简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weekly Trading Forecast: Beware Volatility Between the Fed, NFPs, GDP and Trade Wars

요약:The fundamental environment will grow increasingly tumultuous over the coming week. We wil continue to sort through general themes like the lifting of the US

Australian Dollar Forecast – Australian Dollar May Look Past CPI Report for the Fed and US Data

Why did the Australian Dollar fall after an upbeat jobs report? The same logic may undermine the impact of CPI data as AUD eyes the Fed and a plethora of US economic statistics ahead.

Crude Oil Forecast - Prices May Continue CLimb on GDP Growth Recovery Bet

Factors that dragged global growth forecasts lower could subside which has potential to rejuvenate the world economy and oil demand.

British Pound Forecast – Positive Backdrop, Bullish Outlook

Sterling is coming off its weekly highs heading into the weekend, but the outlook for a reinvigorated British Pound remains bullish.

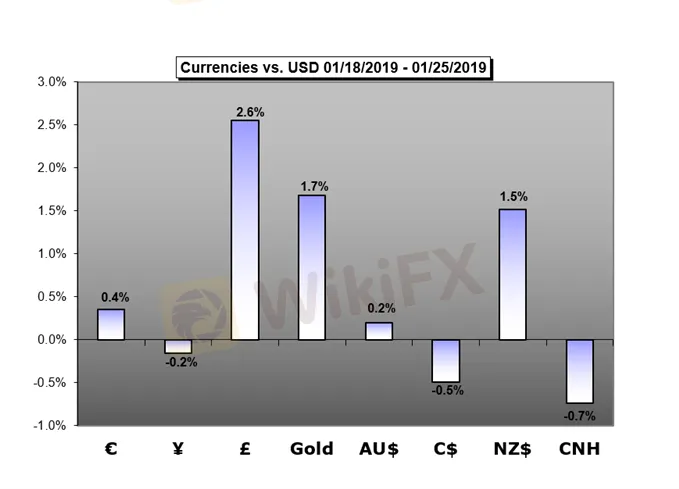

US Dollar Forecast – US Dollar Torn Between Domestic Strength, Global Headwind

The US Dollar may be torn between signs of economic resilience domestically and worrying developments abroad. Another round of trade war negotiations is a wild card.

Gold Forecast – Gold Prices Eye Fed Rate Decision and US-China Trade Talks Next

After Golds sharp rally on Friday, price rests at a crucial inflection point ahead of the Fed rate decision and US-China trade talks.

Equities Forecast – Stock Markets Look to Earnings and FOMC, DAX to Eurozone GD

The US stock market will look to earnings from some of the major corporations like Microsoft, Amazon and Facebook. Elsewhere, the DAX will look to German employment data.

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

See how retail traders are positioning in the majors using the IG Client Sentiment readings on the sentiment page.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

WikiFX "3·15 외환 권리 보호의 날" – 블랙리스트 공식 발표

제1회 WikiFX Korea 모의 투자 대회 시작! 벚꽃이 흩날리는 봄, WikiFX와 함께

환율 계산기