简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Only Checklist You Need for FX Broker Selection!

Abstract:"Finding the best forex broker isn't easy. It's about considering important things, not just one 'best' choice. Let's explore the key factors that make a broker good."

In the ever-evolving landscape of forex trading, the search for the ultimate broker remains a quest marked by nuanced considerations. The notion of a solitary “best forex broker” dissolves under the scrutiny of specific, pivotal criteria that each brokerage must weather.

1. Spread/Commissions – The Cost of Transactions

Within the realms of forex trading, the price of transactions, quantified as spreads and commissions, exerts a direct influence on gains. While seemingly inconsequential for novices engaged in limited trade volumes, these expenses burgeon in significance as trade volumes surge.

2. Leverage – A Changing Landscape

Leverage and margins have undergone substantial reductions under prevailing regulations. Despite this, unregulated brokers may still entice traders with the allure of high leverage.

3. Regulation – Ensuring Trade Integrity

The cornerstone of reliability in forex trading lies within regulatory compliance. Regulatory oversight nurtures trade transparency and fortifies trader security, rendering regulated brokers more trustworthy. However, divergent regulations can inadvertently shackle trade possibilities.

4. Safety of Funds – The Brokers Responsibility

Fund and data safety epitomize a broker's integrity. The segregation of client funds from the company's finances reigns supreme, ensuring a safety net in dire circumstances like bankruptcy.

5. Broker Type – Direct vs. Indirect Access

Brokerages unveil either direct or indirect pathways to the forex market. Indirect brokers maneuver through the interbank market, vending positions to traders with modest initial balances and fixed spreads. On the contrary, direct brokers mandate higher capital but offer variable spreads.

6. Trading Resources – The Power of Information

Vital to traders are the resources proffered by brokers: market insights, analysis, historical data, and a plethora of currency pairs. Striking a balance in the volume of data is imperative; an overflow may prove distracting.

7. Customer Support – A Pivotal Pillar

Irrespective of a trader's prowess, robust support channels and empathetic assistance from brokers stand as cornerstones in this domain.

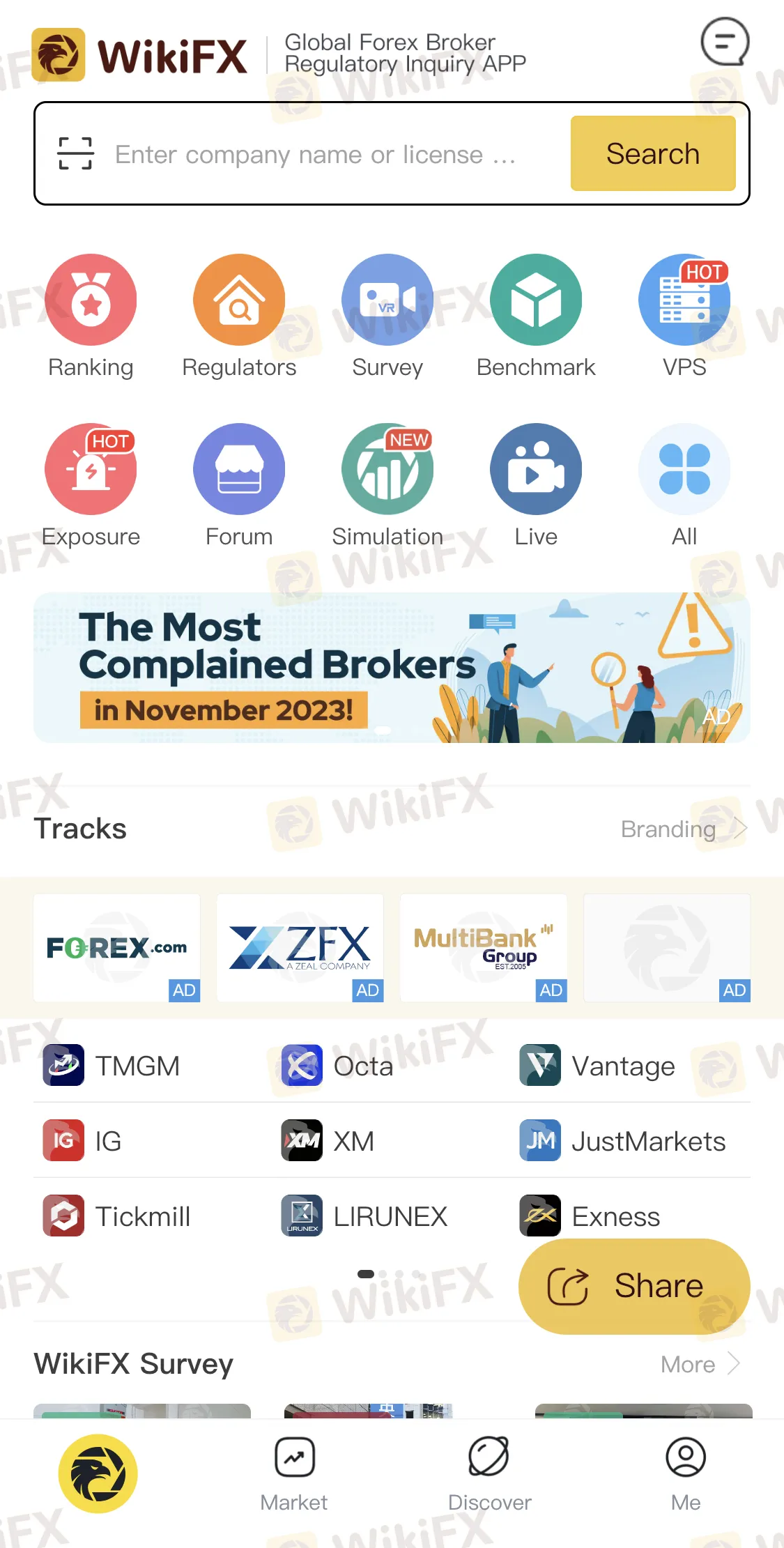

WikiFX, the premier global forex broker regulatory query platform, stands as an indispensable tool for traders seeking safe and reliable brokerages. With an extensive database and user-friendly interface, WikiFX provides an in-depth analysis of brokerages' regulatory compliance, user reviews, and transparency levels. The platform's unique features include comprehensive reports on broker legitimacy, ensuring traders make informed decisions. Whether it's verifying a broker's regulatory status, accessing authentic user reviews, or staying updated on crucial industry news, WikiFX's free mobile application, available on Google Play and the App Store, offers unparalleled convenience. Empowering users with detailed insights and real-time information, WikiFX remains committed to ensuring traders have the resources needed to navigate the complex world of forex trading confidently.

Download yours now for free, or visit www.wikifx.com without further ado.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Ultimate Guide to Automated Forex Trading in 2025

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Will natural disasters have an impact on the forex market?

The forex market is known for its rapid responses to global events, but the influence of natural disasters, such as earthquakes and typhoons, can be less straightforward. While headlines may scream about catastrophic damage and economic disruption, the long-term effects on currency values often depend on a blend of immediate shock and underlying economic fundamentals.

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Online scam groups in the Philippines trick Filipinos into gambling and love scams, from Manila to Bacolod, causing trafficking and pain as police fight back.

Why does your mood hinder you from getting the maximum return from an investment?

Investment decisions are rarely made in a vacuum. Aside from the objective data and market trends, our emotions—and our overall mood—play a crucial role in shaping our financial outcomes. Whether you’re feeling overconfident after a win or anxious after a loss, these emotional states can skew your decision-making process, ultimately affecting your investment returns.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator