简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | Is ZFX Reliable?

Abstract: In this article, we will look in-depth at ZFX, examining its key features.

In this article, we will look in-depth at ZFX, examining its key features.

About ZFX

Name: ZFX

Registered Country: /Region: United Kingdom

Website: www.zealmarkets.com

Phone: +44(0)2071579968;

Address: No. 1 Royal Exchange, London, EC3V 3DG, United Kingdom; Office 1, Unit 3, 1st Floor, Dekk Complex, Plaisance, Mahe, Seychelles; Suite C, Orion Mall, Palm Street, Victoria, Mahe, Seychelles

Email: support@zfx.co.uk; cs@zfx.com

In an era of advancing technology and prevailing investment trends, many individuals have turned to using their smartphones for the stock market, futures, and forex trading. Consequently, they encounter a crucial question: “How to choose a broker?” As a result, they often seek advice from platforms like Forex Scam Alert. Given the recent influx of inquiries regarding ZFX Mountain and Sea Securities, today we will share insights on how to evaluate this platform.

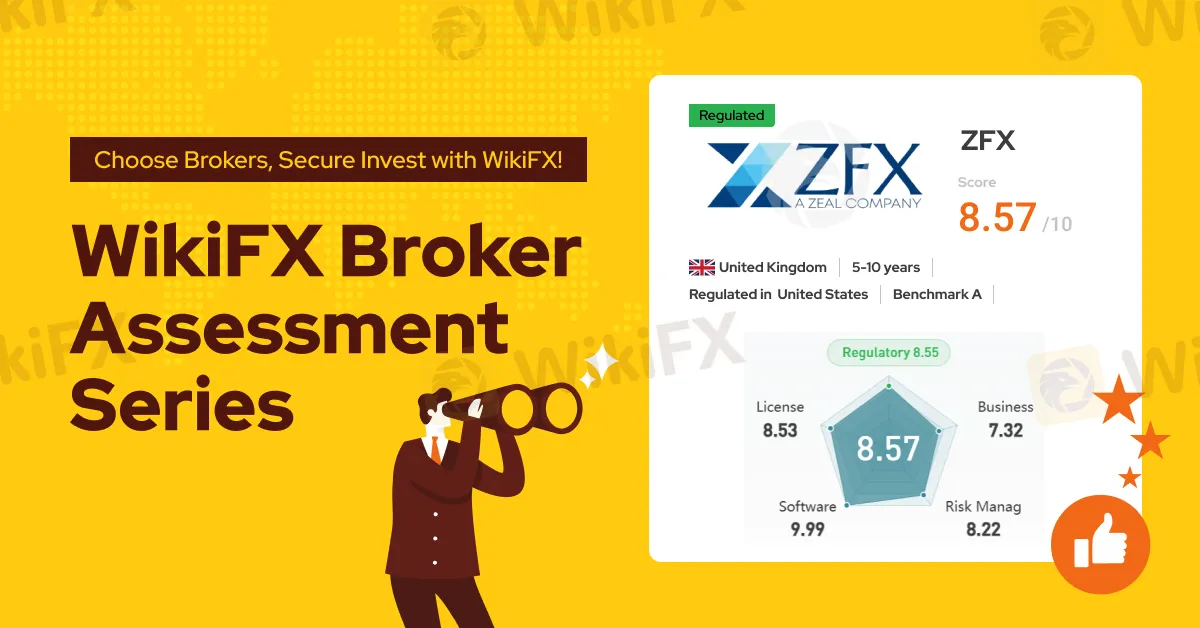

A search on WikiFX reveals that ZFX, a forex broker established for 5-10 years, employs the main trading software MT4/MT5. It holds a direct license from the UK's Financial Conduct Authority (FCA) and is regulated by the Seychelles Financial Services Authority (FSA) offshore. Additionally, it offers a “100% official intervention for complaints” service. WikiFX gives this broker a favorable score of 8.57/10.

Currently, ZFX offers three types of accounts for investors to choose from ECN, standard STP, and micro. The micro account has a minimum deposit limit of $50, a maximum leverage of 1:2000, and a minimum spread of 1.5. Both ECN and standard STP accounts have a maximum leverage of 1:500, with minimum spreads of 0.2 and 1.3 respectively, and require minimum deposits of $1000 and $200. All accounts support EA services.

ZFX's trading environment has an overall rating of AA, ranking 39th out of 130 brokers. Trading speed and costs are rated as A, while overnight costs and software disconnection are rated as AA, with the average disconnection frequency being deemed perfect.

On-Field Survey

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

WikiFX did make an on-site survey on ZFX in May 2022 and successfully found their office.

Conclusion

Based on the above findings, ZFX, regulated by the UK's FCA, demonstrates a strong performance in its trading environment, making it a high-quality broker. Investors can decide whether to use it based on their circumstances. If you still want to learn about other brokers, consider using the “Broker Inquiry” feature on the WikiFX app to confirm relevant regulatory information, trading environments, and ratings, helping you find the ideal platform for your needs.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

March Oil Production Declines: How Is the Market Reacting?

Oil production cuts in March are reshaping the market. Traders are closely watching OPEC+ decisions and supply disruptions, which could impact prices and future production strategies.

How to Calculate Leverage and Margin in the Forex Market

Leverage amplifies both potential profits and risks. Understanding how to calculate leverage and margin helps traders manage risks and avoid forced liquidation.

RM1.29 Million Lost in ‘C Baird VIP’ WhatsApp Scam

A 43-year-old company auditor and subcontractor in Malaysia became the latest victim of an elaborate investment scam after losing RM1.29 million to a fraudulent scheme promoted via WhatsApp.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator