简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Forecast

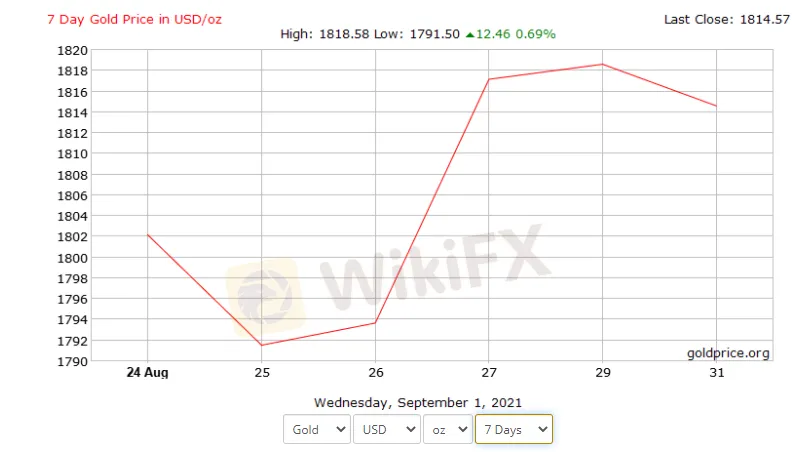

एब्स्ट्रैक्ट:XAU/USD attempts to reclaim $1,820 on dollar weakness.

Gold prices attempt to cross beyond $1,820 and record some gains following the previous session‘s consolidative move. The prices seem to be stabilizing now to make a consolidative move in a trading band. The yellow metal is rangebound amid continuing debate over Fed’s monetary policy. A lower USD valuation, which makes the precious metal less expansive for the other currencies holders continues to support gold prices. The softer US ADP data weighed on the greenback. The lower US benchmark Treasury yields also supported gold prices as it enhances the appeal of the non-yielding asset. Concerns over the delta coronavirus crisis reduce investor confidence and risk appetite that eventually supported corrective pullback in gold prices. Investors now turn their attention to the Nonfarm payroll data on Friday for an update on US labour market conditions.

The price of gold is trading at $1,813.88 and between a low of $1,813.33 and a high of $1,814.21.

The US dollar dropped after the ADP National Employment Report showed private payrolls rose by 374,000 in August, up from 326,000 in July but well short of the 613,000 forecasts.

There are now even more expectations for a disappointing jobs number this week which pushes back the case for a taper no sooner than December.

अस्वीकरण:

इस लेख में विचार केवल लेखक के व्यक्तिगत विचारों का प्रतिनिधित्व करते हैं और इस मंच के लिए निवेश सलाह का गठन नहीं करते हैं। यह प्लेटफ़ॉर्म लेख जानकारी की सटीकता, पूर्णता और समयबद्धता की गारंटी नहीं देता है, न ही यह लेख जानकारी के उपयोग या निर्भरता के कारण होने वाले किसी भी नुकसान के लिए उत्तरदायी है।

WikiFX ब्रोकर

GO MARKETS

Pepperstone

IB

EC Markets

HFM

IC Markets Global

GO MARKETS

Pepperstone

IB

EC Markets

HFM

IC Markets Global

WikiFX ब्रोकर

GO MARKETS

Pepperstone

IB

EC Markets

HFM

IC Markets Global

GO MARKETS

Pepperstone

IB

EC Markets

HFM

IC Markets Global

रेट की गणना करना