简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

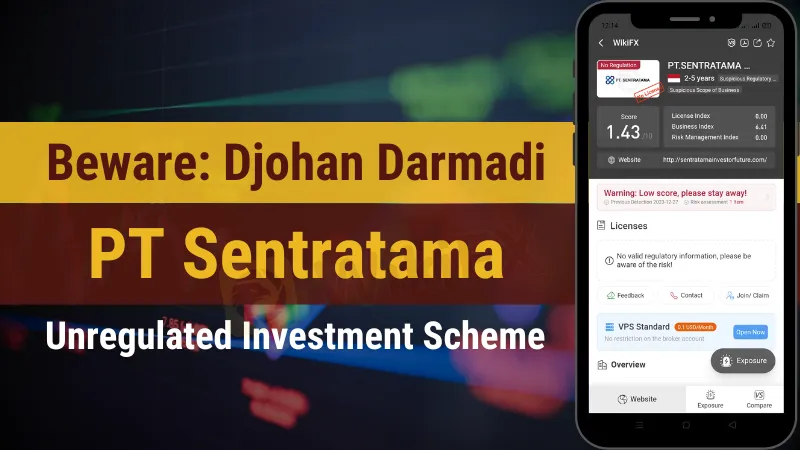

Beware: Djohan Darmadi PT Sentratama Unregulated Investment Scheme

Abstract:Investors warned about PT Sentratama's unregulated scheme linked to Djohan Darmadi's brokerage, raising concerns over illicit practices and client fund restitution.

Investors, exercise caution! A noteworthy development has transpired within the financial sector concerning an unregulated organization that maintains a close affiliation with PT Sentratama Investor Berjangka, a regulated brokerage owned by Djohan Darmadi. Since late 2022, the unregulated entity in question, PT Sentratama (unregulated), has generated concern among clients as a result of its illicit operations and persistent non-restitution of clients' funds.

Regulated

Unregulated Company Raises Red Flags

PT Sentratama (unregulated), which possesses an eerily similar name to the legitimate PT Sentratama Investor Berjangka, which operates by Indonesian financial regulations, has been identified as an unregistered and unauthorized entity. The affiliation between these two organizations is worrisome and has prompted inquiries regarding their activities.

Dubious Practices Uncovered

Investors who conducted business with PT Sentratama Investor Berjangka, the brokerage affiliated with Djohan Darmadi, have documented instances in which they were inadvertently coerced into opening an account with PT Sentratama (an unregulated entity) when they initially registered with this regulated brokerage. Without the investors' informed assent, this strategy exposes them to potentially hazardous and unregulated investments, which is a matter of grave concern.

Clients Left in Limbo

The most concerning element of this circumstance is PT Sentratama's (unregulated) indifference to the plight of its clients. A considerable number of investors, including those who placed their trust in the name Djohan Darmadi, have encountered a predicament in which their capital has become entangled with the unregulated organization. They have not been granted any support or resolution despite their pitiful cries for aid.

Reviews from the Victims

BAPPEBTI Awareness and Action

Due to PT Sentratama's (unregulated) failure to assist, investors have sought assistance from the regulatory body Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI). Many, however, have been dissatisfied with the apparent inaction of BAPPEBTI in promptly addressing this matter.

Protecting Yourself from Investment Scams

When contemplating investment opportunities, investors must exercise prudence and conduct thorough research in light of this circumstance. To prevent becoming a victim of unregulated schemes such as PT Sentratama, the following are critical guidelines:

Regulatory Compliance Verification: Verify the regulatory status of any brokerage or financial institution before investing with it by contacting the appropriate authorities.

Conduct Research on the Firm: Conduct an inquiry into the organization's past, present, and potential affiliations with unregulated organizations.

Examine contracts in detail: Consistently review and comprehend the terms and conditions of any investment agreement to ensure that they correspond with your anticipated outcomes.

Consult Legal Counsel: To protect your interests, seek the counsel of legal experts who are specialists in financial matters when uncertainty arises.

Scam Reports Suspected: Report any suspected fraudulent activity or personal experience of falling victim to a scheme to the relevant regulatory authorities.

About BAPPEBTI

The regulatory body in Indonesia tasked with the oversight and regulation of futures and commodities trading is known as the Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI). BAPPEBTI safeguards the interests of investors and maintains the financial sector's overall stability by guaranteeing the integrity and transparency of Indonesia's financial markets.

It is strongly recommended that investors maintain a state of alertness and knowledge, exercising prudence when engaging with financial institutions and, when needed, seeking support from regulatory bodies such as BAPPEBTI. In the realm of investments, the case of PT Sentratama (unregulated) serves as a poignant illustration of the criticality of regulatory compliance and due diligence.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

SEC Ends Crypto.com Probe, No Action Taken by Regulator

The SEC has closed its investigation into Crypto.com with no action taken. Crypto.com celebrates regulatory clarity and renewed momentum for the crypto industry.

Bitpanda Secures Full Broker-Dealer License in Dubai

Bitpanda has officially obtained a full broker-dealer license from the Dubai Virtual Assets Regulatory Authority (VARA), marking a significant milestone in its international expansion. This approval, which follows preliminary authorization granted three months earlier, enables the European digital asset exchange to introduce its comprehensive suite of virtual asset services to investors in the United Arab Emirates (UAE).

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Interactive Brokers adds Solana, XRP, Cardano, and Dogecoin to its platform, enabling U.S. and U.K. clients to trade crypto 24/7 with low fees.

Gold Surges to New Highs – Is It Time to Buy?

Recently, gold prices have once again set new records, surpassing $3,077 per ounce and continuing a four-week winning streak. Is It the Right Time to Invest?

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Gold Surges to New Highs – Is It Time to Buy?

Currency Calculator