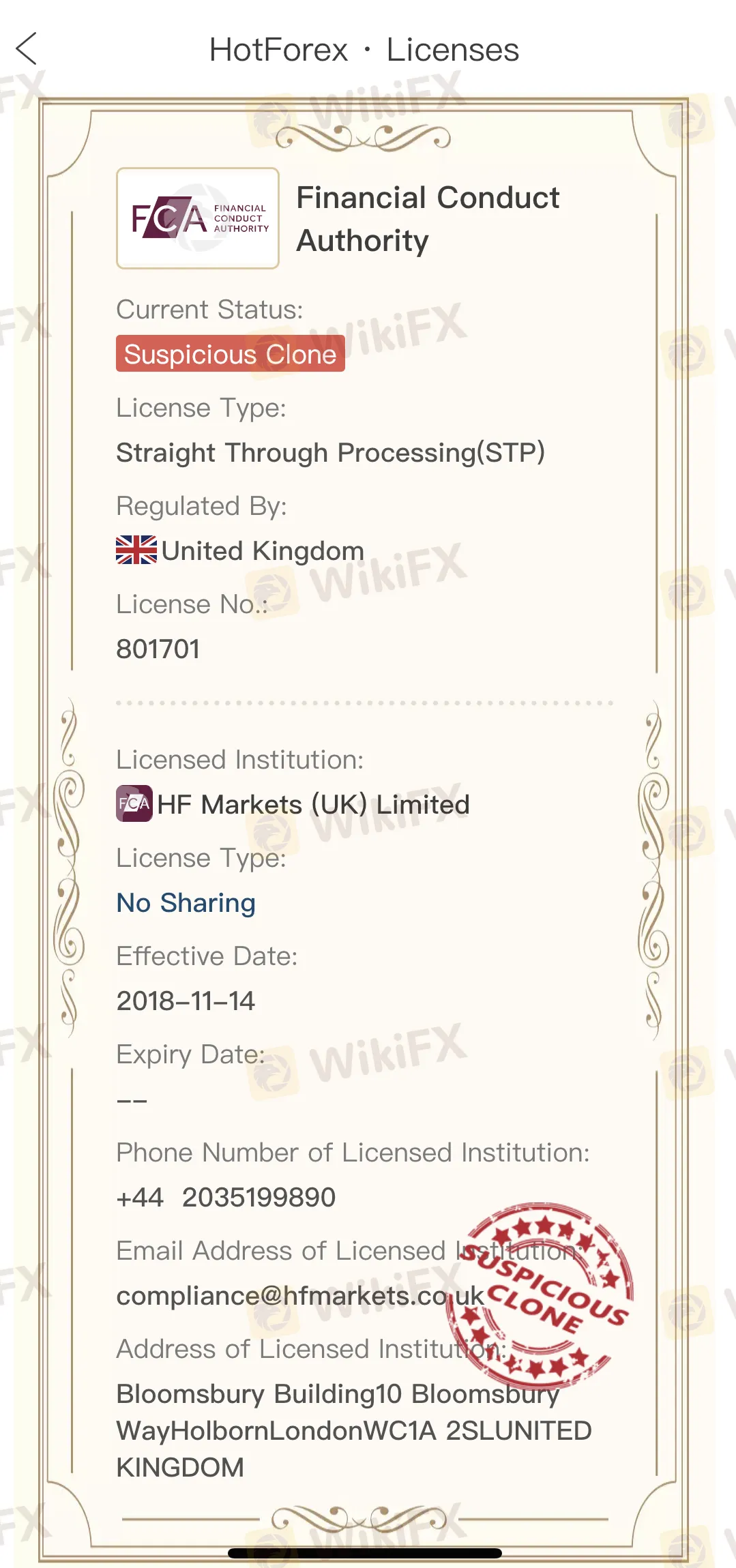

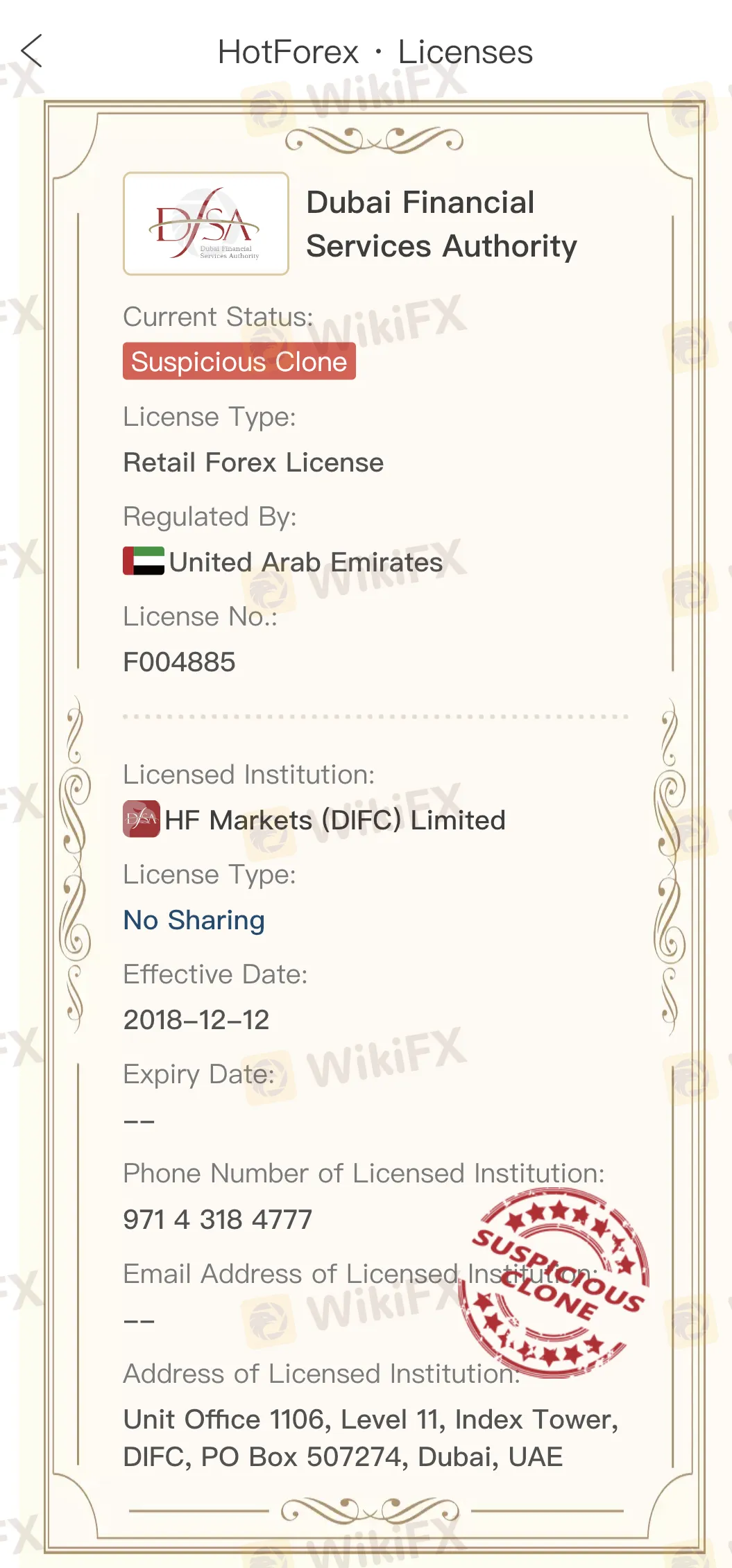

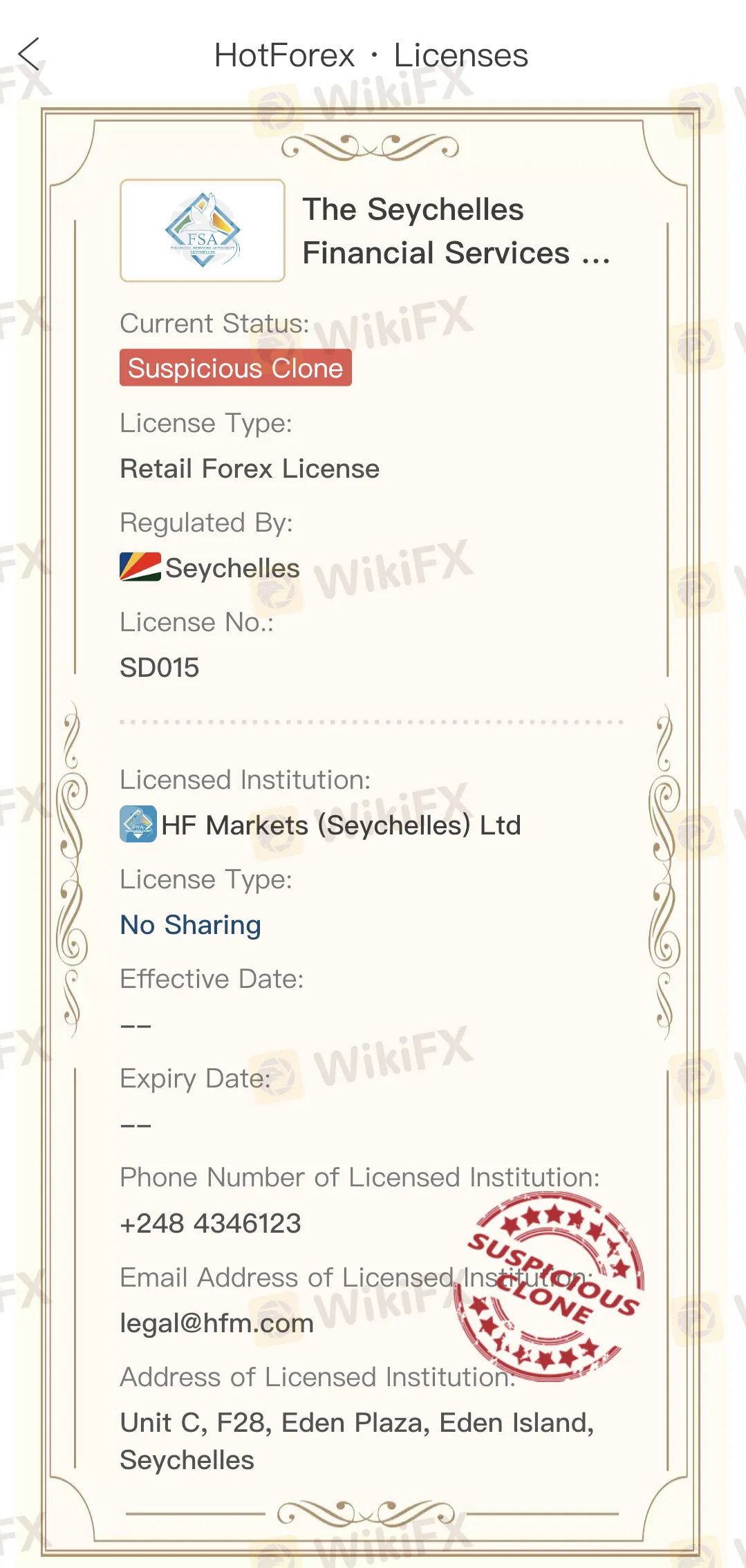

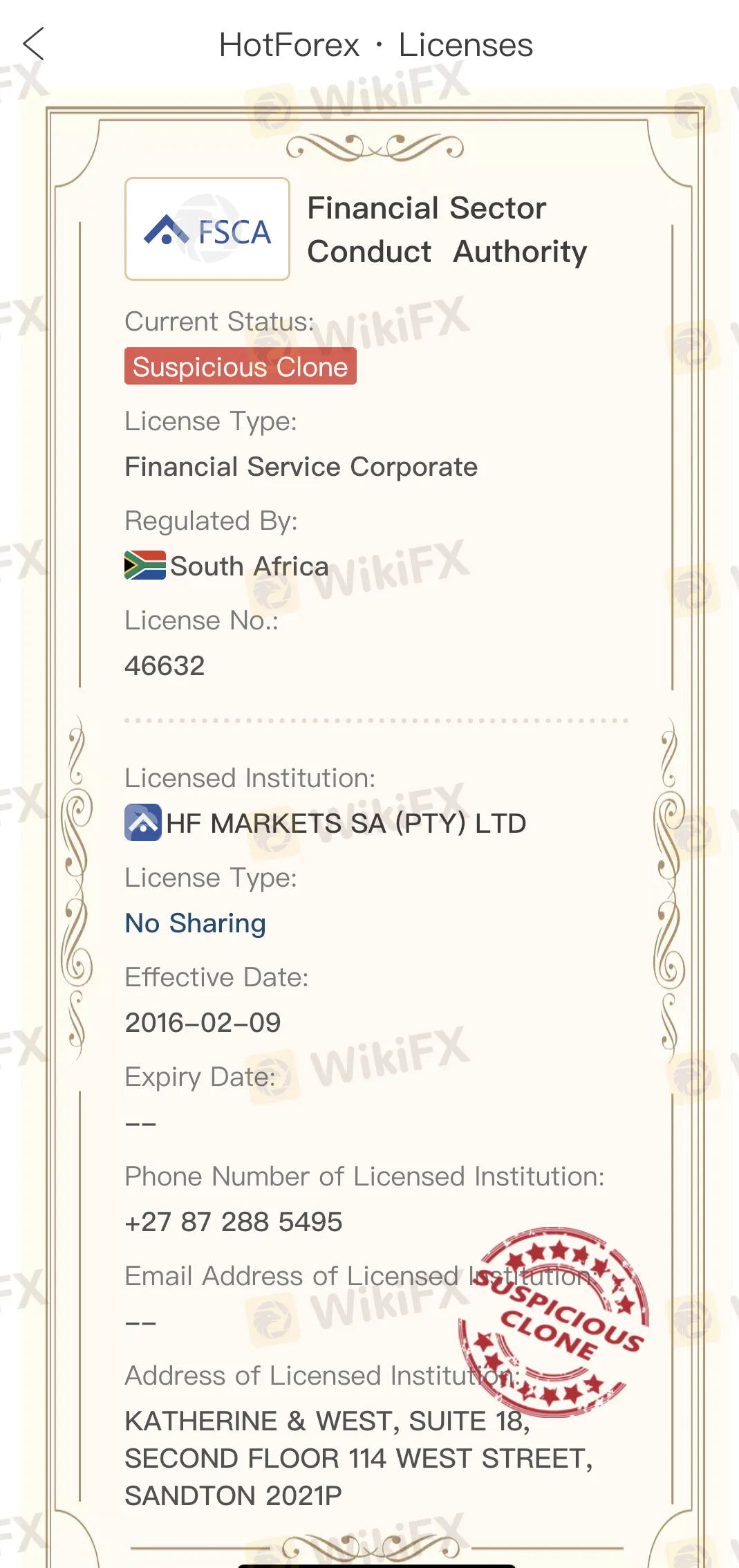

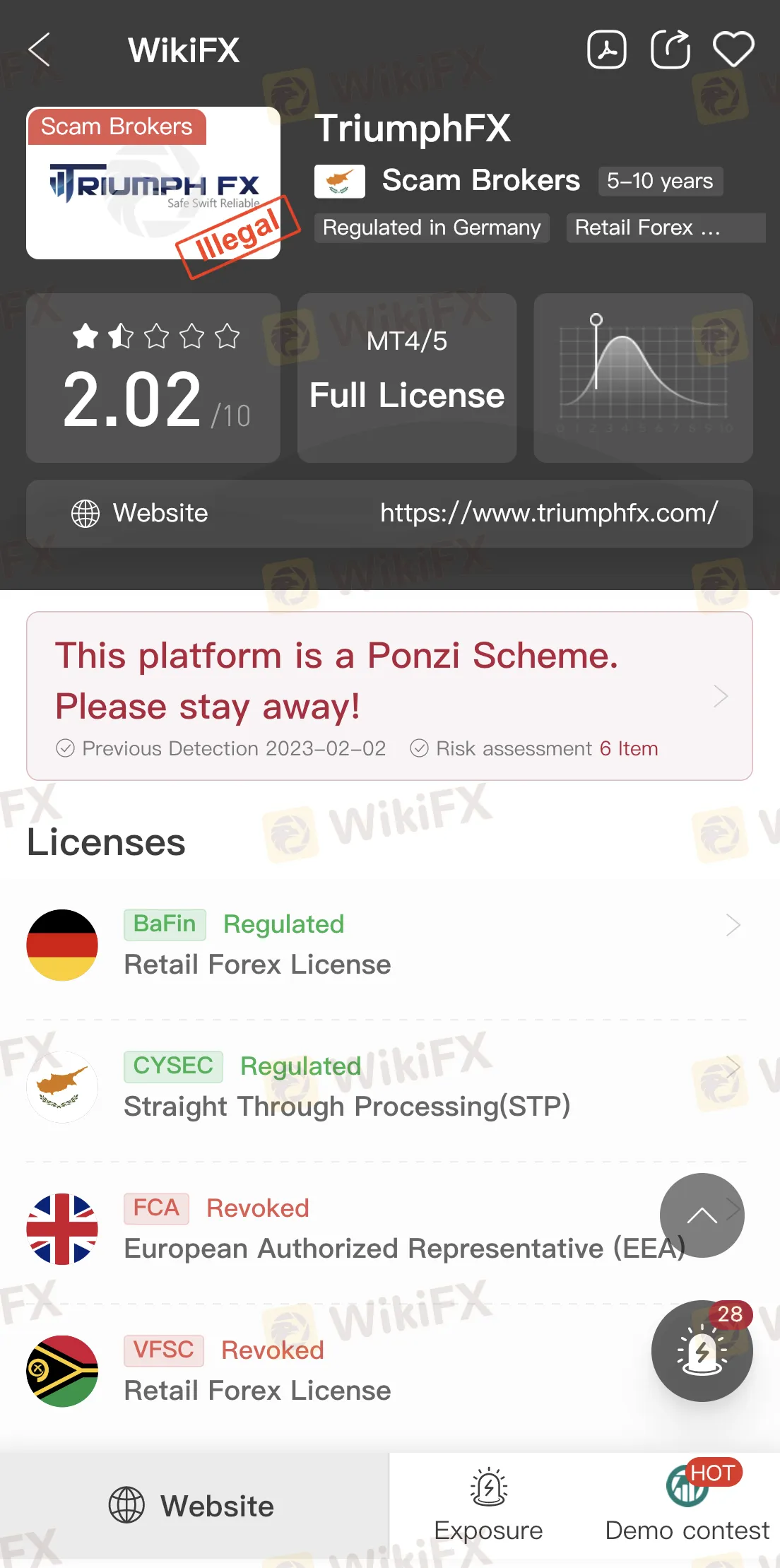

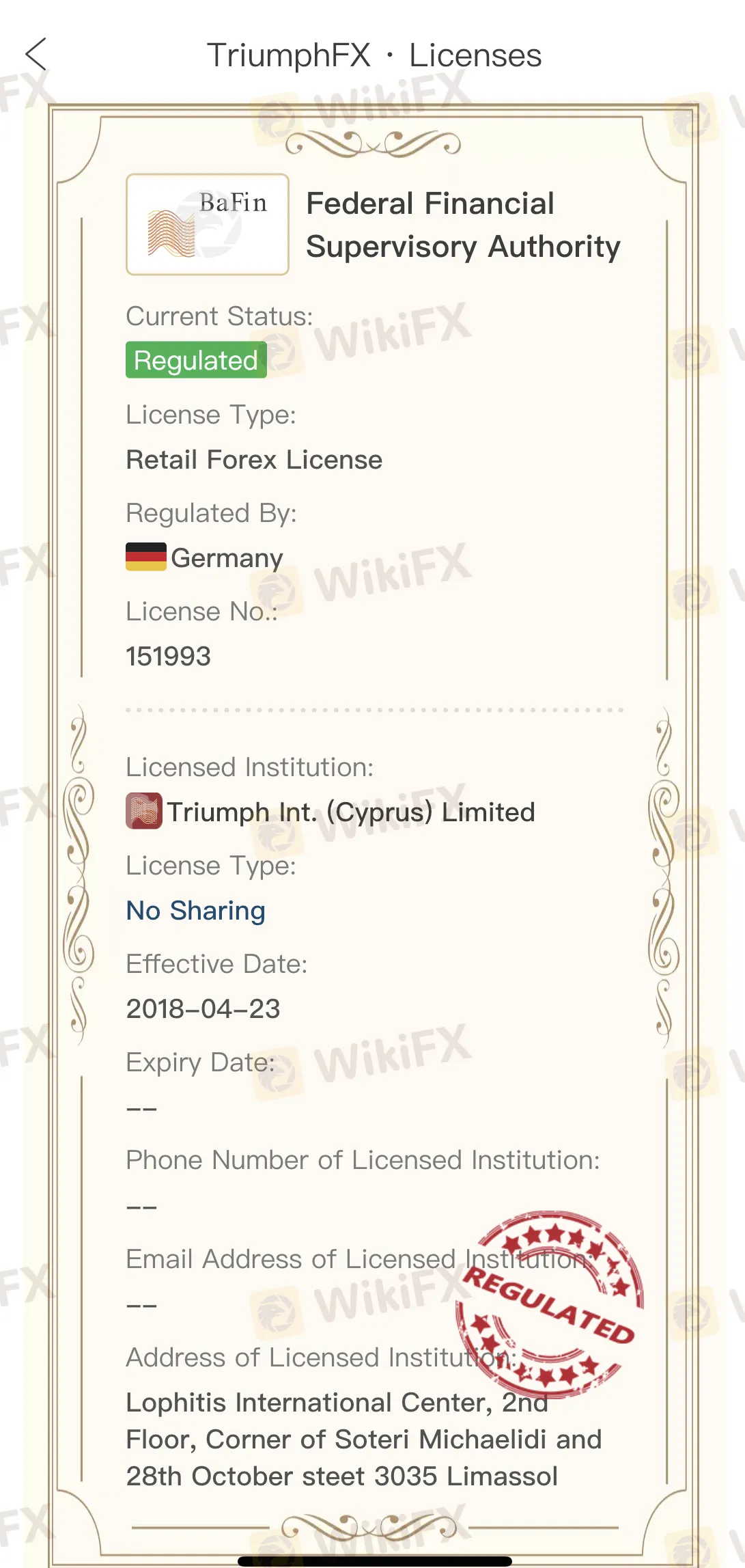

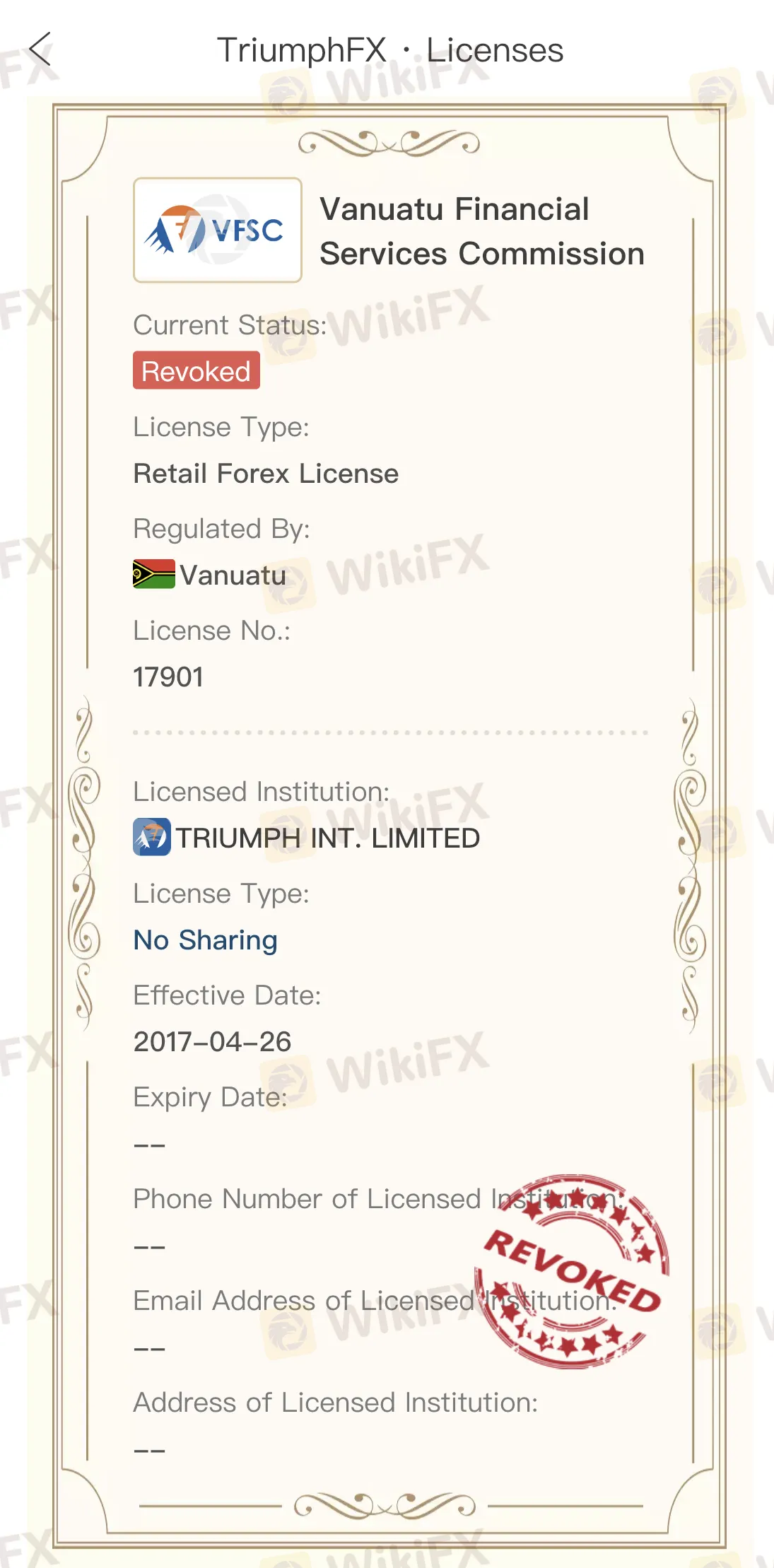

To illustrate how self-explanatory the WikiFX app is, here are 3 forex broker profiles and their respective licenses:

Broker 1:

Broker 2:

Broker 3:

Why Are Brokers' Licenses Taken Away?

Each regulated forex broker must abide by a set of rules set by its regulatory body. Additionally, they must consent to yearly evaluations and audits of their business practices to ensure continued compliance with all applicable laws and standards. As part of their onboarding procedures, forex brokers must abide by the contracts they enter into with each trading client. The revocation of a licence is possible if any rules or regulations are broken.

Brokers must abide by the laws and regulations of the nation in which they are based and the guidelines established by the national regulator issuing a licence. Even if a broker initially establishes itself as adhering to all applicable laws, if it later ceases to do so, its licence may be cancelled. Therefore, to ensure that the businesses to whom they issue licences are still compliant, national authorities should regularly monitor them.

Laws have certain similarities, even though they differ from nation to nation. Forex brokers' requirement to maintain sufficient liquidity to cover client investments is a fundamental aspect of forex regulation in several jurisdictions. In accordance with fair representation laws, all forex brokers must disclose all potential risks associated with forex trading. They cannot promise or guarantee that traders will make a profit or receive a specific rate of return on their investment.

Due to safety reasons, it is imperative that you only deal with authorised brokers. Always confirm the regulatory status of the broker you're using before signing up with them, and keep an eye on the situation to ensure nothing changes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Best Regulated Forex Brokers Offering Daily Trading Signals

Discover the best-regulated forex brokers offering daily trading signals. Compare features, pros, cons, and key considerations for informed trading decisions.

A Focus on BotBro: Exploring the Intersection of AI Technology and Forex Trading

In recent years, the integration of artificial intelligence (AI) into financial markets has revolutionized trading strategies, particularly in the realm of forex (foreign exchange) trading. This evolution has given rise to automated trading bots like BotBro, which leverage AI to execute trades with precision and efficiency.

VPFX Secures UAE SCA License, Expands FX and CFDs Services

VPFX obtains UAE SCA Category Five license, enabling FX and CFDs promotion. Learn about its expansion and broker services at vpfx.net.

Scam Exposed: GlobTFX Deceives Another Investor

This article will focus on sharing the testimonies of victims deceived by GlobTFX's false profit claims, revealing how the platform responds to user complaints and demands for compensation with fraudulent tactics.

WikiFX Broker

Latest News

EBSWARE Prop Launches Forex Trading Tournaments for Brokers

Key Risks and Downsides of Forex Trading Explained

How a Crypto Scam Cost Company Manager RM2.56 Million

TD Bank to Sell $14.9 Billion Schwab Stake, Repurchase Shares

Warning Against Agra Markets: Stay Cautious!

Scam Exposed: GlobTFX Deceives Another Investor

Trump tariffs: Retaliate or negotiate - what will US partners do next?

Hacker Who Breached SEC Account and Falsely Announced Bitcoin ETF Approval Faces Trial

Oil Prices Fluctuate as Iran and Trump Clash!

Best Regulated Forex Brokers Offering Daily Trading Signals

Currency Calculator