简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Reviews TDX Global in Depth

Abstract:In this article, we'll look in-depth at TDX Global, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

In this article, we'll look in-depth at TDX Global, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX aims to provide you with the information you need to make an informed decision about using this platform.

Background:

TDX Global Technologies, also known as TDX Global, is an international brokerage company in various South Asian countries, including China, Singapore, Malaysia, Thailand, Indonesia, Vietnam, and more. They offer different trading options like foreign currencies, precious metals, commodities, global indices, and stocks.

The company is registered under the laws of England & Wales with the registration number 13014221. Their registered office is located at 16, Point Pleasant, Putney, London, SW18, 1GG, United Kingdom, known as TDX Global Technologies (U.K) Ltd.

Types of Accounts:

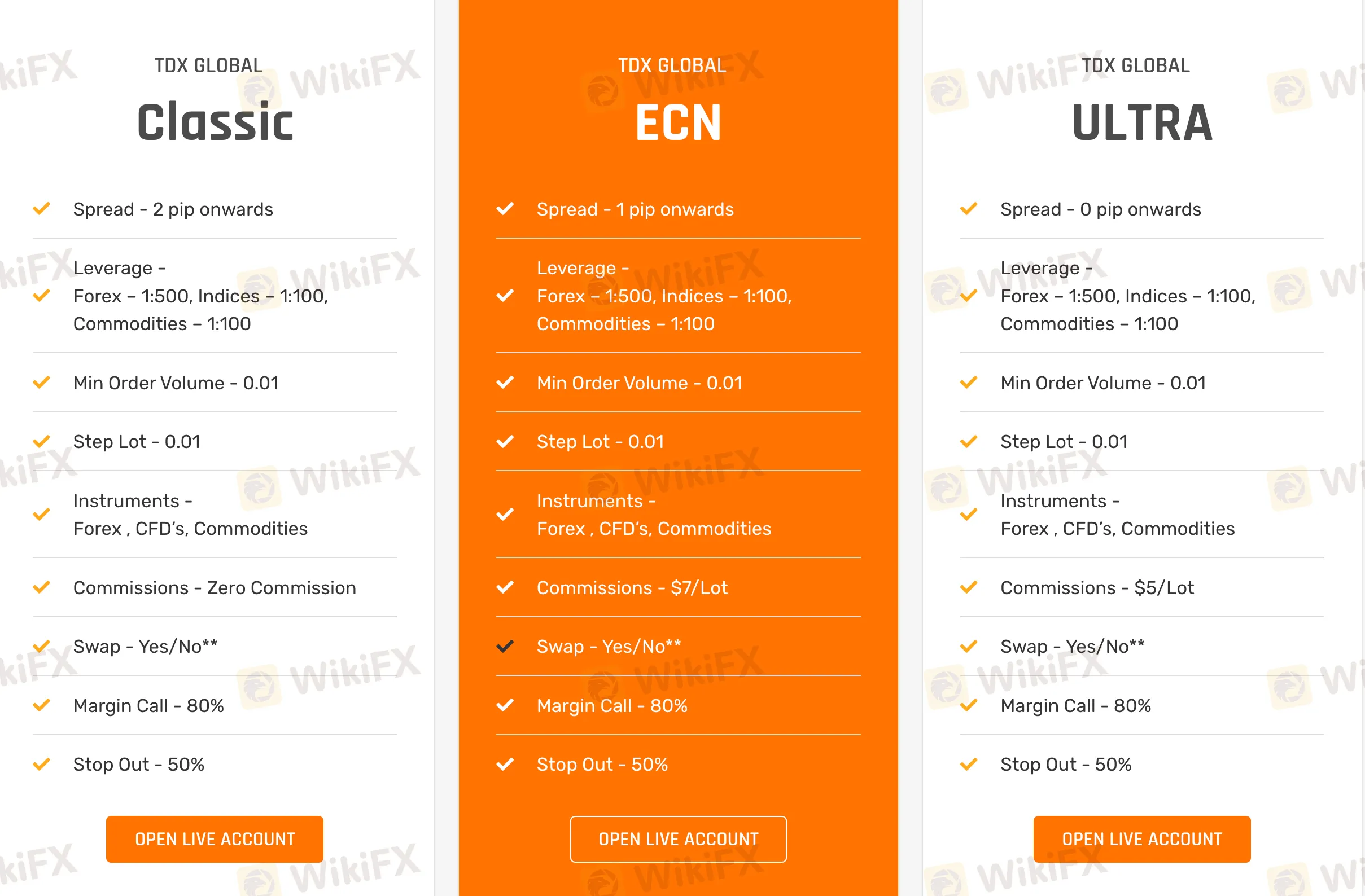

TDX Global offers three types of trading accounts, namely Classic, ECN and Ultra:

The Classic account is a commission-free account. Its spreads start from 2 pips. The maximum level of leverage is 500 times.

The ECN account charges a $7 commission per lot traded with spreads starting from 1.0pips. The maximum leverage is 500 times.

The Ultra account charges a $5 commission per lot traded with spreads starting from 0 pip onwards.

In addition, swap-free Islamic accounts are also available for Muslim traders upon request.

Deposit and Withdrawals:

Clients can finance their accounts through TDX Global's payment options, including E-wallets, Cryptocurrencies, and direct banking. The broker claims to process transactions 24/7 to ensure that payments are handled promptly, with a commitment to completing them within one business hour.

Below are the deposit and withdrawal options that TDX Global offers:

Notably, these options are relatively lacking in comparison to the other brokers.

Trading Platforms:

TDX Global's trading platform is the renowned MetaTrader 5 (MT5). MT5 is a popular multi-asset trading platform that offers a wide range of features, including powerful technical analysis tools, flexible charting tools, advanced order management tools, automated trading, and cross-platform compatibility. It is used by millions of traders and investors to trade forex, CFDs, stocks, and futures. MT5 is available for desktop, web, and mobile devices.

Research & Education:

TDX Global's education resources are relatively lacking in comparison to its peers. The broker only provides daily market outlook and calendar, trading ideas, and technical analysis on certain major currency pairs. There are no comprehensive free lessons or resources that cater to traders at various skill levels.

Customer Service:

TDX Global provides around-the-clock customer service so customers can get the support and assistance they need anytime. TDX Global also provides customer service options in several foreign languages for customers unfamiliar with English, such as Korean, Japanese, Mandarin and more.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has given TDX Global a WikiScore of 6.19 out of 10, indicating that it is only a borderline safe broker within the industry.

Upon examining TDX Global's licenses, WikiFX found that TDX Global operates under the ASIC regulations and the United States' Financial Crimes Enforcement Network.

Although TDX Global is a regulated broker, WikiFX would encourage our users to opt for a more rounded broker. As aforementioned, TDX Global is evidently playing second fiddle to its industry peers in certain areas, such as deposit and withdrawal options and education resources. There are better brokers that traders can opt for. We encourage our users to entrust a broker with at least a WikiScore of 8.0 and above to ensure top-notch products and services.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Is Billion Bucks Fx Scam?

Recent claims on YouTube and social media platforms allege that Billion Bucks Fx is a scam broker. Many traders have reportedly lost money after investing with this broker, and it has been given a notably low score of 1.06/10 by independent rating platforms. In this article, we break down the details of Billion Bucks Fx, assess the risks, and provide insight into whether investors should be wary of its services.

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

The worlds of social media and decentralized finance (DeFi) have converged under a new banner—SocialFi. Short for “Social Finance,” SocialFi leverages blockchain technology to reward user engagement, giving individuals direct control over their data and interactions. While SocialFi has primarily emerged in the context of content creation and crypto communities, its principles could soon revolutionize the forex market by reshaping how traders share insights and monetize social influence.

Do This ONE Thing to Transform Your Trading Performance Forever

The story is all too familiar. You start trading with high hopes, make some quick profits, and feel like you've finally cracked the code. But then, just as fast as your gains came, they disappear. Your account balance dwindles, and soon you’re left wondering what went wrong. Worse still, fear and confusion creep in, making every new trade a stressful gamble rather than a calculated decision. If this cycle sounds familiar, you’re not alone.

This FREE App Is Helping Millions Avoid Financial Scams

Fraudulent brokers, Ponzi schemes, and deceptive trading platforms are on the rise, making it increasingly difficult to distinguish between legitimate and illicit financial services. Fortunately, there’s a powerful, free tool designed to help users identify and avoid scams before it’s too late—WikiFX.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

The Growing Threat of Fake Emails and Phishing Scams

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator