简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

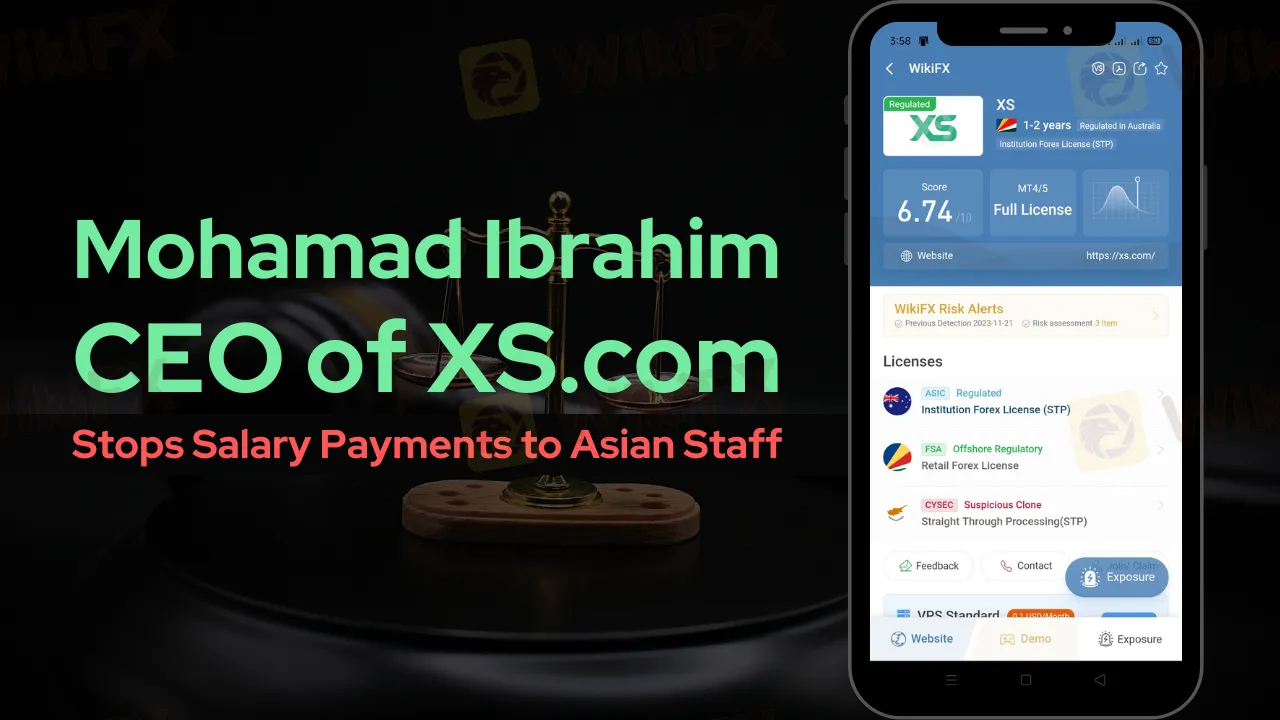

Mohamad Ibrahim, CEO of XS.com, Stops Salary Payments to Asian Staff

Abstract:An investigation for the allegations against XS.com's CEO, Mohamad Ibrahim, for halting salary payments to Asian and African employees. It details Ibrahim's professional background, employee grievances, and the company's controversial responses, exploring the impact on XS.com's reputation and the wider fintech industry. The report emphasizes the importance of ethical leadership and corporate accountability.

The corporate ethics and financial stability of XS.com, a prominent global fintech player, have been brought into question following recent allegations against its CEO, Mohamad Ibrahim. Accused of halting salaries for the company's Asian and African employees, Ibrahim's actions have stirred a mix of concern and outrage both within and beyond the organization. This report delves into the unfolding controversy, examining the claims, the responses, and the broader implications for XS.com and the industry at large.

Mohamad Ibrahim's Professional Background

Highlighting Mohamad Ibrahim's ascent to CEO after his tenure as Regional Director at Exness, this section establishes his professional pedigree. Concurrently, it outlines XS.com's market position, emphasizing its regulatory compliance across various jurisdictions. The contrast between the company's standing and the recent allegations paints a complex picture of leadership and corporate governance.

Detailed Employee Allegations

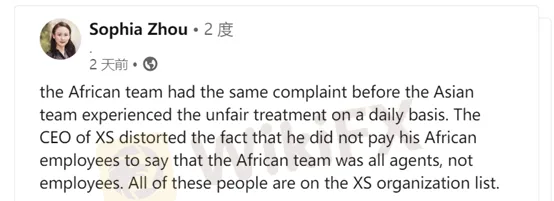

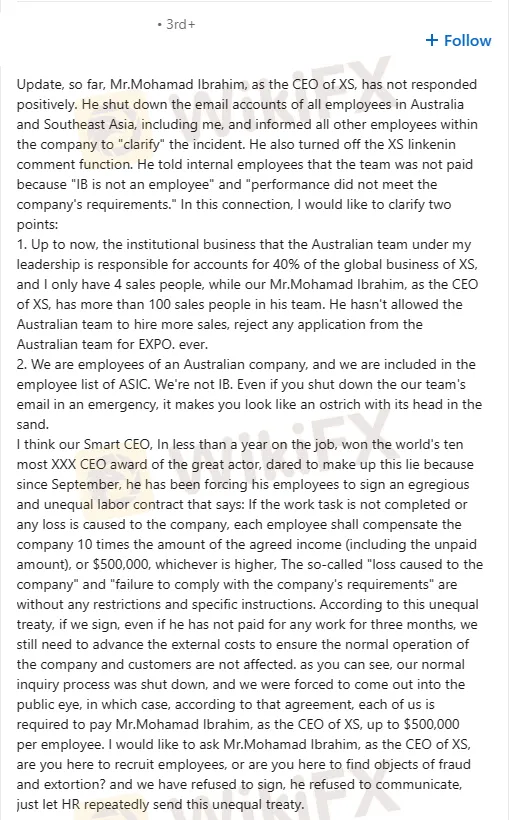

This section offers a comprehensive view of the employees' grievances. It elaborates on the cessation of salaries and commissions, underscoring the severity and personal impact on staff. The narrative is enriched with direct quotes from affected employees, particularly focusing on the Australian team's leader, who highlights their critical role in the company's global operations. The detailed account underscores the discord between the employees' contributions and the CEO's alleged disregard for their welfare.

Investigating Ibrahim's actions post-allegations, this part scrutinizes the shutting down of email accounts, the silencing of online discourse, and the controversial labor contracts introduced. The analysis probes into the legal and ethical dimensions of these actions, questioning their alignment with the company's stated values and regulatory commitments.

This segment assesses the ripple effects of the controversy on XS.com's market standing and corporate image. It debates potential repercussions for investor confidence, client relations, and internal morale. The discussion extends to the fintech industry at large, contemplating the incident's influence on sector-wide ethical standards and regulatory scrutiny.

Bottom line

In conclusion, the release reemphasizes the gravity of the allegations against Mohamad Ibrahim and the imperative for transparent, ethical leadership in the finance sector. It calls for a balanced but thorough investigation into the matter, underscoring the need for accountability and corporate responsibility.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

SEC Ends Crypto.com Probe, No Action Taken by Regulator

The SEC has closed its investigation into Crypto.com with no action taken. Crypto.com celebrates regulatory clarity and renewed momentum for the crypto industry.

Bitpanda Secures Full Broker-Dealer License in Dubai

Bitpanda has officially obtained a full broker-dealer license from the Dubai Virtual Assets Regulatory Authority (VARA), marking a significant milestone in its international expansion. This approval, which follows preliminary authorization granted three months earlier, enables the European digital asset exchange to introduce its comprehensive suite of virtual asset services to investors in the United Arab Emirates (UAE).

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Interactive Brokers adds Solana, XRP, Cardano, and Dogecoin to its platform, enabling U.S. and U.K. clients to trade crypto 24/7 with low fees.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Gold Surges to New Highs – Is It Time to Buy?

Currency Calculator