简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

BDSwiss Safety Analysis: Account Types and Withdrawal Overview

Abstract:Established in 2012, BDSwiss claims that it has built a reputation with over 1 million active traders worldwide. With competitive spreads starting from 0.0 pips, diversified account types, multiple deposit and withdraw methods, BDSwiss offers both novice and experienced traders comprehensive trading conditions. In this guide, well walk you through the process of opening a BDSwiss account, making deposits, and withdrawing funds, so you can get started on your trading journey with ease. The table below is an overview of BDSwiss's basic information. We can have an initial understanding of it.

Established in 2012, BDSwiss claims that it has built a reputation with over 1 million active traders worldwide. With competitive spreads starting from 0.0 pips, diversified account types, multiple deposit and withdraw methods, BDSwiss offers both novice and experienced traders comprehensive trading conditions.

In this guide, well walk you through the process of opening a BDSwiss account, making deposits, and withdrawing funds, so you can get started on your trading journey with ease.

The table below is an overview of BDSwiss's basic information. We can have an initial understanding of it.

| BDSWISS Review Summary | |

| Founded | 2012 |

| Registered Country/Region | Seychelles |

| Regulation | FSA (offshore) |

| Market Instruments | 250+ CFDs on Forex, Shares,Indices, Commodities & Cryptos |

| Demo Account | ✅ |

| Account Type | Cent, Classic, VIP, Zero-Spread |

| Min Deposit | $10 |

| Leverage | 1:2000 |

| Spread | From 0 pips |

| Trading Platforms | MT5, BDSwiss Mobile App, BDSwiss WebTrader |

| Copy Trading | ✅ |

| Payment Methods | Visa, MasterCard, Skrill, Neteller, korapay, OZOW, M PESA, vodafone, airtel, tiGO, GCash, PayMaya, Prompt Pay, DultNow, pix, beeteller, cryptos, wire transfer, etc. |

| Deposit & Withdrawal Fee | None |

| Inactivity Fee | $30 or equivalent monthly if inactive for over 90 consecutive days |

| Customer Support | 24/5 live chat, contact form |

| Email: support@km.bdswiss.com | |

BDSWISS Accounts

If you are interested in trading with BDSwiss, it is recommended to open a risk-free demo account before exposing yourself to the real trading situation.

Demo Account

The good news is that BDSwiss supports demo trading, providing a risk-free environment to practice trading strategies, familiarize yourself with the platform, and gain confidence before committing to real funds. While it is important to note that the Cent account cannot be used for demo trading.

Account Types

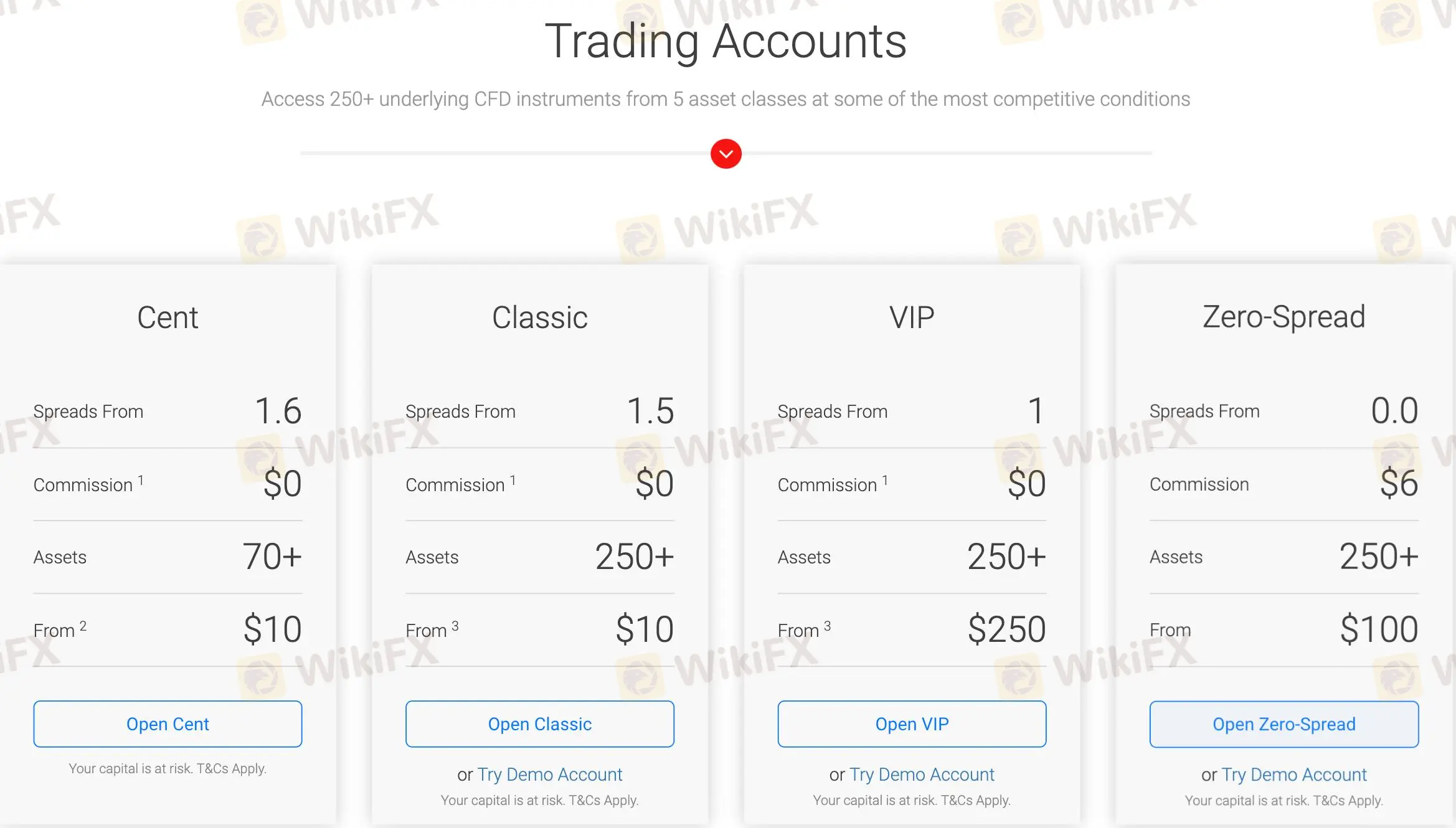

BDSwiss offers four types of accounts for individual traders, each designed to suit different trading styles. Lets take a quick look at the key differences.

The Cent account has the highest spread, with an average spread of 1.6 pips for EUR/USD, while the others are lower, especially the Zero Spread account. As for commission fees, the Zero Spread account charges a $6 commission per trade, while the others are commission-free.

Regarding asset categories, the Cent account offers just over 70 assets, while the other accounts offer more than 250 assets.

| Account Comparison | Cent | Classic | VIP | Zero-Spread |

| Avg. Spread (EURUSD) | 1.6 | 1.5 | 1 | From 0.0 |

| Leverage | up to 1:2000 | Default Leverage (up to 1:400) Dynamic Leverage (up to 1:2000) | Default Leverage (up to 1:400) Dynamic Leverage (up to 1:2000) | Default Leverage (up to 1:400) Dynamic Leverage (up to 1:2000) |

| Instruments | 70+ | 250+ | 250+ | 250+ |

| Available CFDs Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies | Forex, Stocks, Indices, Commodities, Cryptocurrencies | Forex, Stocks, Indices, Commodities, Cryptocurrencies | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Commissions (per round lot) | $0 on all pairs | $2 (200CUD) on Indices & 0.15% on Shares | $0 on all pairs | $6 on all pairs, $6 on commodities, $2 on indices, & 0.15% on shares |

| Margin Call at | 50% margin level | 50% margin level | 50% margin level | 50% margin level |

| Stop Out at | 20% margin level | 20% margin level | 20% margin level | 20% margin level |

| Instant Withdrawals | *only for credit card withdrawals up to 2,000 €/$/£ | $0 Fees on Deposits & CC Withdrawals | $0 Fees on Deposits & CC Withdrawals | $0 Fees on Deposits & CC Withdrawals |

| Platforms | WebTrader, Mobile App, MetaTrader 4 | WebTrader, Mobile App, MetaTrader 4, MetaTrader 5 | WebTrader, Mobile App, MetaTrader 4, MetaTrader 5 | WebTrader, Mobile App, MetaTrader 4, MetaTrader 5 |

| Trading Alerts | Limited Access | Limited Access | VIP Access | VIP Access |

| Autochartist Performance Stats | [+] $500 min deposit | [+] $500 min deposit | ✅ | ✅ |

| Personal Account Manager | ✅ | ✅ | ✅ | ✅ |

| Priority Services | ✅ | ✅ | ✅ | ✅ |

| Autochartist Standard Tools | ✅ | ✅ | ✅ | ✅ |

| Trading Central | ✅ | ✅ | ✅ | ✅ |

| Trading Academy & Live Webinars | ✅ | ✅ | ✅ | ✅ |

| Swap-Free account *Available for 90 days | ✅ | ✅ | ✅ | ✅ |

| VIP Webinars | ❌ | ❌ | ✅ | ✅ |

| 24/5 Support | ✅ | ✅ | ✅ | ✅ |

| Minimum Deposit | $10 | $10 | $250 | $100 |

Minimum Deposit

For BDSwiss, the minimum deposit for both the Cent account and the Classic account is relatively low, starting at $10.

It is worth noting that the Cent account also charges withdrawal fees.

BDSwiss offers a quick account opening process, claiming to complete it in just 49 seconds, which is much faster compared to some brokers that require identity verification and email notifications before proceeding.

Corporate Account

In addition, BDSwiss also offers a corporate account type. Below is the process for opening a corporate account and the documents required for registration.

How to Open a Corporate Account?

- Complete Compulsory QuestionnaireFill out a questionnaire covering important account-related information.

- Application ReviewAfter submission, the application will be reviewed.

- Account ApprovalUpon approval, your corporate account will be opened, granting access to the client dashboard.

Documents Needed to Open a Corporate Account

- Certificate of Incorporation

- Certificate of Registered Office (if available)

- Certificate of Directors and Secretary

- Declaration of Ultimate Beneficial Owner (UBO)

- Certificate of Good Standing or a recent excerpt from the company registry (for companies older than one year)

- Certificate of Registered Shareholders

- If the beneficial owner or representative is a company, provide their corporate documents.

- Memorandum & Articles of Association (if available)

- Board Resolution

- A resolution by the Board of Directors authorizing the opening of a trading account with BDSwiss and granting authority to operate the account.

- Full KYC Documentation for Directors and Shareholders with 25% or more ownership

- Proof of Identification: A certified true copy of the person(s) passport (photograph and signature required), must be valid and clearly readable.

- Proof of Residence: A recent utility bill (water, gas, electricity) or a bank statement (not older than six months) showing the permanent address of the individual.

Safety Analysis

According to our WikiFX teams investigation, BDSwiss holds a total of three licenses:

- FSA (Seychelles Financial Services Authority)

- Offshore Regulated: BDSwiss holds an offshore retail forex license, which is considered a lower-tier regulator with less investor protection.

- NFA (National Futures Association, USA)

- Unauthorized: BDSwiss is not authorized by the NFA and cannot offer services to US clients.

- CYSEC (Cyprus Securities and Exchange Commission)

- Suspicious Clone: BDSwiss is linked to CySEC, but has been flagged as a “suspicious clone,” indicating potential unauthorized operations under its name.

- Market Making (MM): BDSwiss operates as a market maker under CySEC, which could present conflicts of interest.

In 2024, BDSwiss also obtained a Category 5 license (“Financial Advisory and Introducing”) from the Securities and Commodities Authority (SCA) of the UAE. This marks a strategic expansion for BDSwiss in the Middle East and North Africa region.

In addition to its regulatory environment, BDSwiss offers negative balance protection, meaning your losses will not exceed your deposit. For EU traders, if the broker encounters similar financial difficulties, you can also be covered up to €20,000 through the ICF (Investor Compensation Fund) provided by the broker.

BDSwiss has a strict verification process. Initially, applicants must submit standard identification and proof of residence documents. Afterward, applicants must complete an appropriateness test and provide financial information to determine if they are suitable for market participation.

Editor's Comment

BDSwiss's regulatory status presents a mixed picture. While it holds licenses from offshore and reputable regulators like CySEC and the UAE's SCA, concerns about clone operations and its offshore FSA license remain.

Furthermore, being unauthorized by the NFA and operating under a market maker model may deter some traders due to the potential conflicts of interest.

On the positive side, features like negative balance protection, the ICF compensation fund, and a strict verification process contribute to its overall safety. However, prospective clients should consider the mixed regulatory status and weigh the risks before engaging with the broker.

Trading Platforms & Tools

BDSwiss offers the popular MetaTrader 5 (MT5) along with its proprietary WebTrader and mobile apps. These platforms are designed to meet the needs of both beginners and experienced traders, providing advanced tools, real-time market quotes, and automated trading options.

For example, MT5 supports over 80 technical indicators, while BDSwiss WebTrader features unique trend analysis tools.

Additionally, the mobile app allows for trading anytime, anywhere, providing real-time quotes, interactive charts, and 24/7 access to cryptocurrency pairs.

| Platform | Image | Features | Tips |

| MetaTrader 5 (MT5) |  | A popular and advanced trading platform. | - Over 80 technical indicators- Advanced charting tools- Automated trading options |

| WebTrader |  | BDSwiss‘s proprietary trading platform accessible via web browser. | - Unique trend analysis tools- Real-time market quotes- Suitable for both beginners & experts |

| Mobile App |  | BDSwiss’s mobile trading app for trading on-the-go. | - Real-time quotes- Interactive charts- 24/7 access to cryptocurrency pairs- Anytime, anywhere access |

Fees

BDSwiss offers competitive spreads starting from 1.6 pips for Cent accounts and 0.0 pips for Zero Spread accounts. No commission is charged for Forex, cryptocurrency, and commodity pairs, while commissions for other CFDs depend on your account type.

Overnight Fees: Positions held overnight incur a swap fee, which varies based on position size and the product. Swap fees are either charged or credited after 5:00 PM EST.

Currency Conversion: If the account currency differs from the deposit currency, BDSwiss automatically converts the deposit at the standard exchange rate with no additional fees or markups.

Spreads and Commissions: BDSwiss charges a spread for non-stock CFDs and a commission for stock CFDs. Forex, crypto, and commodity pairs have variable spreads based on account type, while indices and stocks have fixed commissions.

Inactivity Fee: A fee of $30 or the equivalent in the accounts base currency is charged monthly if no trading activity occurs for 90 consecutive days. This continues until the account balance reaches zero.

Deposit & Withdrawal

Payment Methods

BDSwiss offers clients a variety of secure deposit and withdrawal options, including popular payment methods such as Visa, Mastercard, Skrill, Neteller, as well as local payment systems like MPESA and PayPal. Deposits via most methods are processed instantly, while withdrawals are typically processed within 24 hours.

Additionally, BDSwiss covers all collection fees and recommends that clients use the same method for withdrawals as for deposits. To ensure security and compliance, withdrawals require complete account verification.

Deposit & Withdrawal Fees

BDSwiss does not charge deposit or withdrawal fees, and the withdrawal processing time is very fast, with the company claiming an average withdrawal time of 5 hours.

Although there are no fees for withdrawals via credit card, a withdrawal fee of €10 will apply for amounts less than €100 when using bank transfers or other methods.

For accounts with no activity for over 90 days, a fee of €30 or the equivalent in the account's currency will be charged monthly.

| Deposit Option | Accepted currencies | Approx. Processing Time |

| VISA | EUR, GBP, USD | Instant* |

| Mastercard | EUR, GBP, USD | Instant* |

| Skrill | EUR, GBP, USD | Instant* |

| NETELLER | EUR, GBP, USD | Instant* |

| PAYO | ZAR | Instant* |

| Korapay | NGN | Instant* |

| OZOW, MPESA, airtel, vodafone, MTN, airteltigo, Orange Money | ZAR, KES, GHS, TZS, XOF, UGX | Instant* |

| PromptPay, VietQR, DuitNow, PayMaya, GCash | THB, IDR, PHP, VND, MYR | Instant* |

| Pix | BRL | Instant* |

| Beeteller | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Instant* |

| LetKnow, SpeedlightPay and ChipPay | BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZCASH, ADA | Instant* |

| Bank Wire | ZAR, AED, AUD, BBD, BGN, BHD, CAD, CHF, CZK, DKK, EUR, GBP, GHS, HKD, HRK, HUF, ILS, JPY, KES, MWK, MXN, NOK, NZD, OMR, PHP, PKR, PLN, QAR, RON, SAR, SEK, SGD, THB, TND, TRY, TTD, UGX, USD, ZMW | 1-5 days |

| Withdrawal Option | Accepted currencies | Approx. Processing Time |

| VISA | EUR, GBP, USD | Processed within 24 hours* |

| Mastercard | EUR, GBP, USD | Processed within 24 hours* |

| Skrill | EUR, GBP, USD | Processed within 24 hours* |

| NETELLER | EUR, GBP, USD | Processed within 24 hours* |

| PAYO | ZAR | Processed within 24 hours* |

| Korapay | NGN | Processed within 24 hours* |

| OZOW, MPESA, airtel, vodafone, MTN, airteltigo, Orange Money | ZAR, KES, GHS, TZS, XOF, UGX | Processed within 24 hours* |

| PromptPay, VietQR, DuitNow, PayMaya, GCash | THB, IDR, PHP, VND, MYR | Processed within 24 hours* |

| Pix | BRL | Processed within 24 hours* |

| Beeteller | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Processed within 24 hours* |

| LetKnow, SpeedlightPay and ChipPay | BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZCASH, ADA | Processed within 24 hours* |

| Bank Wire | ZAR, AED, AUD, BBD, BGN, BHD, CAD, CHF, CZK, DKK, EUR, GBP, GHS, HKD, HRK, HUF, ILS, JPY, KES, MWK, MXN, NOK, NZD, OMR, PHP, PKR, PLN, QAR, RON, SAR, SEK, SGD, THB, TND, TRY, TTD, UGX, USD, ZMW | Processed within 24 hours* |

Customer Complaints and Withdraw Issues

The revocation of the CySEC license, layoffs, and the departure of executives have amplified concerns among BDSwiss customers. These developments have triggered anxiety, especially among those who have not yet received their withdrawals.

Despite internal changes, what matters most to customers is their ability to trade and access their funds, and BDSwiss has evidently failed to provide satisfactory answers.

One user told WikiFX that he submitted a withdrawal request on September 20, 2024, but has yet to receive any payment. Although his transaction history shows the request as “processing,” there has been no further progress. Despite multiple inquiries to customer service regarding the issue, he received only repetitive answers, empty apologies, and no meaningful updates. The staff also failed to provide a date for when the process would be completed.

Conclusion

Overall, BDSwiss offers a wide range of trading products and account types, with clear and transparent fees and no hidden charges. It also provides demo accounts, and trading platforms such as MT5, WebTrader, and a mobile app, making it quite beginner-friendly.

However, in terms of security, compared to other brokers like AVAtrade and IB, its regulatory status is weaker, holding only an offshore FSA license, and its CySEC license has been revoked. Additionally, there have been significant changes in the companys management in 2024.

Moreover, user feedback regarding difficulties with withdrawals is also a point that warrants careful consideration.

FAQs

Does BDSwiss offer an affiliate program?

Yes, BDSwiss offers both an affiliate program and an IB (Introducing Broker) program.

What deposit methods does BDSwiss offer?

BDSwiss offers bank transfers, credit/debit cards, and e-wallet services.

What is the average processing time for deposits and withdrawals with BDSwiss?

Deposits and withdrawals typically take 1-3 business days to process.

Can I use a demo account with BDSwiss?

Yes, BDSwiss offers demo accounts. However, it is important to note that Cent accounts do not offer demo account testing.

Does BDSwiss have restricted regions?

Accepted countries: Australia, Canada, the UK, Singapore, Hong Kong, France, Germany, Norway, Sweden, Italy, Denmark, the UAE, Saudi Arabia, Kuwait, Luxembourg, Thailand, Qatar, and most other countries.

Prohibited countries: The United States, South Africa, Belgium, Congo, Cyprus, India.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

How to Avoid Risks from Scam Brokers in Forex Investment

Beware: Forex Investment Fraud Targeting Low Income Earners

Central Bank Policies,Forex Markets and Gold Prices

These 24 Crypto Scams Are Accelerating the Theft of Your Assets

49 Foreigners Arrested in Illegal POGO Raid in Pasay City

Beware of Fake 'Educational Foundations' Targeting Crypto Investors, Warns North Dakota Regulator

We Asked Grok About Illegal FX Brokers—Here’s What It Revealed

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

Online Investment Scams on the Rise: How Two Victims Lost Over RM100K

Vanished Savings: How One Woman Lost RM412,443 to an Online Scam

Currency Calculator