简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Ultima Markets | USDJPY Analysis: The dovish speech of the Bank of Japan Governor

Sommario:In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the USDJPY for MAR 26, 2025.Fundamental Analysis of USDJPYUSDJPY Key TakeawaysProbability of a rate hike in Japan i

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the USDJPY for MAR 26, 2025.

Fundamental Analysis of USDJPYUSDJPY Key Takeaways

Probability of a rate hike in Japan in the second half of the year: Market speculation about further rate hikes by the Bank of Japan has pushed Japanese government bond yields to their highest level in nearly two decades, and the swap market expects a 76% chance of a rate hike at the Bank of Japan‘s July meeting and a 100% chance of a rate hike at the end of October.

Speech by the Bank of Japan Governor: Today, Bank of Japan Governor Kazuo Ueda said that he will continue to work towards a stable and sustainable inflation target of 2%. It is inappropriate to consider changing the Bank of Japan’s 2% inflation target at this time. Potential inflation is still slightly below 2%. Potential dovish comments push the yen to depreciate in the short term.

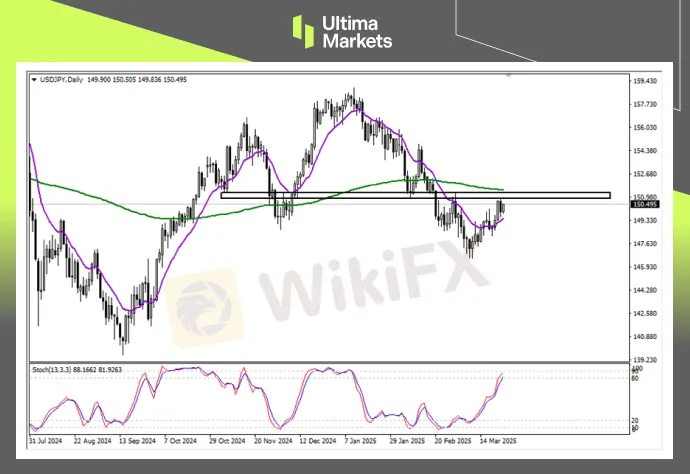

Technical Analysis of USDJPY Daily and Hourly Charts USDJPY Daily Chart Insights

(USDJPY Daily Price Chart, Source: Ultima Markets MT4)

Stochastic oscillator:The indicator accelerates to rise and enters the overbought area, suggesting that the short-term bullish trend is strong and cannot be easily bearish.

Strong resistance area: USD/JPY is currently rising close to the long-short conversion price area, which is also near the green 200-day moving average. The exchange rate has already reacted to the resistance decline yesterday, so be wary of false breakthroughs.

USDJPY H1 Chart Analysis

(USDJPY H1 Price Chart, Source: Ultima Markets MT4)

Stochastic oscillator:The indicator accelerates to rise and enters the overbought area, suggesting that the short-term bullish trend is strong and cannot be easily bearish.

Strong resistance area: USD/JPY is currently rising close to the order near 150.550, and the second resistance price is near the previous false breakthrough resistance line of 150.761.

Pivot Indicator Insights for USDJPY

(USDJPY M30 Price Chart, Source: Ultima Markets APP)

According to Pivot Indicator in Ultima Markets APP, the central price of the day is established at 149.90,

Bullish Scenario: Bullish sentiment prevails above 149.90, first target 150.75, second target 150.95;

Bearish Outlook: In a bearish scenario below 149.90, first target 149.55, second target 149.20.

How to Navigate the Forex Market with Ultima Markets

To navigate the complex world of trading successfully, its imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

IB

ATFX

AvaTrade

TMGM

Trive

FOREX.com

IB

ATFX

AvaTrade

TMGM

Trive

FOREX.com

WikiFX Trader

IB

ATFX

AvaTrade

TMGM

Trive

FOREX.com

IB

ATFX

AvaTrade

TMGM

Trive

FOREX.com

Rate Calc