简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Fortrade Sees 576% Jump in FY20 Net Profit

概要:The massive jump in profits was fueled by a higher turnover.

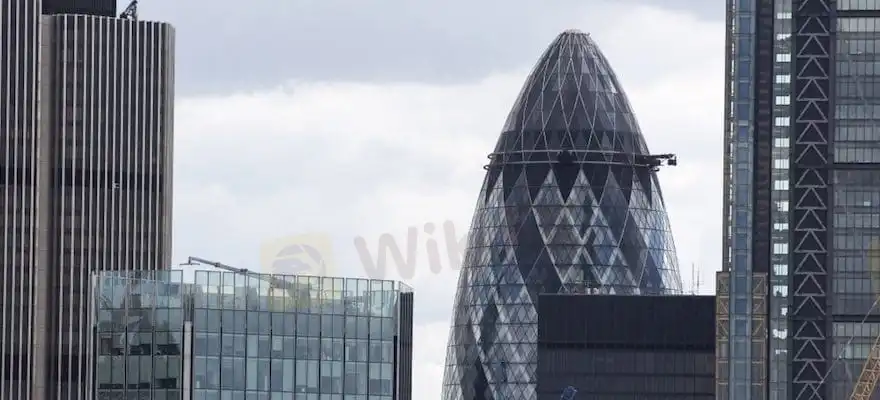

Fortrade, a London-based forex and CFDs broker, has seen a solid uptick across all its key performance metrics for the financial year 2020, ending December 31, according to the latest Companies House filing.

The yearly turnover of the broker came in at £26.67 million, up from the previous years £15.54 million. That was a year-over-year jump of more than 71.6 percent. However, the cost of sales for the year also jumped to £22.09 million from £12.15 million.

The gross profit for the year came in at £4.58 million, while considering administrative expenses and other payable interests and charges, the pre-tax profit came down to almost £1.2 million, which is an increase of more than 592 percent from the previous year.

Fortrade ended the year with a net profit of £995,642, which is much higher when compared to 2019s £147,404.

“The results for the year and financial position at the year-end were considered satisfactory by the directors who expect continued growth in the foreseeable future,” the filing noted.

Rebound in Performance

Established in 2013, Fortrade offers CFDs trading services with forex, stocks, indices, commodities, and US treasuries. It targets both retail and institutional clients.

The broker reported these solid numbers after a dull performance in 2019 when both revenue and profits dropped, Finance Magnates reported earlier.

“The group continues to look for opportunities overseas and therefore, the directors expect that the parent company will grow its businesses in both core market and new markets and this will lead to an improvement in the groups financial results and the key performance indicators,” the broker added in the filing.

免責事項:

このコンテンツの見解は筆者個人的な見解を示すものに過ぎず、当社の投資アドバイスではありません。当サイトは、記事情報の正確性、完全性、適時性を保証するものではなく、情報の使用または関連コンテンツにより生じた、いかなる損失に対しても責任は負いません。

WikiFXブローカー

話題のニュース

WikiFX「3·15 外国為替権利デー」、ブラックリストを正式に発表

FX投資における悪徳業者リスクの回避~ライセンス規制からリスクを見抜く方法を解説

デジタル時代の新たな貧困ビジネス~SNSに蔓延する「成功保証」が若者を食い物にする

日本、暗号資産の税率引き下げへ、ビットコイン準備金には慎重姿勢

桜が舞う春、WikiFXのデモ取引大会で賞金30万円を手に入れよう!

レート計算