简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Tickmill News: Top Trade Opportunities After Ukraine War: Euro vs. Norwegian Krone

abstrak:The Norwegian Krone tends to strengthen against the Euro when crude oil prices rise. Norway exports a lot, having a current account surplus of over 6% of GDP over 40 years. Energy exports to the Eurozone account for most of this prosperity.

Trade between the Euro and the Norwegian Krone is being considered for the aftermath of the Ukraine war: Top Trade Opportunities

When crude oil prices are rising, the Norwegian Krone tends to appreciate versus the Euro. Norway is a prolific exporter, with a current account surplus that has averaged more than 6% of GDP over the last 40 years. Much of this prosperity may be attributed to energy sales to the Eurozone.

This suggests a consistent underlying drain of Euros from the currency bloc to Norway. When the price of crude oil rises on global markets, this is predictably exacerbated. A higher barrel price encourages capital flows out of EUR and into NOK. As a result, the Krone is trading at three-year highs versus the Euro, as Russia's invasion of Ukraine fuels supply disruption worries, driving oil prices skyrocketing. Sanctions imposed by the West have hampered Russian exports, pinching an already constrained post-pandemic market.

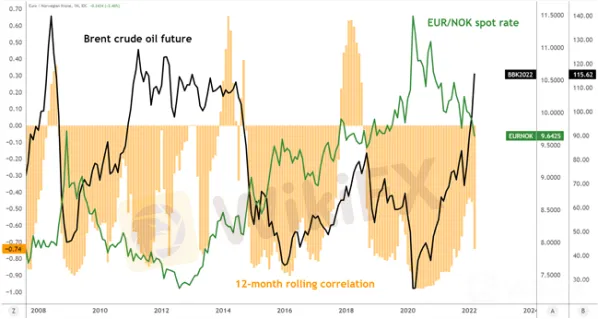

12-MONTH ROLLING CORRELATION OF EUR/NOK VS. BRENT CRUDE OIL

A complete restoration to pre-war 'normalcy' is improbable. Germany and other important Eurozone economies have publicly committed to diversify away from Russian energy, putting a pressure on the regional supply/demand balance and seeming to drag the EUR/NOK down in the long run.

Nonetheless, the cessation of military action will almost definitely provide some respite. This suggests that a short-term alleviation of shortage worries may cause oil prices to rise before structural factors reestablish their control, resulting in a tighter market overall.

This suggests that a short-term rally when the guns fall quiet may provide an opportunity to sell into the longer-term downturn for EUR/NOK. Positive RSI divergence indicates that bearish momentum is fading, even if the bigger trend is still pointing lower after last year's collapse.

A rebound from immediate support at 9.3867 targets a past swing low that has been recast as resistance at 9.6624, with a break above that aiming for the inflection point at 9.9004. Probing over the 10.00 mark is possible. Breaking support, on the other hand, seems to first reveal 9.1587.

SPOT EUR/NOK (WEEKLY CHART)

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Magbasa pa ng marami

Challenge Yourself: Transform from Novice to Expert

From a forex novice to a trading expert, all it takes is this one opportunity! Join us for the Forex Beginner's Advancement Journey challenge and unlock your potential! Here, if you're a beginner, participating in the event and posting on selected topics will not only deepen your understanding of forex basics and help you advance but also earn you a Learning Encouragement Award. For those with some experience in forex, discussing insights under the event topics will allow you to exchange experiences and share techniques with like-minded peers, while also having the chance to win a Perspective Sharing Award! Come challenge yourself and break through the limits of forex trading together!

Sa likod ng Orfinex Prime Brokerage: Isang kaso ng pagsalangsang at negligencia

Orfinex Prime: Mga Allegasyon ng Negligencia at Paglabas | Ang mga problema ng mga kliyente ay nagpapahayag ng mga hindi ligtas na pamamaraan sa pagbebenta, malinaw na presensya sa Dubai, at mga alalahanin ng pagsalangsang. Gumawa ng mga aksyon para sa proteksyon ng mga mamimili.

I-claim ang Iyong 50% Welcome Bonus hanggang $5000!

Bukas sa Parehong Bago at Existing na Customer!

The pound, gilts and renewables: the winners and losers under Britain’s future PM

The race to be the next leader of Britain’s ruling-Conservative Party and the country’s prime minister is into its final leg, with the September outcome likely to shape the fortunes of sterling, gilts and UK stocks in coming months.

Broker ng WikiFX

Exchange Rate