Tous les produits

MoreSélection du courtier

Filtrez et présentez une évaluation complète de plusieurs courtiers. Vous pouvez consulter les informations réglementaires, les services de l'entreprise, les dépôts et les retraits, les spreads, les actualités, les avis des utilisateurs, les plaintes, etc. Nos filtres de recherche vous aident à en savoir plus sur les courtiers et leurs informations, vous aidant à sélectionner des courtiers de haute qualité pour l'ouverture de compte ou la vérification des informations.

Comparaison des courtiers

Choisissez des pages d'informations complètes pour deux ou plusieurs courtiers afin de comparer leurs réglementations, dépôts et retraits, spreads, avis, plaintes et autres détails. En effectuant une évaluation complète des courtiers, vous pouvez analyser leurs forces et leurs faiblesses, ce qui vous aide à sélectionner un courtier de qualité qui répond à vos exigences actuelles.

Par caractéristiques

Classement WikiFXMarquePopularitéFraudesClassement des écartsGuide du commerçantPar règlement

Régulateurs populaires

Tous les produits

MoreSélection du courtier

Filtrez et présentez une évaluation complète de plusieurs courtiers. Vous pouvez consulter les informations réglementaires, les services de l'entreprise, les dépôts et les retraits, les spreads, les actualités, les avis des utilisateurs, les plaintes, etc. Nos filtres de recherche vous aident à en savoir plus sur les courtiers et leurs informations, vous aidant à sélectionner des courtiers de haute qualité pour l'ouverture de compte ou la vérification des informations.

Comparaison des courtiers

Choisissez des pages d'informations complètes pour deux ou plusieurs courtiers afin de comparer leurs réglementations, dépôts et retraits, spreads, avis, plaintes et autres détails. En effectuant une évaluation complète des courtiers, vous pouvez analyser leurs forces et leurs faiblesses, ce qui vous aide à sélectionner un courtier de qualité qui répond à vos exigences actuelles.

Par caractéristiques

Classement WikiFXMarquePopularitéFraudesClassement des écartsGuide du commerçantPar règlement

Régulateurs populaires

Tous les produits

MoreSélection du courtier

Filtrez et présentez une évaluation complète de plusieurs courtiers. Vous pouvez consulter les informations réglementaires, les services de l'entreprise, les dépôts et les retraits, les spreads, les actualités, les avis des utilisateurs, les plaintes, etc. Nos filtres de recherche vous aident à en savoir plus sur les courtiers et leurs informations, vous aidant à sélectionner des courtiers de haute qualité pour l'ouverture de compte ou la vérification des informations.

Comparaison des courtiers

Choisissez des pages d'informations complètes pour deux ou plusieurs courtiers afin de comparer leurs réglementations, dépôts et retraits, spreads, avis, plaintes et autres détails. En effectuant une évaluation complète des courtiers, vous pouvez analyser leurs forces et leurs faiblesses, ce qui vous aide à sélectionner un courtier de qualité qui répond à vos exigences actuelles.

Par caractéristiques

Classement WikiFXMarquePopularitéFraudesClassement des écartsGuide du commerçantPar règlement

Régulateurs populaires

Tous les produits

MoreSélection du courtier

Filtrez et présentez une évaluation complète de plusieurs courtiers. Vous pouvez consulter les informations réglementaires, les services de l'entreprise, les dépôts et les retraits, les spreads, les actualités, les avis des utilisateurs, les plaintes, etc. Nos filtres de recherche vous aident à en savoir plus sur les courtiers et leurs informations, vous aidant à sélectionner des courtiers de haute qualité pour l'ouverture de compte ou la vérification des informations.

Comparaison des courtiers

Choisissez des pages d'informations complètes pour deux ou plusieurs courtiers afin de comparer leurs réglementations, dépôts et retraits, spreads, avis, plaintes et autres détails. En effectuant une évaluation complète des courtiers, vous pouvez analyser leurs forces et leurs faiblesses, ce qui vous aide à sélectionner un courtier de qualité qui répond à vos exigences actuelles.

Par caractéristiques

Classement WikiFXMarquePopularitéFraudesClassement des écartsGuide du commerçantPar règlement

Régulateurs populaires

EURUSD Re-Enters 18-Month Resistance Range as US Dollar Rallies

EURUSD may break below the lower lip of the 18-month descending resistance channel if fundamental risks worsen and push the US Dollar higher.

GBPUSD Near-Term Outlook Bearish as US Dollar Gains, AUD May Rise

The Pound Sterling outlook turned more bearish after GBPUSD cleared support as the Dollar gained and the Euro weakened. AUDUSD may rise if the RBA downplays near-term rate cut bets.

EURUSD May Fall on Draghi Comments - Italy Budget Risks Escalating

EURUSD will be watching tomorrows meeting in Portugal where ECB officials – along with BoE Governor Mark Carney – will be discussing whether the Eurozone needs more stimulus.

EURUSD Testing Critical 18-Month Resistance - Will it Hold?

EURUSD will likely be in pain as Eurozone CPI data is published, though dovish undertones from Fed Chairman Jerome Powell may help mitigate or even reverse some of EURUSDs losses.

EURUSD Rate at Support Ahead of Trump Auto Tariffs Decision

Spot EURUSD continues to hover around technical support near the 1.12 price level while traders await next week's looming decision from President Trump on taxing EU auto exports.

Currency Volatility: EURUSD in Spotlight Ahead of EZ Inflation, US NFP

Tomorrow's economic data from the Eurozone and United States highlights EURUSD with inflation and nonfarm payroll numbers on deck. What might forex traders expect for spot prices?

EUR Forecast: Traders Eye Eurozone GDP, Jobs, CPI Data Upcoming

The Euro came under renewed pressure after suffering steep losses against the US Dollar and the Japanese Yen since last Friday. Could EUR face additional downside next week with Eurozone GDP and Inflation data on deck?

Euro at Risk as US Ends Iran Oil Waivers - Trade War Tensions Rise

The Euro could suffer after the US recent decision to end all Iranian oil-importing waivers. The conflicting geostrategic approaches to Iran between the EU and US may strain already-tense trade relations.

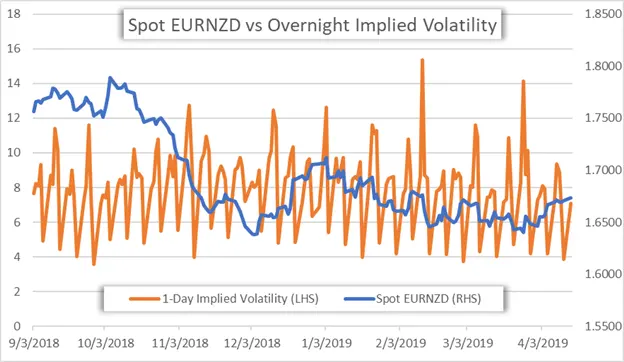

Spot EURNZD Could Swing Tomorrow from ZEW and CPI Data

High-impact economic data out of the Eurozone and New Zealand tomorrow has potential to send EURNZD gyrating in an otherwise quiet market.

EURUSD Price Edging Higher, ECB Leaves Monetary Settings Unchanged

The European Central Bank has left its monetary policy unchanged, as expected, with no further details on TLTRO-III, no news on possible tiered deposit rates and no change in its economic forecasts.

Currency Volatility: EURUSD Traders Eye ECB Meeting, Fed Minutes

EURUSD overnight implied volatility jumped to its highest level in over a month as forex traders gear up for potentially sharp reactions to the latest ECB meeting and Fed minutes expected tomorrow.

German Manufacturing Slump Long-Term Negative for Euro

A tumble in German industrial orders in February suggests the Eurozones largest economy is struggling, and that could have a detrimental impact on the Euro in the months ahead.

ECB Sinks EUR/USD Towards July 2017 Lows, Chinese Trade Data Next

EUR/USD faces June 2017 lows after sinking through key support levels after dismal ECB economic projections. Up next, markets eye the impact of slowing growth

EUR/USD Eyeing Italy GDP, Eurozone PMI Data - Gloomy ECB Outlook

EUR/USD may be vulnerable to Italian GDP data and Eurozone PMI as regional growth sputters. Traders are now eyeing the upcoming ECB rate decision and

EUR/USD to Fall on Eurozone, German GDP? Downside Risks Growing

The Euro may experience some pain tomorrow as Eurozone and German GDP is scheduled to be released. The risk of a EUR/USD selloff is potentially

EUR/USD Outlook: Possible Spain Election Reinforces Trend Lower

Talk of a possible snap parliamentary election in Spain this year will likely keep EUR/USD on the downward path paved principally by a stronger US

EUR/USD in Focus as EU Finance Ministers Discuss Trade, Budget

The Euro may be looking out for key comments or policy developments from the Economic and Financial Affairs Council meeting between EU finance ministers.