简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

An Impressive 189 Percent Return Over Three Years for CMCMarkets (LON:CMCX) Investors

abstrak:Investing in a company's shares might result in total loss (assuming no leverage). Investing in a great company may more than quadruple your money. For example, CMC Markets plc (LON: CMCX) has seen its share price rise 148% in three years. That type of return is rock solid. It has down 2.4% in the last week.

Investors of CMCMarkets (LON: CMCX) will be happy with their 189 percent gain over the previous three years.

The worst-case scenario after investing in a company's stock (assuming no leverage) is that you lose all of your money. However, if you invest in a fantastic firm, you may more than double your money. For example, in the previous three years, the share price of CMC Markets plc (LON: CMCX) has increased by 148%. That kind of return is as steadfast as stone. In the previous seven days, it has fallen 2.4 percent.

So, during the previous three years, let's look at the underlying fundamentals to determine whether they've evolved in lockstep with shareholder returns.

'Ships will sail across the globe, but the Flat Earth Society will thrive,' Buffett says. There will continue to be significant price and value disparities in the marketplace...' Comparing the change in profits per share (EPS) with the share price movement is an imprecise but basic technique to examine how the market opinion of a firm has moved.

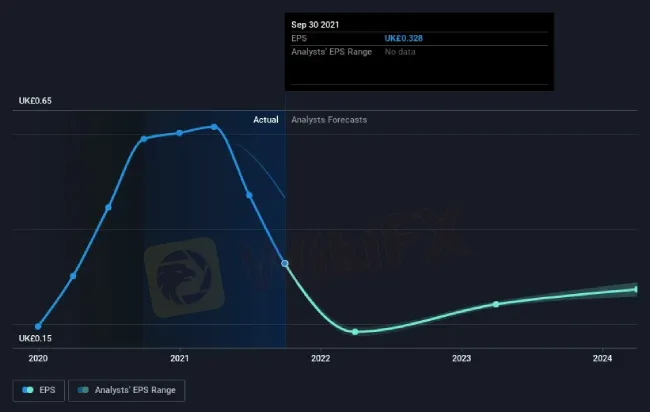

Over three years, CMC Markets was able to raise its EPS at a rate of 43 percent each year, propelling the stock price upward. The average yearly rise in share price is 35%, which is less than the EPS growth. As a result, it seems that the market has lowered its growth projections significantly. This cautious attitude is reflected in the company's (very low) P/E ratio of 6.82.

The graph below shows how EPS has evolved throughout time (unveil the exact values by clicking on the image).

It's great to see how CMC Markets' earnings have increased over the years, but the future is more essential for shareholders.

How Do Dividends Work?

Investors should assess the overall shareholder return in addition to the share price return (TSR). The TSR includes the value of any spin-offs or discounted capital raisings, as well as any dividends, assuming that dividends are reinvested. It's safe to conclude that the TSR provides a more full view of dividend-paying equities. For the previous three years, CMC Markets has had a TSR of 189 percent. This is more than the previously indicated share price return. This is mostly due to its dividend payouts!

A Different Point of View

CMC Market owners are lost 43 percent year so far (even after dividends), although the market is up 10.0 percent. Keep in mind, however, that even the finest companies may sometimes underperform the market for twelve months. Long-term stockholders, on the other hand, have profited, with an average annual gain of 19% over the last five years. The current sell-off may represent an opportunity, therefore it's worth looking at the underlying data for indicators of a long-term growth tendency. It's always intriguing to look at long-term share price performance. However, to properly comprehend CMC Markets, we must examine several additional elements. Take, for example, hazards. Every firm has them, and we've identified two danger flags for CMC Markets that you should be aware of.

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Magbasa pa ng marami

Challenge Yourself: Transform from Novice to Expert

From a forex novice to a trading expert, all it takes is this one opportunity! Join us for the Forex Beginner's Advancement Journey challenge and unlock your potential! Here, if you're a beginner, participating in the event and posting on selected topics will not only deepen your understanding of forex basics and help you advance but also earn you a Learning Encouragement Award. For those with some experience in forex, discussing insights under the event topics will allow you to exchange experiences and share techniques with like-minded peers, while also having the chance to win a Perspective Sharing Award! Come challenge yourself and break through the limits of forex trading together!

Sa likod ng Orfinex Prime Brokerage: Isang kaso ng pagsalangsang at negligencia

Orfinex Prime: Mga Allegasyon ng Negligencia at Paglabas | Ang mga problema ng mga kliyente ay nagpapahayag ng mga hindi ligtas na pamamaraan sa pagbebenta, malinaw na presensya sa Dubai, at mga alalahanin ng pagsalangsang. Gumawa ng mga aksyon para sa proteksyon ng mga mamimili.

I-claim ang Iyong 50% Welcome Bonus hanggang $5000!

Bukas sa Parehong Bago at Existing na Customer!

The pound, gilts and renewables: the winners and losers under Britain’s future PM

The race to be the next leader of Britain’s ruling-Conservative Party and the country’s prime minister is into its final leg, with the September outcome likely to shape the fortunes of sterling, gilts and UK stocks in coming months.

Broker ng WikiFX

Exchange Rate