简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Oversold in the Short-Term But Still in Trouble

요약:The Euro remains around 1.1200 to the US dollar after hitting the lowest level since June 2017 in Thursdays heavy sell-off. On the slate, US

EURUSD Price, Chart and US Non-Farm Payrolls:

The Euro remains under pressure after a dovish ECB meeting.

US non-farm payrolls will add end of week volatility.

Q1 2019 EUR Forecast and USD Top Trading Opportunitie

A bruised Euro remains around the 1.1200 against the US dollar after the ECB yesterday downgraded growth and inflation forecasts, pushed rate hikes back further and announced a fresh round of bank liquidity. The central banks action, while supportive for the economy, give further credence to a much lower Euro and multi-year lows remain insight.

EURUSD, EURJPY: Euro Drops as ECB Announces Fresh Round of TLTROs.

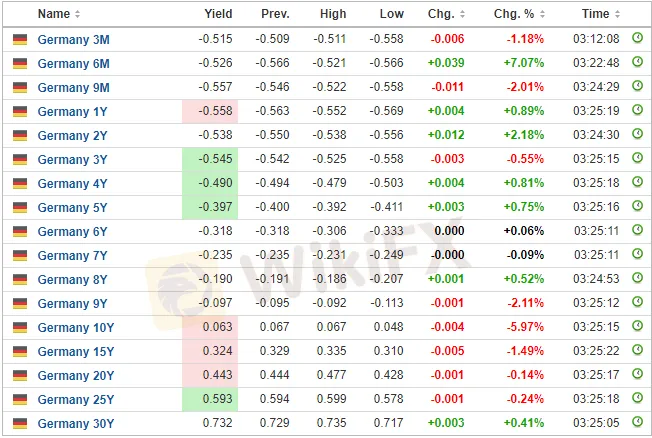

German government bond yields fell further – the curve is in negative territory all the way out to nine years – with the 10-year now yielding just six basis points and back to lows last seen in November 2016. This drop-in yield is in spite of the cessation of the QE program which has helped to drive bond yields lower over the past four years.

The latest German Factory Orders disappointed this morning with a m/m negative figure of 2.6% against predictions of 0.5% growth. The annual figure was also worse than expected at -3.9% against expectations of -3.1%.

DailyFX Economic Calendar.

The daily EURUSD chart looks oversold in the short-term, using the RSI indicator, and the pair may nudge higher ahead of the US labor report. Market expectations are for 180k jobs to be added in February with average hourly earnings pushing 0.3% higher m/m.

However, the Euro remains weak and any better-than-expected US data at 13:30 could see the pair re-testing Thursdays 21-month low at 1.1175.

EURUSD Technical Analysis: Sellers Try to Clear a Path Below 1.10.

EURUSD Daily Price Chart (August 2018 – March 8, 2019)

Retail traders are 70.6% net-long EURUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however give us a stronger bearish contrarian bias.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기