简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

First Quarter 2019 Fundamental Forecasts for the US Dollar, Euro, Oil, Equities, and More

요약:The fourth quarter and 2018 are now in the books, and the ongoingresurgence of market volatility and uncertainty around key thematic influences are set to

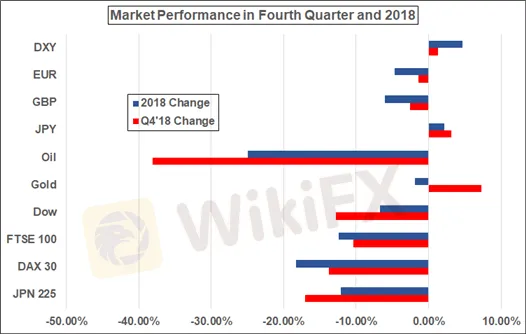

The fourth quarter and 2018 are now in the books, and the ongoingresurgence of market volatility and uncertainty around key thematic influences are set to carry into 2019. With fundamental issues around US-led trade wars, Brexit, political uncertainty rising in Europe, emerging market contagion, among others lingering, the first three months of the New Year should produce opportunities across asset classes.

See all of the DailyFX Trading Guides from the Quarterly Forecasts to the Top Trading Opportunities, How to Trade Event Risk, Building Confidence in Trading and so much more.

USD Buffeted by Market Volatility, Fed, Politics

Heading into 2019, the Greenback will continue to be buffeted by systemic crosswinds that could cater to its more elementary fundamental roles or alternatively see capital diverted by unique stability risks.

Missed Window of Opportunity at End of 2018 Portends Weak Start to 2019 for Euro

Heading into first quarter of 2019, even as the Italian government appears to have actually reached an agreement this time around after months of tense negotiations, its difficult to feel that troubles will fade and storm clouds dissipate.

GBP Rudderless on Brexit Permutations

The United Kingdom is scheduled to leave the European Union on March 29, 2019; and as we stand, the Brexit Withdrawal Agreement that is currently on offer from the EU to the UK will not pass through a vote in the House of Commons.

Yen Still a Haven in a Very Uncertain World

In truth, the Japanese currency will start the New Year on a knife-edge, its fate very much prey to developments beyond Japan. Developments within Japan have been few, at least as far as were concerned here.

Crude Oil to Continue Sliding with Flush Demand and Waning Supply

At the start of October, West Texas Intermediate (WTI) crude traded at levels near four-year highs. In the weeks following, the commodity plummeted nearly 40 percent. Despite an incredibly painful quarter for crude, the outlook remains bleak.

Gold Price Likely to Continue 2018 Downtrend

If the Fed follows through and raises rates, financial market participants will be taken by surprise and investors will possibly flock to the greenback. Rising rates, in turn, would be bad for Gold.

Global Stocks Still Vulnerable After Brutal Selloff

A toxic mix of slowing economic growth, an ongoing trade war between the US and China, as well as political instability in Europe poisoned risk appetite across the equity space. However, it seems to have been the Feds dogged determination to normalize monetary policy that set the stage for markets to truly care about these headwinds.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기