简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Sterling: GBPUSD Technical Analysis and Brexit Update

요약:The British Pound continues to drift lower ahead of a pivotal Brexit week for UK PM May. Support may be tested all the way down

GBPUSD Price and Brexit Volatility:

GBPUSD struggles to break through Fibonacci retracement.

Brexit news may now provoke larger price reactions.

Q1 2019 GBP Forecast and USD Top Trading Opportunitie

Sterling volatility is set to increase over the coming weeks as Brexit negotiations and UK Parliamentary votes take hold of price action. PM May faces three votes next week – March 12-14 – and the outcome of these will steer the British Pound going into the end of the month, unless the UK and EU agree an extension of Article 50 beyond March 29. The EU has asked the UK for more clarity today about its Irish border backstop proposal, which the EU currently reject, while the UK has stated that it still requires legally binding assurances that there will be no hard border in Ireland.

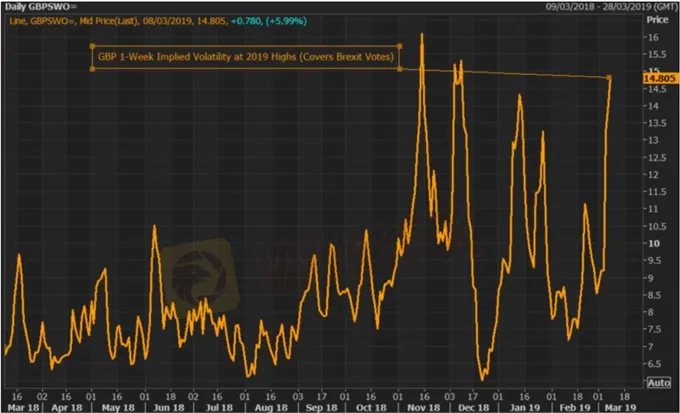

This unease is shown in the latest one-week Sterling volatility chart which has jumped to its highest level since early December 2018. Volatility is expected to stay high until the end of the month or at least until an agreement is signed off.

GBPUSD continues to respect the bullish uptrend started at the beginning of the year with higher lows holding despite the weakness seen in the pair over the last 10-days. The pair rejected resistance at the 38.22% Fibonacci retracement level (1.3177) twice this week and this level may cap upside momentum in the short-term. To the downside there is a possibility of a move back to the 200-day moving average at 1.2937, a point where it currently intersects bullish momentum.

GBPUSD Daily Price Chart (July 2018 – March 8, 2019)

Retail traders are 57.0% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however currently suggest a stronger bearish trading bias for GBPUSD.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

제1회 모의 투자 대회 수상자 발표

벚꽃 앱테크 이벤트 당첨자 발표

[4월 2일 거래 팁] 美 관세 발표 임박,‘불확실성 장세’에서 살아남는 법은?

환율 계산기