简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

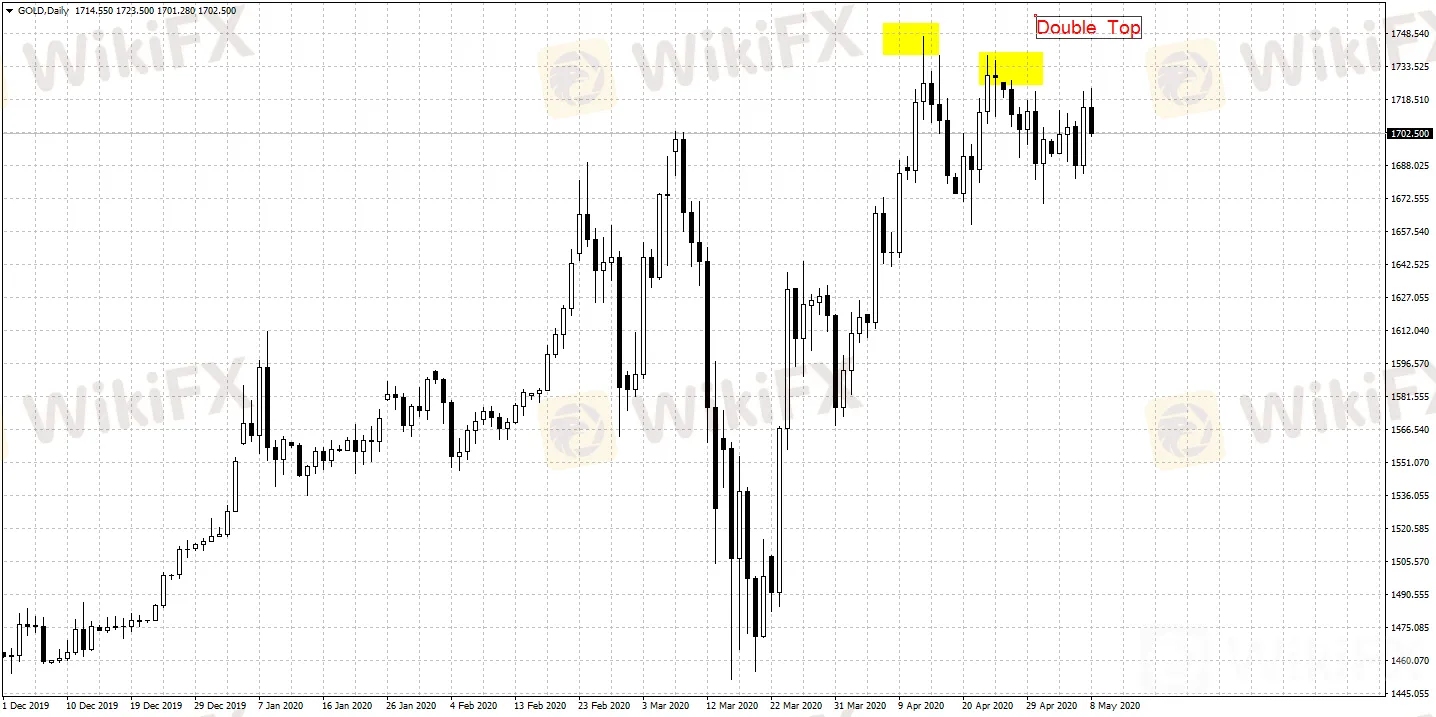

Central Banks’ Gold Purchases Decline Will Have Far-reaching Effects

abstrak:From WikiFX news. As the world’s top gold buyer, Central Bank of Russia’s decision to stop gold purchase starting from April may signal an upcoming big decline in global central banks’ net gold-purchase.

From WikiFX news. As the world‘s top gold buyer, Central Bank of Russia’s decision to stop gold purchase starting from April may signal an upcoming big decline in global central banks net gold-purchase.

The reason for gold prices plummet is that facing market liquidity drain, investors thus sell off gold for dollars in order to pay margin calls. From our observation, the foreign exchange reserves of global central banks are shrinking rapidly, and a bullish trend of the USDX recently indicates there may be another round of dollar shortage in the market.

Given that many central banks have cut their holdings of US Treasury Bonds and the Fed may reduce quantitative easing scale, it seems that global central banks have few options to acquire dollar liquidity other than selling off gold reserves. As most central banks are currently focused on reviving domestic economy, this only increases their demand for dollar. Central banks in countries such as Sri Lanka, Germany and Tajikistan have begun selling their gold reserves.

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Broker ng WikiFX

Exchange Rate