简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FSMA Alert: Protecting Yourself from Fraudulent Unauthorized Investment Firms in Belgium

Abstract:Firms that have been warned by the Belgian financial watchdog FSMA for doing unauthorized financial investment business.

Belgium, like many other countries, has its fair share of fraudulent financial investment firms. These companies promise high returns on investments, but often fail to deliver, leaving investors with substantial losses. Fraudulent financial investment firms in Belgium have become increasingly common in recent years, and investors must be vigilant when investing their money.

Red Flags: How to Spot a Fraudulent Financial Investment Firm in Belgium

The first red flag of a fraudulent financial investment firm in Belgium is the promise of high returns on investments. If an investment firm is offering returns that seem too good to be true, then they probably are. Legitimate investment firms cannot guarantee high returns, as there is always a risk associated with investments. Investors should be wary of any investment firm that makes unrealistic promises or guarantees.

Another warning sign of a fraudulent financial investment firm is a lack of transparency. Investors should be able to easily access information about the investment firm, including their financial statements, investment strategy, and performance history. If an investment firm is not willing to provide this information, or if it is difficult to obtain, then it is likely a fraudulent firm.

Here is the list of unauthorized firms that I've been doing business within Belgium:

BINOTRADER

BUXBERG

CEDAR FINANCIAL

CENTRAL MARGINS

COINS TRADES

GROW DEPOSITS

MEGA MARKETS

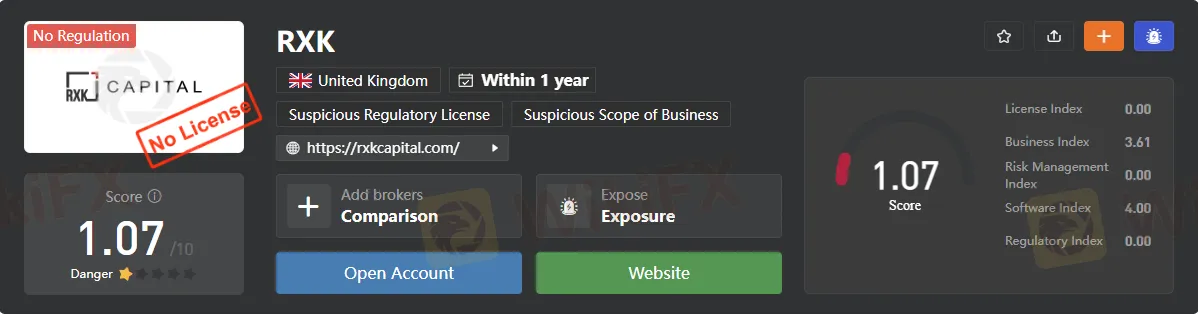

RXK

STB MARKETS

WILTON OPTION

XPOKEN

Fraudulent investment firms may also use high-pressure sales tactics to convince investors to invest their money. These tactics may include aggressive phone calls or emails, offering limited-time offers, or promising exclusive investment opportunities. Legitimate investment firms will not pressure investors into making quick decisions or force them to invest in a particular investment.

How Proper Research and Consumer Rights Can Help You Spot Fraudulent Investment Firms in Belgium

One of the best ways to protect oneself from fraudulent investment firms is to do proper research. Investors should conduct due diligence on any investment firm before investing their money. This research should include reading online reviews, checking the firm's reputation with regulatory bodies, and verifying the legitimacy of the firm's claims.

Investors should also be aware of their rights as consumers. The Belgian Financial Services and Markets Authority (FSMA) regulates financial services in Belgium and provides consumer protection for investors. If an investor suspects that an investment firm is fraudulent, they can report it to the FSMA. The FSMA can investigate and take action against fraudulent investment firms, including revoking their license to operate.

Investors should also be wary of investing in unregulated investments.

Unregulated investments are investments that are not subject to regulatory oversight, such as cryptocurrencies, binary options, or forex trading. These investments often promise high returns but are not backed by any tangible assets, making them risky and vulnerable to fraud.

In conclusion, fraudulent financial investment firms in Belgium are a serious problem that investors must be aware of. These firms often promise high returns on investments, use high-pressure sales tactics, and lack transparency. To protect themselves from fraudulent investment firms, investors should conduct proper research, be aware of their rights as consumers, and avoid investing in unregulated investments. It is important to remember that legitimate investment firms cannot guarantee high returns and that there is always a risk associated with investments. By being vigilant and informed, investors can protect themselves from fraudulent investment firms and make informed investment decisions.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Anti-Scam Groups Urge Tougher Action on Fraudsters in UK

Anti-scam groups demand tougher police action on fraudsters as UK fraud rates surge 19%, targeting millions in a penalty-free crime spree exposed by a $35m scam leak.

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Online scam groups in the Philippines trick Filipinos into gambling and love scams, from Manila to Bacolod, causing trafficking and pain as police fight back.

Why does your mood hinder you from getting the maximum return from an investment?

Investment decisions are rarely made in a vacuum. Aside from the objective data and market trends, our emotions—and our overall mood—play a crucial role in shaping our financial outcomes. Whether you’re feeling overconfident after a win or anxious after a loss, these emotional states can skew your decision-making process, ultimately affecting your investment returns.

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Discover the top 5 currency pairs to trade for profit this week, March 31, 2025—USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF—with simple strategies and best times.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator