简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

eToro News: Before Entering Any Trade, Follow This 7-Step Trading Checklist

abstrak:The usage of a trading checklist is a crucial part of the trading process since it helps traders stay focused, stick to their trading plan, and acquire confidence. Keeping a trading checklist offers traders with a list of questions to address before finalizing transactions.

The video above focuses on the core parts of the trading checklist, while this article aims to explore other aspects of the trading checklist in more depth.

WHY SHOULD YOU USE A TRADING CHECKLIST?

Using a trading checklist is an important element of the trading process since it helps traders remain focused, adhere to their trading strategy, and gain confidence. Keeping a trading checklist provides traders with a set of questions to answer before completing deals.

It is critical to distinguish between a trading strategy and a trading checklist. The trading strategy addresses the larger picture, such as the market you are trading and the analytical method you want to use. The trading checklist focuses on each transaction and the parameters that must be completed before making the deal.

YOUR CHECKLIST FOR TRADING

Before you start a business, ask yourself the following questions:

Is the market trending or fluctuating?

Is there a considerable amount of support or opposition nearby?

Is the transaction backed up by an indicator?

How is the risk-to-reward ratio calculated?

How much money am I putting at risk?

Are there any major economic releases that might influence the trade?

Is my trading strategy on track?

IS THE MARKET RANGING OR TRENDING?

Markets in vogue

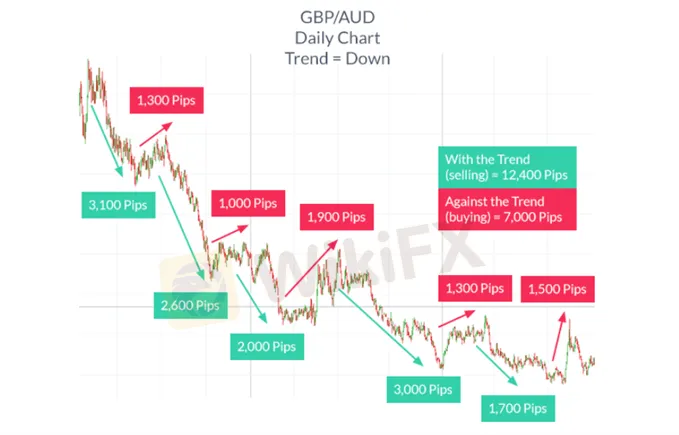

Experienced traders understand that identifying a strong trend and trading in its direction has the potential to result in higher probability deals.

A well-known adage states that trending markets may help traders get out of disastrous trades. As seen here, even if a trader launched a short trade after the trend had already established itself, the trend would continue to deliver more pips to the downside than to the upside.

Traders must consider if the market is showing symptoms of a strong trend and whether 'trend trading' is part of their trading strategy.

Various markets

Price in ranging markets tends to bounce between support and resistance to trade inside a channel. Certain markets, such as the Asian trading session, trade in ranges. Oscillating indicators (RSI, CCI, and Stochastic) may be quite useful for traders that specialize in range trading.

IS THERE A SIGNIFICANT LEVEL OF SUPPORT OR RESISTANCE IN THE NEIGHBORHOOD?

Price action tends to respect specific price levels for a variety of reasons, and knowing how to recognize these levels is critical. Traders do not want to be maintaining a short position after the price has plummeted to a critical level of support just to rebound higher.

The same is true when price hits a crucial level of resistance and then falls quickly. Typically, trend traders look for persistent breaks of these levels as an indicator that the market is about to trend. Range traders, on the other hand, will watch for price to bounce back and forth between support and resistance over extended periods.

IS THE TRADE BACKED UP BY AN INDICATOR?

Indicators help traders confirm high-probability deals. Traders will use one or two indicators to supplement their trading approach, depending on their trading plan and method. Avoid overcomplicating the analysis by using many indicators on a single chart. Maintain a clean, straightforward, and easy-to-read analysis.

WHAT IS THE RISK-REWARD RATIO?

The risk to reward ratio is the ratio of the amount of pips that traders are willing to risk to achieve the objective. According to our Traits of Successful Traders study, which examined over 30 million live transactions, traders who have a good risk to reward ratio are roughly three times more likely to be successful than those who do not. A 1:2 ratio, for example, suggests that a trader risks half of what he or she stands to earn if the deal works out. This idea is further shown in the figure below.

HOW MUCH MONEY AM I RISKING?

This is a question that traders must ask. When pursuing “guaranteed things,” traders often blow up their funds by leveraging the account to the fullest. One approach to prevent this is to keep all transactions' leverage at 10 to one or fewer. Another useful advice is to put stops on all transactions and limit the total amount risked to no more than 5% of the account balance.

Before entering a deal, consider “how much money should I use?”

ARE THERE ANY IMPORTANT ECONOMIC RELEASES THAT MAY AFFECT TRADE?

The “ideal” transaction might be rendered invalid by unexpected market news. While it is almost difficult to predict terrorist attacks, natural catastrophes, or systemic breakdowns in the financial markets, traders may prepare for economic releases such as the NFP, CPI, PMI, and GDP.

Plan ahead of time by consulting our economic calendar, which highlights key economic announcements from the world's leading trade countries.

AM I KEEPING TO THE TRADING PLAN?

All of the preceding is meaningless unless it is linked to the trading strategy. Deviating from the trading strategy will provide inconclusive outcomes and will only aggravate the trading process. Stick to the trading strategy and avoid placing trades until the trading checklist has been completed and the deal may be performed.

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Magbasa pa ng marami

Challenge Yourself: Transform from Novice to Expert

From a forex novice to a trading expert, all it takes is this one opportunity! Join us for the Forex Beginner's Advancement Journey challenge and unlock your potential! Here, if you're a beginner, participating in the event and posting on selected topics will not only deepen your understanding of forex basics and help you advance but also earn you a Learning Encouragement Award. For those with some experience in forex, discussing insights under the event topics will allow you to exchange experiences and share techniques with like-minded peers, while also having the chance to win a Perspective Sharing Award! Come challenge yourself and break through the limits of forex trading together!

Sa likod ng Orfinex Prime Brokerage: Isang kaso ng pagsalangsang at negligencia

Orfinex Prime: Mga Allegasyon ng Negligencia at Paglabas | Ang mga problema ng mga kliyente ay nagpapahayag ng mga hindi ligtas na pamamaraan sa pagbebenta, malinaw na presensya sa Dubai, at mga alalahanin ng pagsalangsang. Gumawa ng mga aksyon para sa proteksyon ng mga mamimili.

I-claim ang Iyong 50% Welcome Bonus hanggang $5000!

Bukas sa Parehong Bago at Existing na Customer!

The pound, gilts and renewables: the winners and losers under Britain’s future PM

The race to be the next leader of Britain’s ruling-Conservative Party and the country’s prime minister is into its final leg, with the September outcome likely to shape the fortunes of sterling, gilts and UK stocks in coming months.

Broker ng WikiFX

Exchange Rate