简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Beware of Ventezo Limited: Withdrawal Issues Raise Red Flags

Abstract:A Philippine trader faces issues withdrawing $900 from Ventezo Limited, raising questions about the broker's integrity and regulatory status.

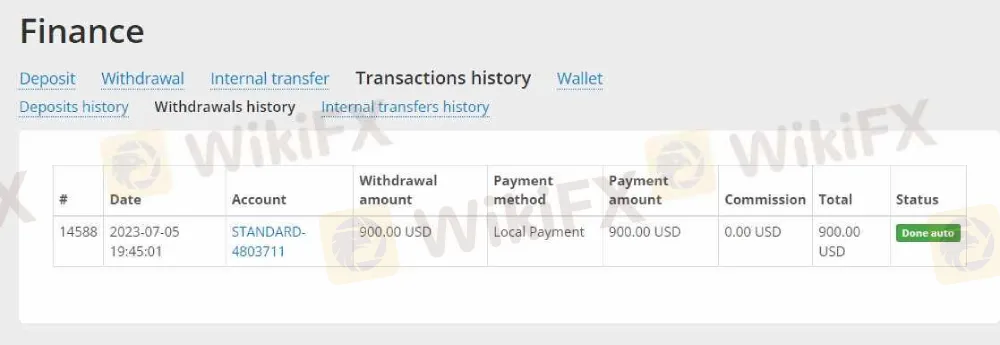

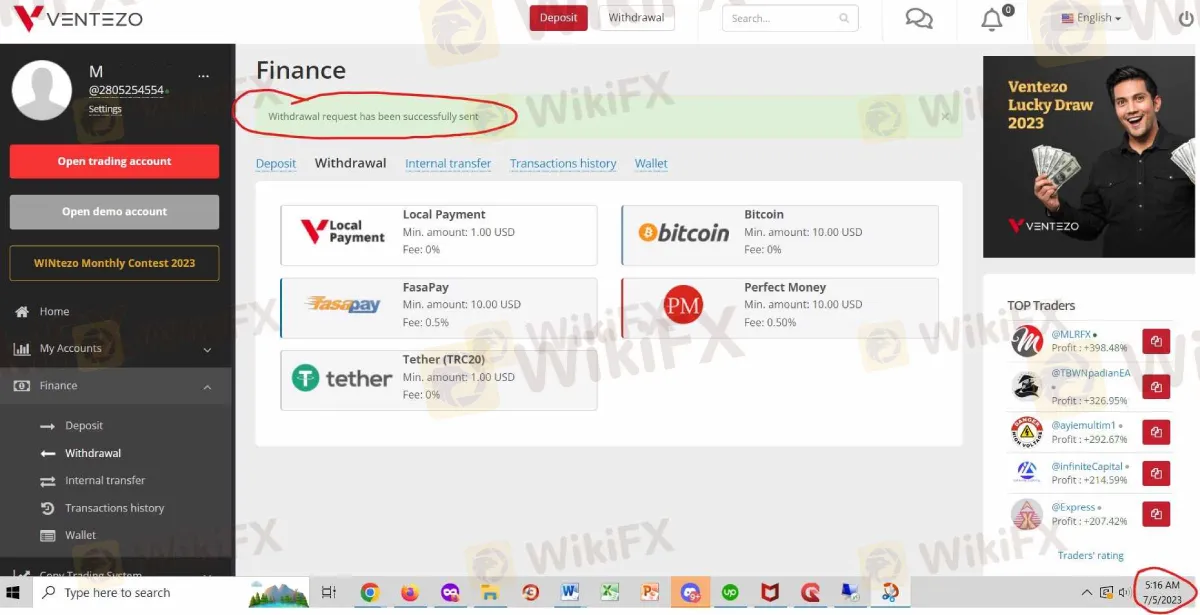

Ventezo Limited, an ECN/CFD broker, is currently under scrutiny due to serious allegations from a trader in the Philippines regarding unresolved withdrawal issues. The trader, who has chosen to remain anonymous, reported experiencing significant difficulties in retrieving $900 from their trading account. Despite receiving official confirmation from Ventezo that the withdrawal request had been successfully processed, the funds have not been transferred to the trader's local bank account, raising serious concerns about the brokers reliability and operational transparency.

Background on Ventezo

Ventezo Limited offers a range of trading instruments, including Forex, Commodities, Indices, and Cryptocurrencies. The broker claims to be regulated by the National Futures Association (NFA) under registration number 0563580. However, a verification check with the NFA reveals that Ventezo is not an active NFA member, which contradicts their regulatory claims. Additionally, Ventezo's official website states that the company is regulated under the SVG Financial Services Authority (SVGFSA). It is important to note that the SVGFSA does not regulate financial businesses engaged in online trading, which casts further doubt on the broker's regulatory legitimacy.

Location and Operations

Ventezo Limited operates from 703, Clover Business Center, Victory Square, 10, Kaliningrad Region, Kaliningrad, Russia. This location adds another layer of complexity to the situation, as it can be challenging for affected traders to seek legal recourse or support due to the geographical and jurisdictional distance.

The Trader's Experienced

The anonymous trader, acting on behalf of their mother who is also a client of Ventezo, has encountered significant issues with the non-release of withdrawn funds. Despite receiving multiple official email confirmations from Ventezo that the withdrawal requests were successfully completed, the funds have not been received in their local bank accounts. This discrepancy between Ventezo‘s system updates and the actual transfer status has raised serious concerns. The trader reported that Ventezo's chat support confirmed that the Philippine Country Manager “Ms. Elenita Canoy” had already transferred the funds. However, these funds have not appeared in the trader’s bank account, indicating a serious issue with the broker's internal processes or transparency.

Conversation with Representative “LLIA”

In an attempt to resolve the issue, the trader engaged in a conversation with a Ventezo representative named “LLIA.” During this interaction, the trader sought more detailed information about the withdrawal issue and possible resolutions. Unfortunately, the conversation did not yield any satisfactory answers or solutions, leaving the trader with continued uncertainty and financial stress.

Lack of Accountability

Repeated follow-up attempts by the trader have failed to resolve the withdrawal issue. This lack of response and accountability from Ventezo raises significant questions about the brokers integrity and operational transparency. The trader even resorted to sending a demand letter via WhatsApp to the owner of Ventezo, but this effort was met with silence, further exacerbating their frustration and concerns. The persistent non-responsiveness from Ventezo highlights a troubling pattern that potential clients should be wary of when considering engaging with this broker.

This case underscores the critical importance of ensuring that online brokers operate with full transparency, accountability, and integrity. Traders must exercise caution and conduct thorough due diligence before engaging with brokers, particularly those that make regulatory claims that cannot be independently verified. The experience of the trader in the Philippines serves as a cautionary tale for others in the trading community.

For more details about this case and to stay informed about similar issues, click here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Authorities Alert: MAS Impersonation Scam Hits Singapore

MAS scam alert: Scammers impersonate officials, causing $614K losses in Singapore since March 2025. Learn how to spot and avoid this impersonation scam.

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

Billboard warns against fake crypto scams using its brand. Learn how to spot fraud and protect yourself from fake promotions.

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

Rising WhatsApp Scams Highlight Need for Stronger User Protections

UK consumers lose £2,437 on average to WhatsApp scams. Revolut demands stricter verification and AI monitoring to combat rising fraud on Meta platforms.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator