简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

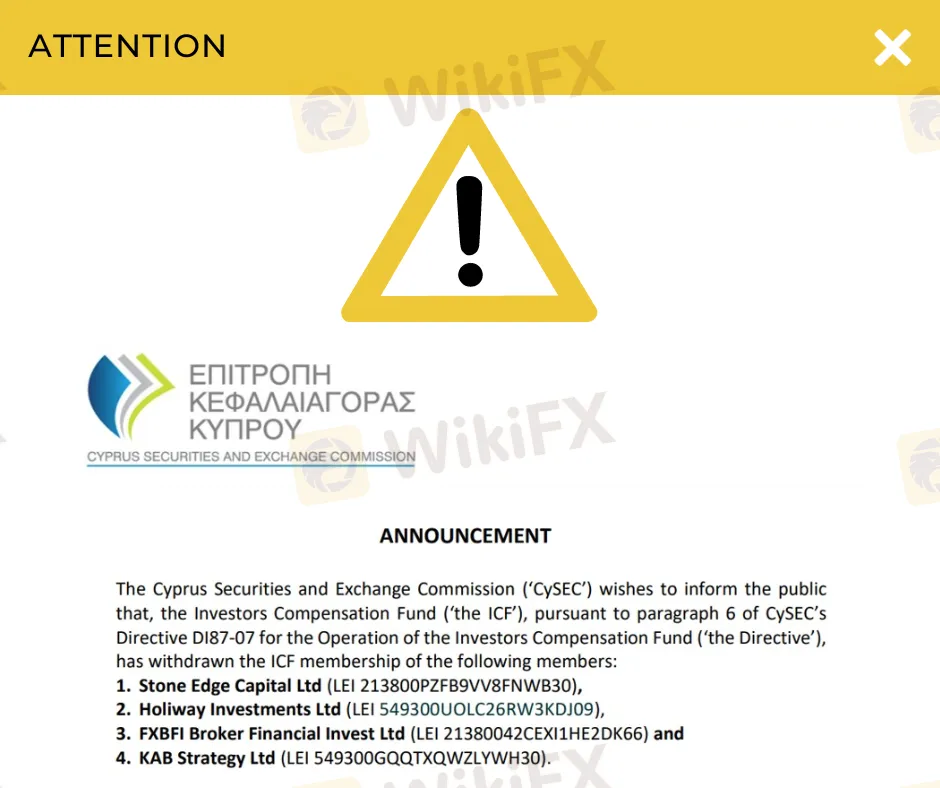

CySEC Cancels 4 Brokers’ ICF Membership

Abstract:CySEC withdraws membership from four major firms, exposing issues like voluntary license renunciations and regulatory compliance lapses.

The Cyprus Securities and Exchange Commission (CySEC) has recently disclosed the withdrawal of membership for four investment firms based in Cyprus by the Investors Compensation Fund (ICF). The affected entities include Stone Edge Capital Ltd, Holiway Investments Ltd, FXBFI Broker Financial Invest Ltd, and KAB Strategy Ltd.

The decision to revoke the membership of these firms stems from CySEC's choice to withdraw their Cyprus Investment Firm (CIF) authorizations, as officially stated by the regulatory body. Despite this development, clients covered by the four firms will retain the ability to file compensation claims for investment activities conducted prior to the withdrawal of membership. Eligibility criteria for such claims are outlined in CySEC's directives.

Established to provide compensation for covered investors in cases where the CIF fails to meet its obligations, the ICF operates under the regulatory mandate that all Cyprus Investment Firms must be its members. Consequently, when CySEC withdraws the CIF license of a firm, the ICF automatically terminates its membership.

KAB Strategy's license withdrawal, disclosed in the latter part of 2023, resulted from the company's voluntary renunciation. Meanwhile, FXBFI Broker Financial Invest also voluntarily relinquished its license, but only after facing a series of enforcement actions against the company due to deficiencies in anti-money laundering (AML) and combating the financing of terrorism (CFT) policies, controls, and procedures. This led to a €50,000 penalty imposed on FXBFI, the operator of 101investing.

In the cases of Stone Edge Capital and Holiway Investments, CySEC's investigations revealed violations of CIF authorization terms, prompting the cancellation of their licenses. In May, CySEC highlighted Stone Edge Capital's non-compliance with organizational standards, citing a lack of adequate systems to identify money laundering transactions. Additionally, the firm neglected to implement internal reporting systems and procedures.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Bitpanda Secures Full Broker-Dealer License in Dubai

Bitpanda has officially obtained a full broker-dealer license from the Dubai Virtual Assets Regulatory Authority (VARA), marking a significant milestone in its international expansion. This approval, which follows preliminary authorization granted three months earlier, enables the European digital asset exchange to introduce its comprehensive suite of virtual asset services to investors in the United Arab Emirates (UAE).

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Interactive Brokers adds Solana, XRP, Cardano, and Dogecoin to its platform, enabling U.S. and U.K. clients to trade crypto 24/7 with low fees.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator