简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

15 cheap stock picks to buy for big buybacks, dividends: Goldman Sachs - Business Insider

abstrak:If you're looking to buy stocks that offer huge cash distributions at cheap prices, Goldman says these 15 are your best bets.

David Kostin, the chief US equity strategist at Goldman Sachs, says he's brought together a group of S&P 500 stocks that return double the average company in the broader index. Kostin adds that the stocks have underperformed the index for the last few years despite their superior returns. The performance of those stocks has steadily gotten worse as investors got more optimistic about economic growth.Visit Business Insider's homepage for more stories.It's a rare combination, but Goldman Sachs says you can get better-than-average returns from a few stocks while also buying them at better-than-average prices.

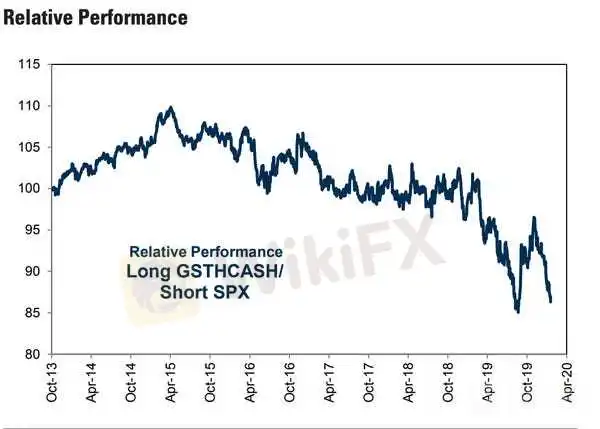

David Kostin, chief US equity strategist at Goldman Sachs, says he's identified a group of stocks that more than double the cash return of the median S&P 500 stock, which is currently 4.4%. Most of them pay hefty dividends, and some augment that by repurchasing large amounts of their stock every year.And yet Kostin says those stocks have been collectively underperforming the S&P 500, as shown in the chart below. It shows the high-return stocks falling farther and farther behind the benchmark index over the last three years, with a few attempted rallies that didn't last long.Put simply, these stocks that offer strong cash distributions can be found at a bargain.

David Kostin of Goldman Sachs says stocks that offer outsize cash returns have underperformed the S&P 500 for years.

Goldman Sachs Global Investment Research

And most recently, they've gotten even cheaper relative to the market as investors got more optimistic about the economy and resumed their preference for growth over higher-yielding stocks.

Listed below are Kostin's top 15 stocks. They're ranked from lowest to highest based on their yield, defined as dividend payouts and stock buybacks as a percentage of their market caps over the past 12 months.

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Broker ng WikiFX

Exchange Rate